Carbon credits enable businesses to offset greenhouse gas emissions by purchasing allowances verified under international standards, driving sustainable environmental impact. Blue bonds finance ocean and water-related projects that enhance marine conservation and promote climate resilience. Discover how these innovative financial instruments contribute uniquely to sustainability and investment strategies.

Why it is important

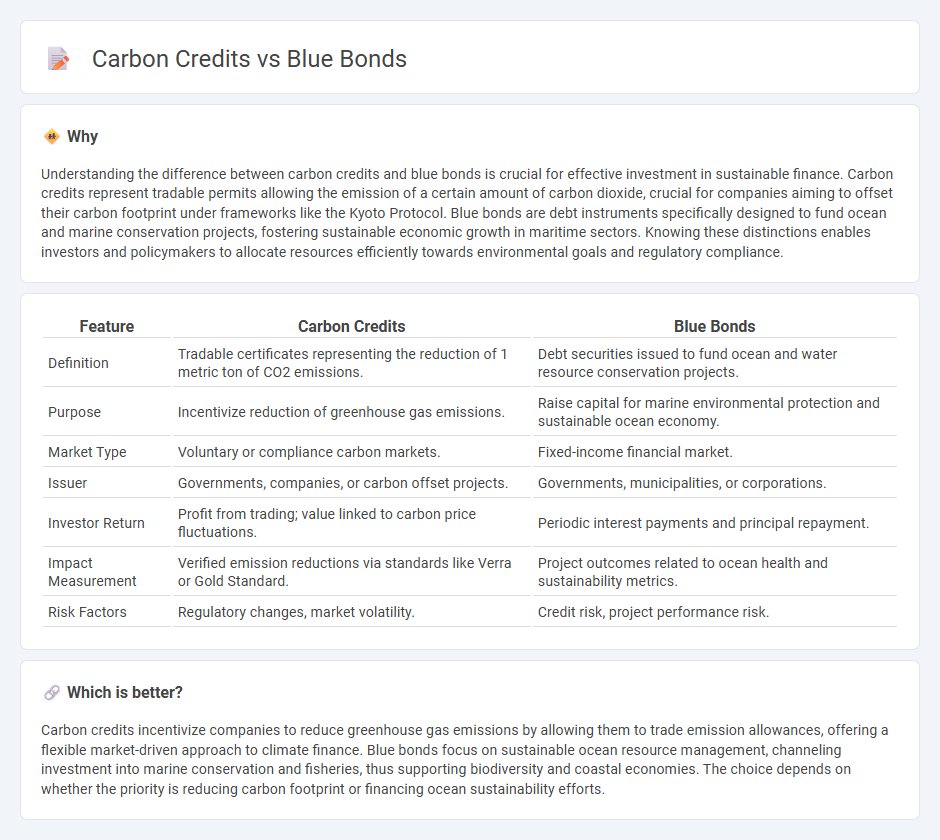

Understanding the difference between carbon credits and blue bonds is crucial for effective investment in sustainable finance. Carbon credits represent tradable permits allowing the emission of a certain amount of carbon dioxide, crucial for companies aiming to offset their carbon footprint under frameworks like the Kyoto Protocol. Blue bonds are debt instruments specifically designed to fund ocean and marine conservation projects, fostering sustainable economic growth in maritime sectors. Knowing these distinctions enables investors and policymakers to allocate resources efficiently towards environmental goals and regulatory compliance.

Comparison Table

| Feature | Carbon Credits | Blue Bonds |

|---|---|---|

| Definition | Tradable certificates representing the reduction of 1 metric ton of CO2 emissions. | Debt securities issued to fund ocean and water resource conservation projects. |

| Purpose | Incentivize reduction of greenhouse gas emissions. | Raise capital for marine environmental protection and sustainable ocean economy. |

| Market Type | Voluntary or compliance carbon markets. | Fixed-income financial market. |

| Issuer | Governments, companies, or carbon offset projects. | Governments, municipalities, or corporations. |

| Investor Return | Profit from trading; value linked to carbon price fluctuations. | Periodic interest payments and principal repayment. |

| Impact Measurement | Verified emission reductions via standards like Verra or Gold Standard. | Project outcomes related to ocean health and sustainability metrics. |

| Risk Factors | Regulatory changes, market volatility. | Credit risk, project performance risk. |

Which is better?

Carbon credits incentivize companies to reduce greenhouse gas emissions by allowing them to trade emission allowances, offering a flexible market-driven approach to climate finance. Blue bonds focus on sustainable ocean resource management, channeling investment into marine conservation and fisheries, thus supporting biodiversity and coastal economies. The choice depends on whether the priority is reducing carbon footprint or financing ocean sustainability efforts.

Connection

Carbon credits and blue bonds are connected through their role in funding environmental sustainability initiatives. Carbon credits represent tradable permits to emit a certain amount of greenhouse gases, incentivizing emission reductions, while blue bonds are debt instruments issued to finance marine and ocean conservation projects that promote carbon sequestration. Both financial tools support the transition to a low-carbon economy by mobilizing private capital for climate mitigation and adaptation efforts.

Key Terms

Sustainability

Blue bonds finance marine and ocean-based projects to promote sustainable water resource management and biodiversity conservation. Carbon credits represent measurable emission reductions that companies and countries purchase to offset their carbon footprint and support climate change mitigation. Explore how these financial instruments drive environmental sustainability and support global green initiatives.

Ocean Conservation (Blue Bonds)

Blue bonds are debt instruments designed specifically to finance ocean conservation projects, providing funds to protect marine ecosystems, support sustainable fisheries, and reduce ocean pollution. Carbon credits represent tradable permits that allow companies to offset carbon emissions by funding projects that reduce greenhouse gases, including some initiatives related to ocean carbon sequestration. Explore more to understand how blue bonds directly target ocean health compared to the broader climate impact of carbon credits.

Emissions Reduction (Carbon Credits)

Blue bonds finance marine and ocean conservation projects that support sustainable fisheries, coastal resilience, and carbon sequestration in blue carbon ecosystems such as mangroves, seagrasses, and salt marshes. Carbon credits represent verified emission reductions or removals achieved by projects that prevent or reduce greenhouse gas emissions, enabling companies to offset their carbon footprint through market-based trading schemes. Explore how these financial instruments contribute to global emissions reduction and sustainable environmental impact.

Source and External Links

Blue Bond | Research and Innovation - European Union - Blue bonds are debt instruments issued by governments, development banks, or corporations to finance marine and ocean-based projects with long-term sustainability and economic benefits, supporting activities aligned with the blue economy and broader sustainable development goals.

Blue Bonds - NAP Global Network - Blue bonds, a subset of green bonds, finance marine resource improvement projects such as coastal climate adaptation, marine pollution control, ecosystem conservation, and sustainable marine value chains, with guidelines provided by institutions like IFC and Asian Development Bank.

Blue Finance - IFC - The International Finance Corporation has facilitated issuing and investing in blue bonds and loans, mobilizing billions to support blue economy projects such as water management, marine pollution reduction, and sustainable fisheries, notably in regions like East Asia Pacific and Central and Eastern Europe.

dowidth.com

dowidth.com