Synthetic risk transfer (SRT) uses credit derivatives to shift risk without transferring the underlying asset, enhancing balance sheet efficiency for financial institutions. Collateralized debt obligations (CDOs) pool various debt instruments to create tranches with different risk and return profiles, attracting diverse investor classes. Explore further to understand how these instruments shape risk management strategies in finance.

Why it is important

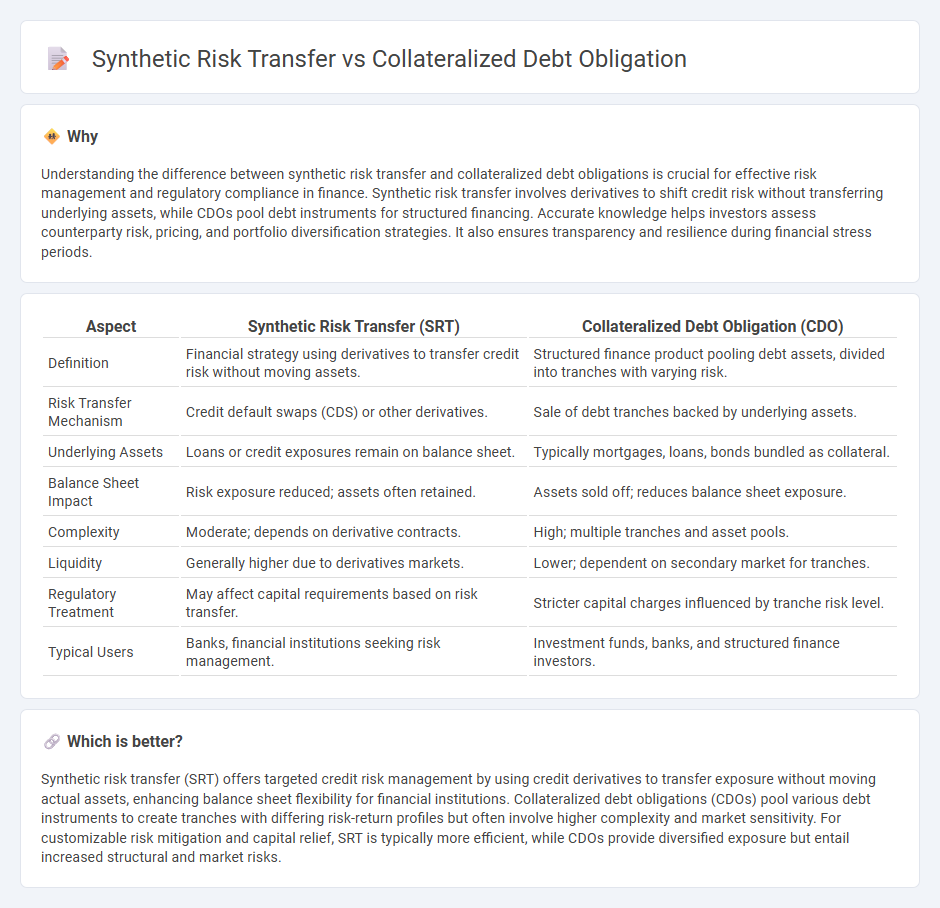

Understanding the difference between synthetic risk transfer and collateralized debt obligations is crucial for effective risk management and regulatory compliance in finance. Synthetic risk transfer involves derivatives to shift credit risk without transferring underlying assets, while CDOs pool debt instruments for structured financing. Accurate knowledge helps investors assess counterparty risk, pricing, and portfolio diversification strategies. It also ensures transparency and resilience during financial stress periods.

Comparison Table

| Aspect | Synthetic Risk Transfer (SRT) | Collateralized Debt Obligation (CDO) |

|---|---|---|

| Definition | Financial strategy using derivatives to transfer credit risk without moving assets. | Structured finance product pooling debt assets, divided into tranches with varying risk. |

| Risk Transfer Mechanism | Credit default swaps (CDS) or other derivatives. | Sale of debt tranches backed by underlying assets. |

| Underlying Assets | Loans or credit exposures remain on balance sheet. | Typically mortgages, loans, bonds bundled as collateral. |

| Balance Sheet Impact | Risk exposure reduced; assets often retained. | Assets sold off; reduces balance sheet exposure. |

| Complexity | Moderate; depends on derivative contracts. | High; multiple tranches and asset pools. |

| Liquidity | Generally higher due to derivatives markets. | Lower; dependent on secondary market for tranches. |

| Regulatory Treatment | May affect capital requirements based on risk transfer. | Stricter capital charges influenced by tranche risk level. |

| Typical Users | Banks, financial institutions seeking risk management. | Investment funds, banks, and structured finance investors. |

Which is better?

Synthetic risk transfer (SRT) offers targeted credit risk management by using credit derivatives to transfer exposure without moving actual assets, enhancing balance sheet flexibility for financial institutions. Collateralized debt obligations (CDOs) pool various debt instruments to create tranches with differing risk-return profiles but often involve higher complexity and market sensitivity. For customizable risk mitigation and capital relief, SRT is typically more efficient, while CDOs provide diversified exposure but entail increased structural and market risks.

Connection

Synthetic risk transfer (SRT) and collateralized debt obligations (CDOs) are connected through their shared purpose of transferring credit risk from financial institutions to investors. SRT employs credit derivatives like credit default swaps to isolate and redistribute risk without selling the actual assets, often involving synthetic CDOs as structured vehicles. These instruments enhance capital relief and risk management by enabling banks to offload specific credit exposures while maintaining asset ownership on their balance sheets.

Key Terms

Asset-backed Securities

Collateralized Debt Obligations (CDOs) involve pooling asset-backed securities (ABS) and issuing tranches with varying risk levels, transferring credit risk through actual asset ownership. Synthetic Risk Transfer (SRT) uses credit derivatives to transfer risk without transferring the underlying ABS, enabling risk management and capital relief without asset sale. Explore the detailed mechanisms and benefits of CDOs and SRTs in ABS portfolios for a deeper understanding.

Credit Derivatives

Collateralized Debt Obligations (CDOs) pool various debt instruments to redistribute credit risk among investors, while Synthetic Risk Transfer (SRT) uses credit derivatives like credit default swaps to transfer credit risk without moving underlying assets. In credit derivatives markets, CDOs offer structured tranches based on actual debt pools, contrasting with SRT's reliance on synthetic exposures to achieve balance sheet optimization. Explore the nuances and strategic applications of both instruments in credit risk management for deeper insights.

Tranching

Collateralized Debt Obligations (CDOs) use tranching to divide pooled debt into slices with varying risk levels, allowing investors to select tranches matching their risk appetite. Synthetic Risk Transfer (SRT) employs credit derivatives like credit default swaps to transfer risk without moving actual assets, and tranching structures are applied to derivatives exposures to tailor risk profiles. Explore deeper into how tranching mechanisms shape risk allocation and investor returns in CDOs and SRTs.

Source and External Links

Fixed Income Securities (Bonds): Collateralized Debt Obligations - A collateralized debt obligation (CDO) is a complex structured finance product backed by a pool of loans and other assets, sold to institutional investors, divided into tranches with prioritized cash flows based on seniority, often used by banks to generate cash, transfer loan risk, and increase profits.

Collateralized Debt Obligation (CDO) - Corporate Finance Institute - A CDO is a synthetic investment product that bundles different loans or bonds into prioritized securities, allocating income according to tranche seniority; it evolved from cash flow CDOs to actively managed marked-to-market CDOs before the 2008 financial crisis.

COLLATERALIZED DEBT OBLIGATIONS (CDOs) - NAIC - CDOs are structured securities collateralized by pools of bonds or loans (e.g., corporate bonds, ABS, RMBS), divided into rated tranches and an unrated equity tranche that absorbs first losses, with cash flows paying debt service to senior holders first and residuals to equity holders.

dowidth.com

dowidth.com