Thematic ETFs focus on specific sectors or trends such as technology, clean energy, or healthcare, offering targeted exposure to emerging market opportunities. Actively managed ETFs employ fund managers who actively select and adjust holdings based on market research and analysis to outperform benchmarks. Discover the key differences and advantages of these investment options to optimize your portfolio strategy.

Why it is important

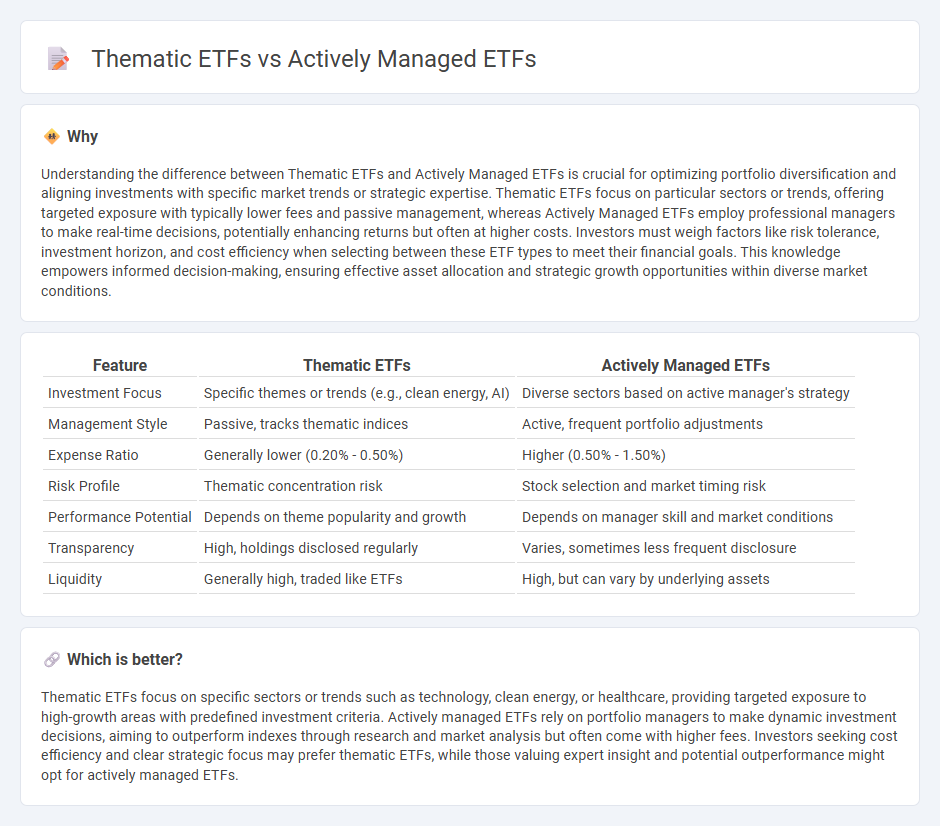

Understanding the difference between Thematic ETFs and Actively Managed ETFs is crucial for optimizing portfolio diversification and aligning investments with specific market trends or strategic expertise. Thematic ETFs focus on particular sectors or trends, offering targeted exposure with typically lower fees and passive management, whereas Actively Managed ETFs employ professional managers to make real-time decisions, potentially enhancing returns but often at higher costs. Investors must weigh factors like risk tolerance, investment horizon, and cost efficiency when selecting between these ETF types to meet their financial goals. This knowledge empowers informed decision-making, ensuring effective asset allocation and strategic growth opportunities within diverse market conditions.

Comparison Table

| Feature | Thematic ETFs | Actively Managed ETFs |

|---|---|---|

| Investment Focus | Specific themes or trends (e.g., clean energy, AI) | Diverse sectors based on active manager's strategy |

| Management Style | Passive, tracks thematic indices | Active, frequent portfolio adjustments |

| Expense Ratio | Generally lower (0.20% - 0.50%) | Higher (0.50% - 1.50%) |

| Risk Profile | Thematic concentration risk | Stock selection and market timing risk |

| Performance Potential | Depends on theme popularity and growth | Depends on manager skill and market conditions |

| Transparency | High, holdings disclosed regularly | Varies, sometimes less frequent disclosure |

| Liquidity | Generally high, traded like ETFs | High, but can vary by underlying assets |

Which is better?

Thematic ETFs focus on specific sectors or trends such as technology, clean energy, or healthcare, providing targeted exposure to high-growth areas with predefined investment criteria. Actively managed ETFs rely on portfolio managers to make dynamic investment decisions, aiming to outperform indexes through research and market analysis but often come with higher fees. Investors seeking cost efficiency and clear strategic focus may prefer thematic ETFs, while those valuing expert insight and potential outperformance might opt for actively managed ETFs.

Connection

Thematic ETFs and Actively Managed ETFs intersect through strategic investment approaches focused on specific sectors or trends, enabling targeted exposure and dynamic portfolio adjustments. Thematic ETFs often concentrate on emerging industries or societal shifts, while actively managed ETFs leverage expert analysis to navigate market fluctuations within these themes. This combination empowers investors to capitalize on evolving market opportunities with tailored, responsive investment vehicles.

Key Terms

Portfolio Management

Actively managed ETFs leverage professional portfolio managers to adjust holdings dynamically, aiming to outperform benchmarks through in-depth market analysis and strategic asset allocation. Thematic ETFs concentrate on specific trends or sectors, offering investors exposure to targeted industries like clean energy or artificial intelligence without constant portfolio adjustments. Explore deeper insights on portfolio management strategies by comparing these ETF types.

Investment Strategy

Actively managed ETFs employ portfolio managers who continuously analyze market trends and adjust holdings to outperform benchmarks, offering dynamic risk management and flexibility. Thematic ETFs concentrate on specific investment themes such as technology innovation, clean energy, or demographic shifts, aiming to capitalize on long-term growth trends within targeted sectors. Explore deeper insights into how these strategies align with your financial goals and risk appetite.

Expense Ratio

Actively managed ETFs typically have higher expense ratios due to frequent trading and active portfolio management compared to thematic ETFs, which often maintain lower costs by focusing on specific sectors or trends with a more passive strategy. The expense ratio for actively managed ETFs can range from 0.50% to over 1.00%, while thematic ETFs generally fall between 0.20% and 0.60%. Explore detailed comparisons and examples to better understand how expense ratios impact your investment returns.

Source and External Links

Actively Managed ETFs - ETF Database - Actively managed ETFs are funds managed by portfolio managers who use proprietary research to select securities aiming to outperform benchmarks, differing from passive ETFs that track an index.

What are Active ETFs? - Wealthtender - Actively managed ETFs invest in securities chosen by managers instead of following an index, with recent regulatory changes such as non-transparent ETFs boosting their growth and appeal.

The Best Active ETFs to Buy for 2025 | Morningstar - Active ETFs are run by managers selecting securities to outperform benchmarks, with some categories like international stocks showing greater potential for alpha over time.

dowidth.com

dowidth.com