Dim sum bonds are yuan-denominated bonds issued outside China, primarily in Hong Kong, catering to investors seeking exposure to Chinese currency assets. Eurobonds, on the other hand, are international bonds issued in a currency other than that of the country where they are sold, offering diversification and flexibility to global investors. Explore further to understand which bond type aligns best with your investment strategy.

Why it is important

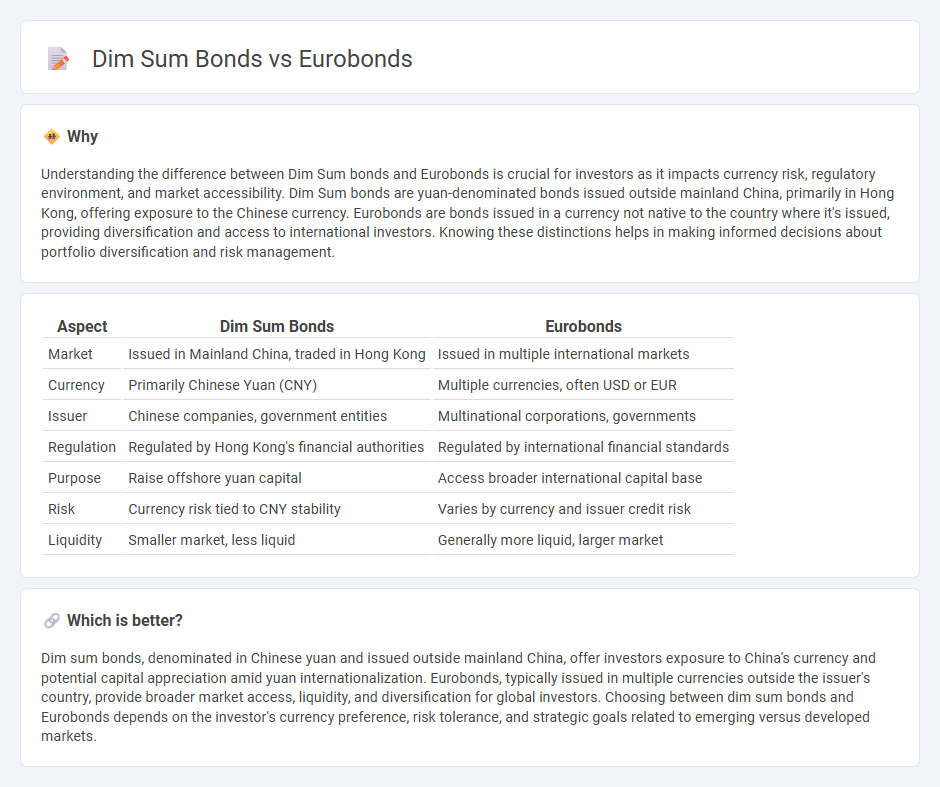

Understanding the difference between Dim Sum bonds and Eurobonds is crucial for investors as it impacts currency risk, regulatory environment, and market accessibility. Dim Sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, offering exposure to the Chinese currency. Eurobonds are bonds issued in a currency not native to the country where it's issued, providing diversification and access to international investors. Knowing these distinctions helps in making informed decisions about portfolio diversification and risk management.

Comparison Table

| Aspect | Dim Sum Bonds | Eurobonds |

|---|---|---|

| Market | Issued in Mainland China, traded in Hong Kong | Issued in multiple international markets |

| Currency | Primarily Chinese Yuan (CNY) | Multiple currencies, often USD or EUR |

| Issuer | Chinese companies, government entities | Multinational corporations, governments |

| Regulation | Regulated by Hong Kong's financial authorities | Regulated by international financial standards |

| Purpose | Raise offshore yuan capital | Access broader international capital base |

| Risk | Currency risk tied to CNY stability | Varies by currency and issuer credit risk |

| Liquidity | Smaller market, less liquid | Generally more liquid, larger market |

Which is better?

Dim sum bonds, denominated in Chinese yuan and issued outside mainland China, offer investors exposure to China's currency and potential capital appreciation amid yuan internationalization. Eurobonds, typically issued in multiple currencies outside the issuer's country, provide broader market access, liquidity, and diversification for global investors. Choosing between dim sum bonds and Eurobonds depends on the investor's currency preference, risk tolerance, and strategic goals related to emerging versus developed markets.

Connection

Dim sum bonds and Eurobonds are interconnected as both represent forms of offshore bond issuance catering to international investors outside the issuer's domestic market. Dim sum bonds are yuan-denominated bonds issued in Hong Kong, allowing foreign entities to raise funds in Chinese currency, while Eurobonds are typically denominated in a currency different from the issuer's home country and traded globally. This connection highlights the growing trend of cross-border financing, providing issuers with diversified currency options and investors with broader access to international debt markets.

Key Terms

Currency denomination

Eurobonds are international bonds denominated in a currency different from the issuer's domestic currency, often issued in major currencies like USD or EUR, attracting global investors and providing currency diversification. Dim sum bonds are yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, allowing foreign investors to access Chinese currency exposure while bypassing onshore regulatory restrictions. Discover how currency denomination impacts investment strategies by exploring more about Eurobonds and Dim Sum bonds.

Issuance location

Eurobonds are typically issued in the international market, outside the jurisdiction of any single country, allowing issuers to tap diverse global investors and raise capital in various currencies. Dim sum bonds, by contrast, are issued in Hong Kong's offshore RMB market, enabling foreign issuers to access Chinese yuan funding and benchmark RMB debt outside mainland China. Explore further insights into issuance strategies and market dynamics of Eurobonds and Dim Sum bonds to optimize your investment decisions.

Regulatory environment

Eurobonds and dim sum bonds operate under distinct regulatory environments that impact issuance and investor protection. Eurobonds are typically governed by international securities laws, allowing issuers to access global capital markets with fewer restrictions, while dim sum bonds are subject to Chinese regulatory frameworks and cleared by the People's Bank of China, ensuring compliance with local monetary policies. Explore in-depth analysis to understand how these regulatory differences influence market dynamics and investment strategies.

Source and External Links

Eurobond (external bond) - A eurobond is an international bond denominated in a currency not native to the country where it is issued, originally created to escape regulation, and categorized by the currency in which they are issued (such as Eurodollar or Euroyen bonds).

Eurobonds Frequently Asked Questions (FAQs) - Eurobonds are fixed income instruments offering issuers flexibility in currency, security type, and jurisdiction, allowing access to a broad international investor base through a well-established ecosystem of advisors and issuance processes.

Eurobond - Overview, How It Works, Benefits to Issuers and Investors - Eurobonds are liquid fixed-income securities issued in a currency different from the country of issuance, enabling companies to raise funds internationally with benefits such as small notional amounts, high liquidity, and broad market reach.

dowidth.com

dowidth.com