Buy Now Pay Later integration enhances customer purchasing power by offering flexible payment options that increase conversion rates and average order values. Bank transfer integration provides a secure, direct payment method favored for its low transaction fees and reduced fraud risk. Explore more to understand which payment gateway aligns best with your business goals.

Why it is important

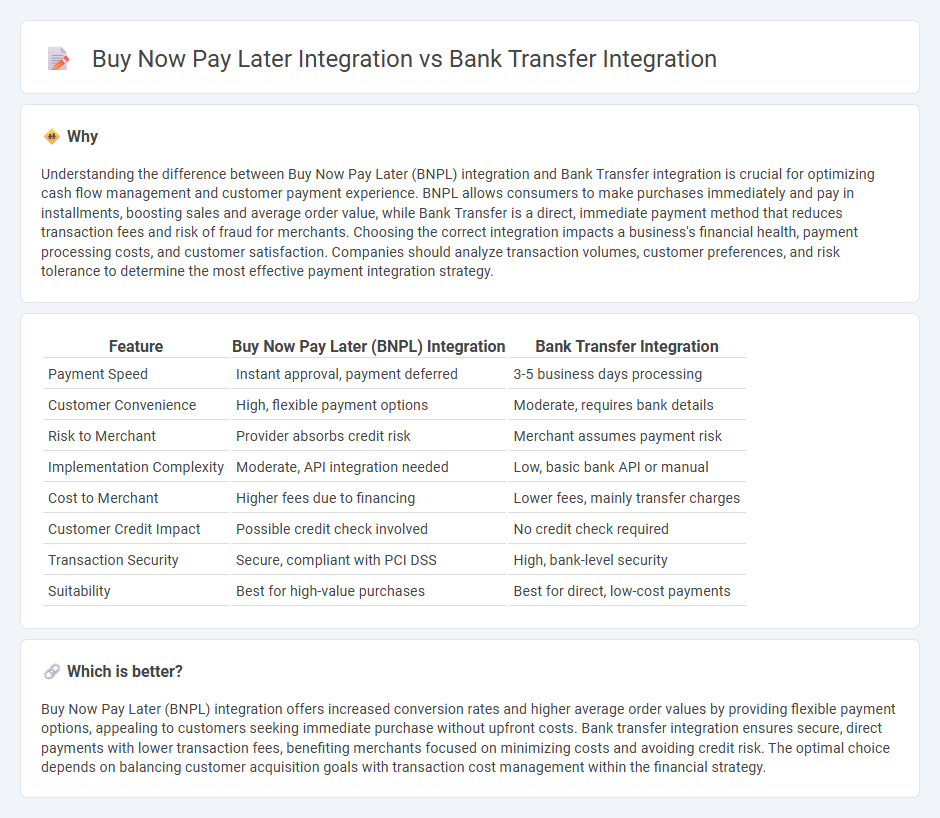

Understanding the difference between Buy Now Pay Later (BNPL) integration and Bank Transfer integration is crucial for optimizing cash flow management and customer payment experience. BNPL allows consumers to make purchases immediately and pay in installments, boosting sales and average order value, while Bank Transfer is a direct, immediate payment method that reduces transaction fees and risk of fraud for merchants. Choosing the correct integration impacts a business's financial health, payment processing costs, and customer satisfaction. Companies should analyze transaction volumes, customer preferences, and risk tolerance to determine the most effective payment integration strategy.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) Integration | Bank Transfer Integration |

|---|---|---|

| Payment Speed | Instant approval, payment deferred | 3-5 business days processing |

| Customer Convenience | High, flexible payment options | Moderate, requires bank details |

| Risk to Merchant | Provider absorbs credit risk | Merchant assumes payment risk |

| Implementation Complexity | Moderate, API integration needed | Low, basic bank API or manual |

| Cost to Merchant | Higher fees due to financing | Lower fees, mainly transfer charges |

| Customer Credit Impact | Possible credit check involved | No credit check required |

| Transaction Security | Secure, compliant with PCI DSS | High, bank-level security |

| Suitability | Best for high-value purchases | Best for direct, low-cost payments |

Which is better?

Buy Now Pay Later (BNPL) integration offers increased conversion rates and higher average order values by providing flexible payment options, appealing to customers seeking immediate purchase without upfront costs. Bank transfer integration ensures secure, direct payments with lower transaction fees, benefiting merchants focused on minimizing costs and avoiding credit risk. The optimal choice depends on balancing customer acquisition goals with transaction cost management within the financial strategy.

Connection

Buy Now Pay Later (BNPL) integration and bank transfer integration are connected through their role in streamlining payment processes and enhancing customer flexibility in financial transactions. Both payment methods leverage secure, real-time data exchange between merchants, banks, and payment gateways to facilitate seamless fund transfers and credit approvals. This integration improves cash flow management for businesses while providing consumers with multiple payment options tailored to their financial preferences.

Key Terms

Settlement

Bank transfer integration ensures direct, secure settlement by transferring funds from the payer's bank account to the merchant's account, typically resulting in faster and guaranteed fund availability. Buy now pay later (BNPL) integration involves a delayed settlement process where the merchant receives payment upfront from the BNPL provider, who then manages the installment payments, posing potential delays in final cash flow. Explore the detailed comparison of settlement mechanisms to optimize your payment infrastructure.

Credit risk

Bank transfer integration minimizes credit risk by requiring immediate payment confirmation, reducing the likelihood of defaults and financial losses. Buy Now Pay Later (BNPL) integration carries higher credit risk as it extends deferred payment options, increasing exposure to potential customer non-payment and requiring comprehensive credit assessment tools. Explore detailed comparisons of risk management strategies in payment integrations to optimize financial stability.

User authentication

Bank transfer integration relies heavily on strong user authentication methods such as two-factor authentication (2FA) and biometric verification to ensure secure transactions directly from the user's bank account. Buy now pay later (BNPL) integration typically uses identity verification and credit scoring algorithms to authenticate users while enabling simplified checkout processes without immediate payment. Explore the differences in security protocols and user experience to understand which authentication method best suits your business model.

Source and External Links

Bank Transfer | Adyen Docs - Bank transfer integration lets merchants offer shoppers the option to pay via bank transfer using virtual bank account numbers, with asynchronous payment confirmation through webhooks, supporting both B2B and B2C transactions internationally.

Bank Transfer API - The Ultimate Guide - IntaSend - An Online Bank Transfer API automates requests to recipient banks for real-time bank transfers initiated by authenticated users, facilitating streamlined payments and disbursements for businesses needing frequent transfers.

Bank transfer payments - Stripe Documentation - Stripe provides bank transfer integration by generating virtual account numbers for customers to send payments securely, automating reconciliation, and supporting multiple currencies and countries with options to enable via dashboard or API.

dowidth.com

dowidth.com