Tokenized treasury bills offer digital ownership of government debt securities, providing transparency, security, and liquidity through blockchain technology. Money market funds invest in short-term, high-quality debt instruments, offering stability and easy access to cash with lower risk. Explore the benefits and differences to make informed investment decisions.

Why it is important

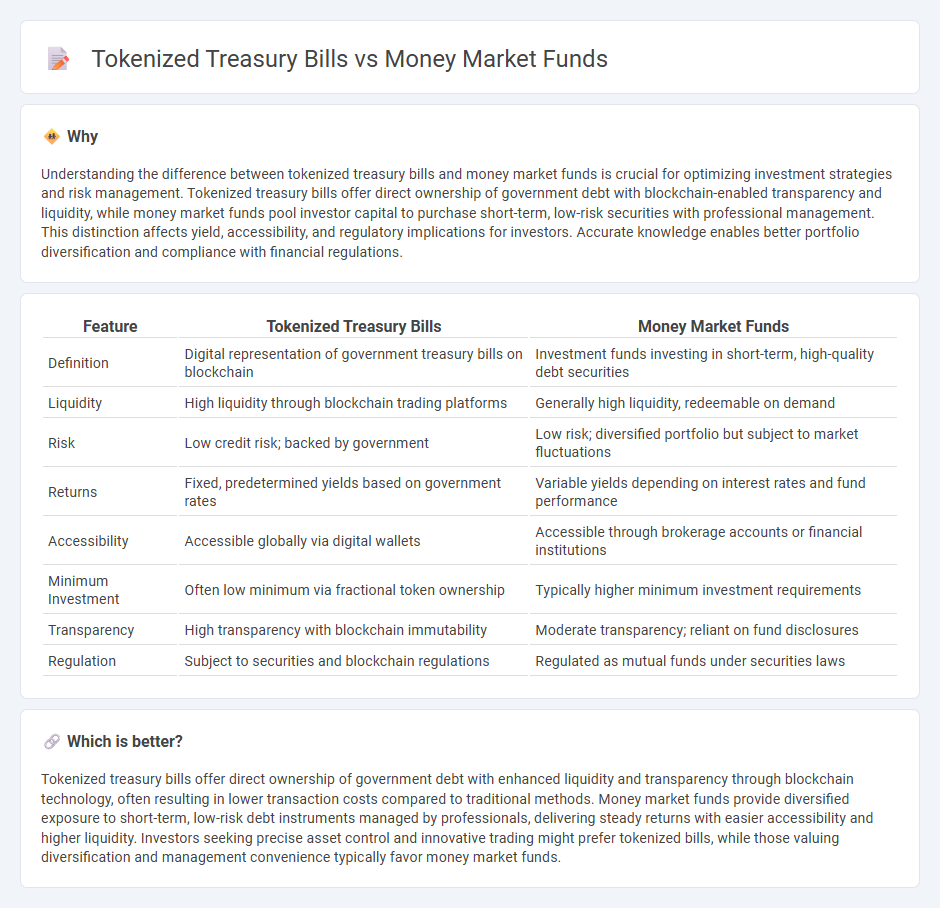

Understanding the difference between tokenized treasury bills and money market funds is crucial for optimizing investment strategies and risk management. Tokenized treasury bills offer direct ownership of government debt with blockchain-enabled transparency and liquidity, while money market funds pool investor capital to purchase short-term, low-risk securities with professional management. This distinction affects yield, accessibility, and regulatory implications for investors. Accurate knowledge enables better portfolio diversification and compliance with financial regulations.

Comparison Table

| Feature | Tokenized Treasury Bills | Money Market Funds |

|---|---|---|

| Definition | Digital representation of government treasury bills on blockchain | Investment funds investing in short-term, high-quality debt securities |

| Liquidity | High liquidity through blockchain trading platforms | Generally high liquidity, redeemable on demand |

| Risk | Low credit risk; backed by government | Low risk; diversified portfolio but subject to market fluctuations |

| Returns | Fixed, predetermined yields based on government rates | Variable yields depending on interest rates and fund performance |

| Accessibility | Accessible globally via digital wallets | Accessible through brokerage accounts or financial institutions |

| Minimum Investment | Often low minimum via fractional token ownership | Typically higher minimum investment requirements |

| Transparency | High transparency with blockchain immutability | Moderate transparency; reliant on fund disclosures |

| Regulation | Subject to securities and blockchain regulations | Regulated as mutual funds under securities laws |

Which is better?

Tokenized treasury bills offer direct ownership of government debt with enhanced liquidity and transparency through blockchain technology, often resulting in lower transaction costs compared to traditional methods. Money market funds provide diversified exposure to short-term, low-risk debt instruments managed by professionals, delivering steady returns with easier accessibility and higher liquidity. Investors seeking precise asset control and innovative trading might prefer tokenized bills, while those valuing diversification and management convenience typically favor money market funds.

Connection

Tokenized treasury bills represent digital securities that offer fractional ownership and enhanced liquidity, bridging traditional finance and blockchain technology. Money market funds invest in short-term, high-quality debt instruments including treasury bills, providing investors with stable returns and liquidity. The integration of tokenized treasury bills in money market funds enables seamless trading, increased transparency, and broader investor access, fostering efficient capital allocation in the financial ecosystem.

Key Terms

Liquidity

Money market funds offer high liquidity by allowing investors to redeem shares quickly, often on the same business day, making them suitable for short-term cash management. Tokenized treasury bills provide liquidity through blockchain technology, enabling faster settlement and fractional ownership, though trading liquidity depends on the platform's user base and secondary market activity. Explore the differences in liquidity features and benefits between money market funds and tokenized treasury bills to make informed investment decisions.

Yield

Money market funds typically offer yields around 0.5% to 2% annually, depending on prevailing interest rates and fund composition. Tokenized treasury bills provide potentially higher yields, often reflecting real-time market demand and blockchain efficiency, with returns varying between 2% to 5% or more. Explore the detailed comparison of yield structures and risk factors to determine the best fit for your investment goals.

Counterparty Risk

Money market funds typically invest in short-term, high-quality debt instruments but carry counterparty risk related to the financial institutions managing the fund and the underlying assets' issuers. Tokenized treasury bills represent government debt in a digital format, reducing counterparty risk by leveraging blockchain technology for transparent ownership and settlement processes. Explore how tokenization can enhance security and efficiency compared to traditional money market funds.

Source and External Links

Money market fund - Wikipedia - A money market fund is an open-end mutual fund investing in short-term, high-quality debt securities aiming to maintain stable asset value and liquidity, regulated by rules to limit credit, market, and liquidity risks in the U.S. and Europe.

What is a money market fund and how do they work? - Vanguard - Money market funds invest in low-risk, short-term debt instruments to offer safety, liquidity, and modest returns, often used for short-term savings or emergency funds, and distinguish from bank money market accounts by being investment products rather than deposits.

Money Market Funds | Charles Schwab - Money market funds invest in short-term, higher-quality securities, are available in different types like prime, government, municipal, and ETF forms, and offer high liquidity with lower risk and capital stability for various investor types.

dowidth.com

dowidth.com