Alternative data consists of non-traditional datasets such as social media activity, geolocation data, and satellite imagery, offering unique insights beyond conventional financial metrics. Transaction data, by contrast, involves direct records of buying and selling activities, providing granular and real-time information on consumer behavior and market trends. Explore how combining alternative data with transaction data can revolutionize financial decision-making and risk assessment.

Why it is important

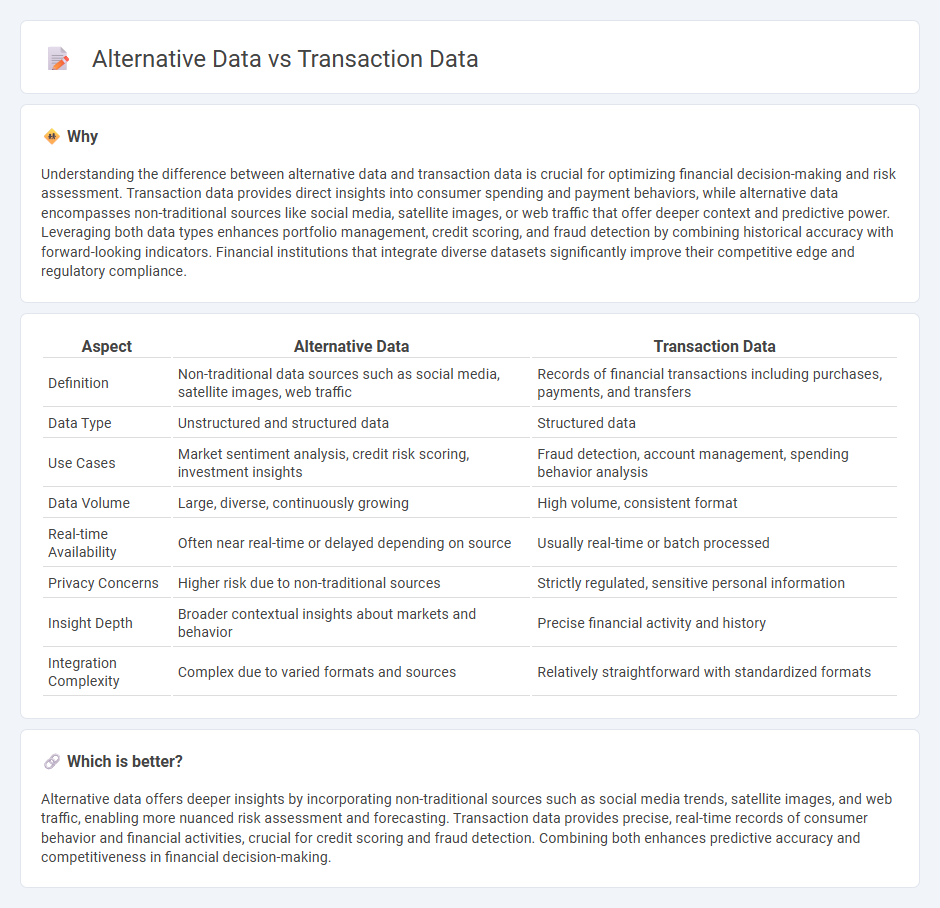

Understanding the difference between alternative data and transaction data is crucial for optimizing financial decision-making and risk assessment. Transaction data provides direct insights into consumer spending and payment behaviors, while alternative data encompasses non-traditional sources like social media, satellite images, or web traffic that offer deeper context and predictive power. Leveraging both data types enhances portfolio management, credit scoring, and fraud detection by combining historical accuracy with forward-looking indicators. Financial institutions that integrate diverse datasets significantly improve their competitive edge and regulatory compliance.

Comparison Table

| Aspect | Alternative Data | Transaction Data |

|---|---|---|

| Definition | Non-traditional data sources such as social media, satellite images, web traffic | Records of financial transactions including purchases, payments, and transfers |

| Data Type | Unstructured and structured data | Structured data |

| Use Cases | Market sentiment analysis, credit risk scoring, investment insights | Fraud detection, account management, spending behavior analysis |

| Data Volume | Large, diverse, continuously growing | High volume, consistent format |

| Real-time Availability | Often near real-time or delayed depending on source | Usually real-time or batch processed |

| Privacy Concerns | Higher risk due to non-traditional sources | Strictly regulated, sensitive personal information |

| Insight Depth | Broader contextual insights about markets and behavior | Precise financial activity and history |

| Integration Complexity | Complex due to varied formats and sources | Relatively straightforward with standardized formats |

Which is better?

Alternative data offers deeper insights by incorporating non-traditional sources such as social media trends, satellite images, and web traffic, enabling more nuanced risk assessment and forecasting. Transaction data provides precise, real-time records of consumer behavior and financial activities, crucial for credit scoring and fraud detection. Combining both enhances predictive accuracy and competitiveness in financial decision-making.

Connection

Alternative data enhances financial analysis by incorporating non-traditional sources such as social media activity, satellite images, and web traffic alongside traditional transaction data. Transaction data provides detailed records of consumer spending behaviors, which, when combined with alternative data, enables more accurate credit risk assessments and investment decisions. This integrated approach allows financial institutions to uncover hidden patterns and trends that improve predictive modeling and portfolio management.

Key Terms

Trade Execution (transaction data)

Transaction data encompasses detailed records of buy and sell orders, timestamps, and trade volumes, crucial for analyzing trade execution efficiency and market impact. Alternative data, such as social media sentiment or satellite imagery, offers broader market context but lacks the precision of transaction-level insights needed for execution optimization. Explore our in-depth analysis to understand how transaction data drives superior trade execution strategies.

Social Media Sentiment (alternative data)

Transaction data captures direct financial exchanges such as purchases and payments, providing reliable insights into consumer behavior and market trends. Social media sentiment, a form of alternative data, analyzes public opinions and emotional tones expressed on platforms like Twitter and Facebook, revealing real-time consumer attitudes and potential market shifts. Explore the impact of social media sentiment on forecasting and investment strategies to enhance your data-driven decisions.

Market Liquidity (transaction data)

Transaction data provides detailed insights into market liquidity by capturing real-time buy and sell orders, trade volumes, and price movements, enabling precise measurement of market depth and efficiency. Alternative data, while useful for broader market sentiment and trends, lacks the granularity and immediacy of transaction data in assessing liquidity conditions. Explore how leveraging transaction data can enhance your understanding of market liquidity and inform smarter trading strategies.

Source and External Links

What is transactional data? | Definition from TechTarget - Transactional data is information collected from transactions, including unique identifiers and timestamps, capturing details like sales, purchases, payments, and other business events, typically managed through relational or NoSQL databases with ACID properties.

What is Transactional Data? - Explanation & Examples - Transactional data records details about business events such as sales and payments, capturing the who, what, when, and where of each transaction, and helps businesses analyze sales performance and operational KPIs.

What is Transactional Data? - Transactional data is data generated from transactions, captured at the point of sale or other business processes, including time, location, price, payment method, and discounts, distinct from analytical or master data categories.

dowidth.com

dowidth.com