Private credit involves direct lending to companies or individuals without intermediaries, offering higher yield potential and customized financing solutions. Asset-backed securities (ABS) pool loans or receivables, transferring risk to investors through tradable financial instruments secured by specific assets. Explore the key differences and benefits of private credit versus asset-backed securities for optimized investment strategies.

Why it is important

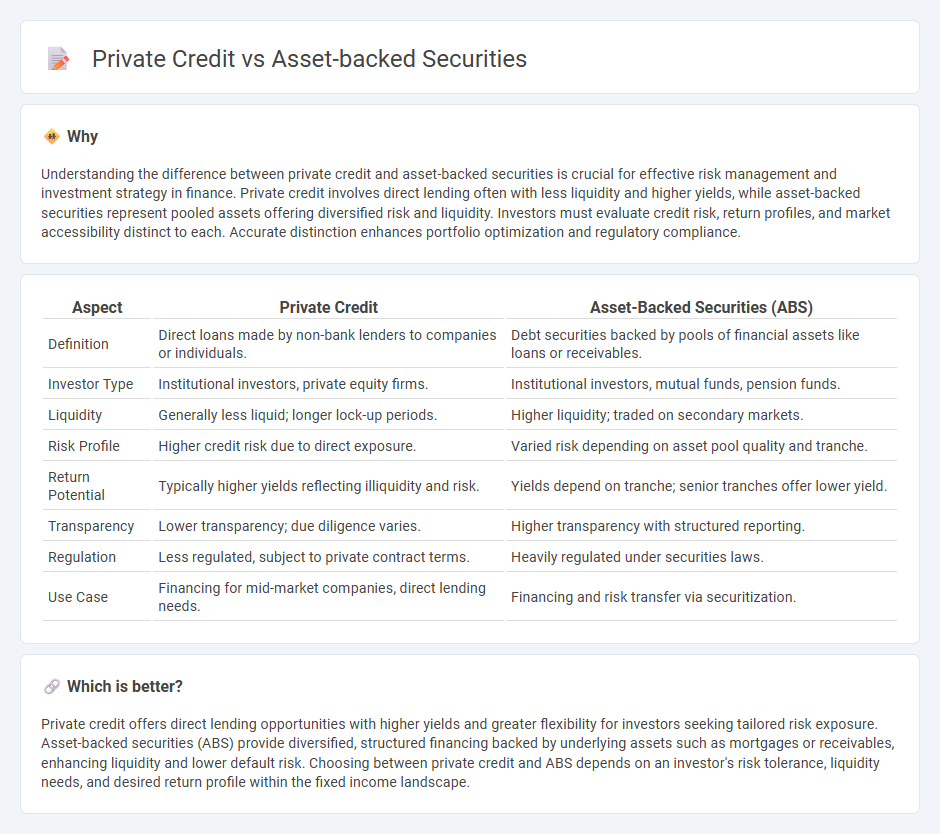

Understanding the difference between private credit and asset-backed securities is crucial for effective risk management and investment strategy in finance. Private credit involves direct lending often with less liquidity and higher yields, while asset-backed securities represent pooled assets offering diversified risk and liquidity. Investors must evaluate credit risk, return profiles, and market accessibility distinct to each. Accurate distinction enhances portfolio optimization and regulatory compliance.

Comparison Table

| Aspect | Private Credit | Asset-Backed Securities (ABS) |

|---|---|---|

| Definition | Direct loans made by non-bank lenders to companies or individuals. | Debt securities backed by pools of financial assets like loans or receivables. |

| Investor Type | Institutional investors, private equity firms. | Institutional investors, mutual funds, pension funds. |

| Liquidity | Generally less liquid; longer lock-up periods. | Higher liquidity; traded on secondary markets. |

| Risk Profile | Higher credit risk due to direct exposure. | Varied risk depending on asset pool quality and tranche. |

| Return Potential | Typically higher yields reflecting illiquidity and risk. | Yields depend on tranche; senior tranches offer lower yield. |

| Transparency | Lower transparency; due diligence varies. | Higher transparency with structured reporting. |

| Regulation | Less regulated, subject to private contract terms. | Heavily regulated under securities laws. |

| Use Case | Financing for mid-market companies, direct lending needs. | Financing and risk transfer via securitization. |

Which is better?

Private credit offers direct lending opportunities with higher yields and greater flexibility for investors seeking tailored risk exposure. Asset-backed securities (ABS) provide diversified, structured financing backed by underlying assets such as mortgages or receivables, enhancing liquidity and lower default risk. Choosing between private credit and ABS depends on an investor's risk tolerance, liquidity needs, and desired return profile within the fixed income landscape.

Connection

Private credit often serves as the underlying collateral in asset-backed securities (ABS), enabling lenders to pool loans such as business loans, consumer credit, or real estate debt. These ABS instruments convert illiquid private credit assets into tradable securities, offering investors exposure to diversified credit risk with varying maturities and yields. The securitization process enhances liquidity in the private credit market and facilitates capital flow to borrowers outside traditional banking channels.

Key Terms

Securitization

Asset-backed securities (ABS) involve pooling financial assets such as loans or receivables, which are then securitized and sold to investors, offering liquidity and risk diversification. Private credit refers to non-bank lending to private companies, often structured without securitization, resulting in less liquidity but higher customization and potentially higher yields. Explore further to understand how securitization transforms asset-backed securities and differentiates them from private credit investments.

Collateral

Asset-backed securities (ABS) are financial instruments backed by a pool of underlying collateral such as loans, leases, or receivables, providing investors with cash flow from these assets. Private credit typically involves direct lending to businesses without securitization, where collateral might include real estate, equipment, or receivables, often resulting in less liquidity but greater control over the asset. Explore further to understand how collateral structures impact risk and return profiles in these investment vehicles.

Direct Lending

Asset-backed securities (ABS) represent pooled financial assets like loans or receivables, offering investors diversified exposure with liquidity, while private credit direct lending involves non-bank lenders providing customized loans directly to companies, often yielding higher returns with increased risk and less liquidity. Direct lending within private credit typically targets middle-market businesses seeking flexible financing solutions absent from traditional capital markets, emphasizing rigorous credit analysis and strong borrower relationships. Explore further to understand how direct lending transforms private credit and reshapes investment strategies.

Source and External Links

Asset-backed securities: Definition, types and examples - StoneX - Asset-backed securities (ABS) are financial pools of assets such as auto loans, credit card receivables, and mortgages that represent contractual obligations to pay returns to investors, created through securitization to convert illiquid assets into liquid securities.

The ABCs of Asset-Backed Securities | Guggenheim Investments - ABS finance pools of familiar asset types and often rank senior to traditional debt, offering investor protections like tranching and overcollateralization, while providing higher yields than similarly rated bonds despite complexity and risks demonstrated during the 2008 financial crisis.

Asset-backed security - Wikipedia - ABS are securities backed by a pool of financial assets, allowing illiquid loans to be converted to tradeable instruments with different risk/return tranches, benefiting originators by reducing capital requirements but increasing risk to investors.

dowidth.com

dowidth.com