Loss harvesting involves strategically selling securities at a loss to offset capital gains and reduce taxable income, enhancing overall portfolio tax efficiency. Qualified dividends are dividends meeting specific IRS criteria, taxed at lower capital gains rates rather than ordinary income rates, offering favorable tax treatment for investors. Explore more to understand how loss harvesting and qualified dividends can optimize your investment returns and tax strategy.

Why it is important

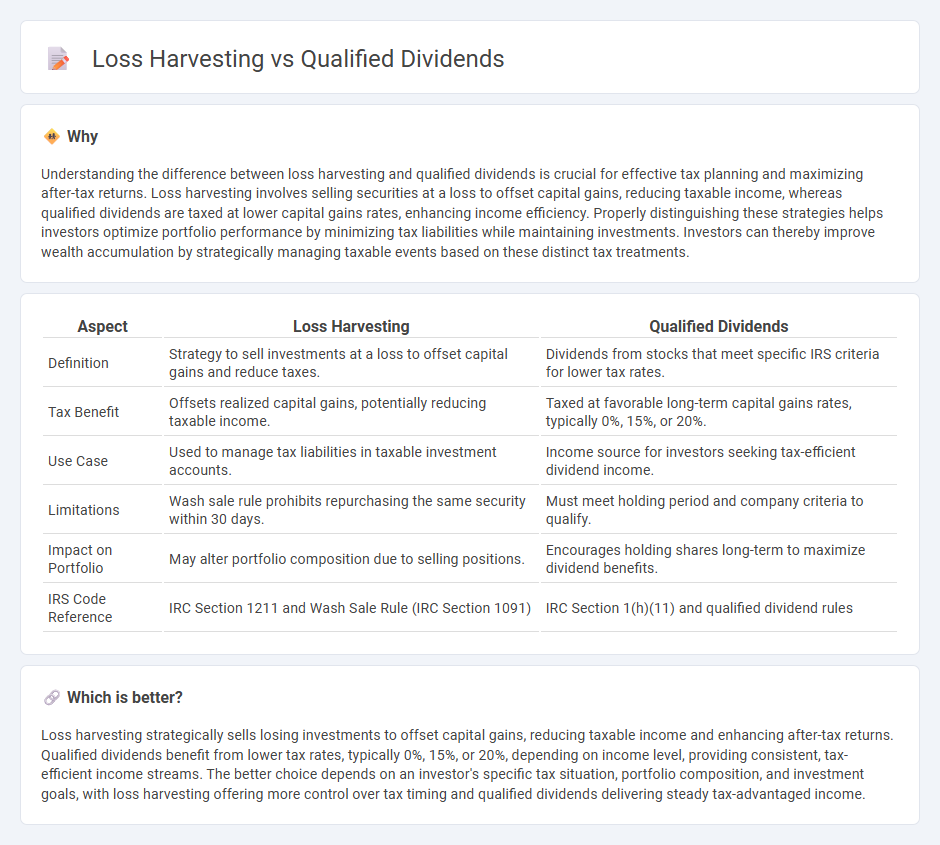

Understanding the difference between loss harvesting and qualified dividends is crucial for effective tax planning and maximizing after-tax returns. Loss harvesting involves selling securities at a loss to offset capital gains, reducing taxable income, whereas qualified dividends are taxed at lower capital gains rates, enhancing income efficiency. Properly distinguishing these strategies helps investors optimize portfolio performance by minimizing tax liabilities while maintaining investments. Investors can thereby improve wealth accumulation by strategically managing taxable events based on these distinct tax treatments.

Comparison Table

| Aspect | Loss Harvesting | Qualified Dividends |

|---|---|---|

| Definition | Strategy to sell investments at a loss to offset capital gains and reduce taxes. | Dividends from stocks that meet specific IRS criteria for lower tax rates. |

| Tax Benefit | Offsets realized capital gains, potentially reducing taxable income. | Taxed at favorable long-term capital gains rates, typically 0%, 15%, or 20%. |

| Use Case | Used to manage tax liabilities in taxable investment accounts. | Income source for investors seeking tax-efficient dividend income. |

| Limitations | Wash sale rule prohibits repurchasing the same security within 30 days. | Must meet holding period and company criteria to qualify. |

| Impact on Portfolio | May alter portfolio composition due to selling positions. | Encourages holding shares long-term to maximize dividend benefits. |

| IRS Code Reference | IRC Section 1211 and Wash Sale Rule (IRC Section 1091) | IRC Section 1(h)(11) and qualified dividend rules |

Which is better?

Loss harvesting strategically sells losing investments to offset capital gains, reducing taxable income and enhancing after-tax returns. Qualified dividends benefit from lower tax rates, typically 0%, 15%, or 20%, depending on income level, providing consistent, tax-efficient income streams. The better choice depends on an investor's specific tax situation, portfolio composition, and investment goals, with loss harvesting offering more control over tax timing and qualified dividends delivering steady tax-advantaged income.

Connection

Loss harvesting strategically offsets capital gains by selling investments at a loss, directly reducing taxable income and enhancing after-tax returns. Qualified dividends benefit from lower tax rates compared to ordinary income, and tax-loss harvesting can maximize these benefits by minimizing overall tax liability. Combining loss harvesting with qualified dividends creates an efficient tax strategy that improves portfolio tax efficiency and increases net investment income.

Key Terms

Taxation

Qualified dividends benefit from preferential tax rates, typically ranging from 0% to 20%, depending on the taxpayer's income bracket, providing significant tax savings compared to ordinary income. Tax-loss harvesting involves selling securities at a loss to offset capital gains and reduce taxable income, effectively lowering the investor's overall tax liability. Explore how strategic management of qualified dividends and tax-loss harvesting can optimize your investment tax efficiency.

Capital Gains

Qualified dividends are taxed at favorable capital gains rates, often lower than ordinary income tax rates, providing a tax-efficient income strategy. Loss harvesting involves selling securities at a loss to offset capital gains, reducing overall taxable income and enhancing portfolio tax management. Explore how integrating qualified dividends with loss harvesting strategies can optimize your capital gains tax outcomes and improve investment returns.

Holding Period

Qualified dividends require a holding period of more than 60 days within the 121-day period surrounding the ex-dividend date to benefit from favorable tax rates, typically 0%, 15%, or 20%. Loss harvesting involves strategically selling securities at a loss to offset gains and reduce taxable income, and the holding period affects whether gains are classified as short-term or long-term for tax purposes. Explore detailed strategies and tax implications to optimize your investment portfolio's performance and tax efficiency.

Source and External Links

Qualified Dividends - Fidelity - Qualified dividends are dividends from shares in domestic or certain foreign corporations held for a minimum holding period and are taxed federally at capital gains rates of 0%, 15%, or 20%, depending on income, often with an additional 3.8% net investment income tax for higher earners.

Qualified Dividends vs Ordinary Dividends: Taxing Dividends - Kiplinger - Qualified dividends, created by the 2003 tax cuts, are dividends taxed at the lower long-term capital gains rates to encourage companies to pay dividends and investors to hold stocks longer, contrasting with ordinary dividends which are taxed at higher ordinary income rates.

Definition: qualified dividend income from 26 USC SS 1(h)(11) - Law.Cornell - Qualified dividend income includes dividends from domestic and qualified foreign corporations that meet specific requirements, including holding period rules, and excludes dividends such as those from tax-exempt corporations or those failing the holding period criteria.

dowidth.com

dowidth.com