Carbon trading and cap and trade are market-based mechanisms designed to reduce greenhouse gas emissions by assigning economic value to carbon credits. Carbon trading enables companies to buy and sell emission allowances, creating financial incentives to decrease pollution, while cap and trade sets a regulatory cap on total emissions and distributes permits accordingly. Explore how these systems drive sustainability and influence global financial markets.

Why it is important

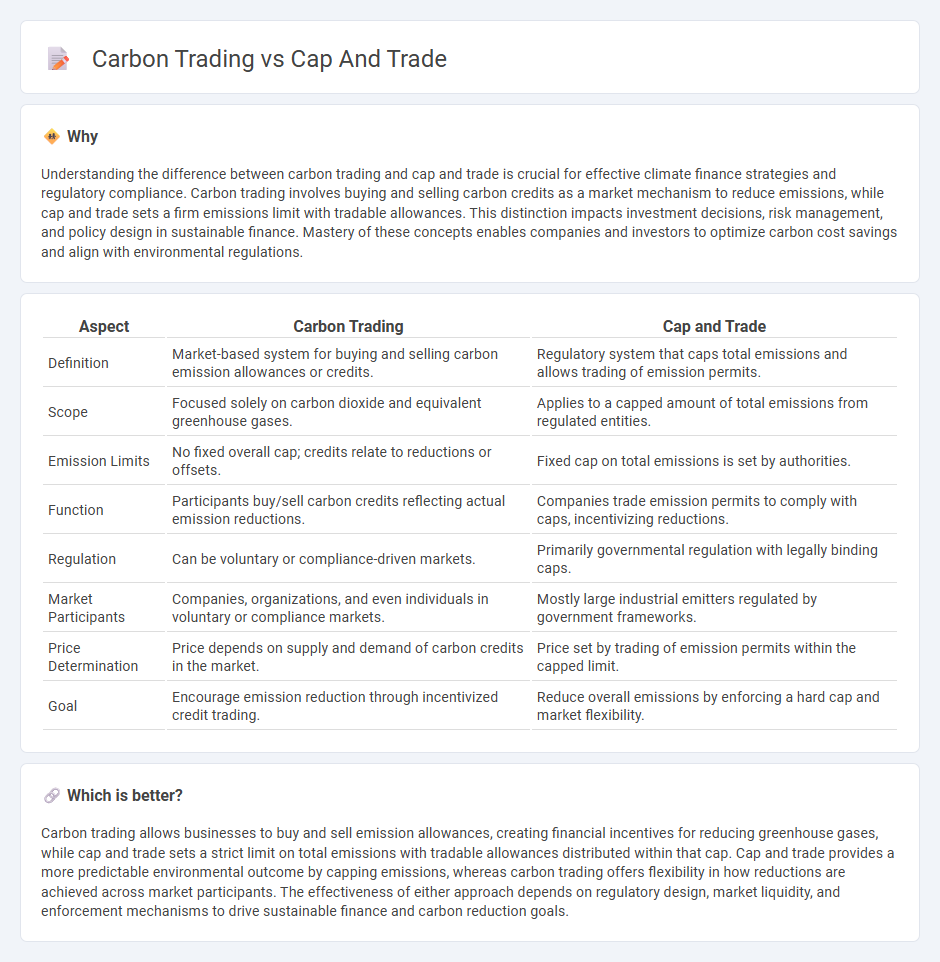

Understanding the difference between carbon trading and cap and trade is crucial for effective climate finance strategies and regulatory compliance. Carbon trading involves buying and selling carbon credits as a market mechanism to reduce emissions, while cap and trade sets a firm emissions limit with tradable allowances. This distinction impacts investment decisions, risk management, and policy design in sustainable finance. Mastery of these concepts enables companies and investors to optimize carbon cost savings and align with environmental regulations.

Comparison Table

| Aspect | Carbon Trading | Cap and Trade |

|---|---|---|

| Definition | Market-based system for buying and selling carbon emission allowances or credits. | Regulatory system that caps total emissions and allows trading of emission permits. |

| Scope | Focused solely on carbon dioxide and equivalent greenhouse gases. | Applies to a capped amount of total emissions from regulated entities. |

| Emission Limits | No fixed overall cap; credits relate to reductions or offsets. | Fixed cap on total emissions is set by authorities. |

| Function | Participants buy/sell carbon credits reflecting actual emission reductions. | Companies trade emission permits to comply with caps, incentivizing reductions. |

| Regulation | Can be voluntary or compliance-driven markets. | Primarily governmental regulation with legally binding caps. |

| Market Participants | Companies, organizations, and even individuals in voluntary or compliance markets. | Mostly large industrial emitters regulated by government frameworks. |

| Price Determination | Price depends on supply and demand of carbon credits in the market. | Price set by trading of emission permits within the capped limit. |

| Goal | Encourage emission reduction through incentivized credit trading. | Reduce overall emissions by enforcing a hard cap and market flexibility. |

Which is better?

Carbon trading allows businesses to buy and sell emission allowances, creating financial incentives for reducing greenhouse gases, while cap and trade sets a strict limit on total emissions with tradable allowances distributed within that cap. Cap and trade provides a more predictable environmental outcome by capping emissions, whereas carbon trading offers flexibility in how reductions are achieved across market participants. The effectiveness of either approach depends on regulatory design, market liquidity, and enforcement mechanisms to drive sustainable finance and carbon reduction goals.

Connection

Carbon trading operates within the framework of cap and trade systems, where governments set a maximum emission cap for industries and allocate or auction carbon allowances. Companies trade these allowances, buying excess permits from lower emitters or selling surplus credits if they stay under their cap, creating a market-driven approach to reduce greenhouse gas emissions. This mechanism incentivizes industries to innovate and cut emissions cost-effectively while ensuring that overall pollution stays within regulated limits.

Key Terms

Allowance

Cap and trade involves setting a maximum limit (cap) on total greenhouse gas emissions, allowing companies to buy and sell emission allowances within that cap. Carbon trading broadly includes cap and trade but also carbon offset credits, which represent emission reductions from projects outside the capped sectors. Explore detailed insights on allowance mechanisms and their impact on emission reduction strategies.

Emission Cap

Emission cap in cap and trade systems sets a maximum limit on greenhouse gas emissions for regulated entities, ensuring overall reduction targets are met. Carbon trading allows businesses to buy and sell emission allowances or credits within this capped limit to optimize compliance costs. Explore detailed insights on how emission caps drive market dynamics and climate policy effectiveness.

Carbon Market

Cap and trade establishes a limit on overall emissions, allowing companies to buy and sell emission allowances within that cap, driving reductions efficiently. Carbon trading refers broadly to buying and selling carbon credits or offsets, including projects outside capped systems like forestry or renewable energy initiatives. Explore detailed insights on carbon markets and their impact on global emission reduction strategies.

Source and External Links

Cap and Trade Basics - Cap and trade is a market-based approach to reducing emissions cost-effectively by setting a limit (cap) on total emissions and allowing companies to buy and sell allowances, which drives investment and innovation through a carbon price.

How cap and trade works - Cap and trade sets a firm limit on pollution while allowing companies flexibility to trade allowances, encouraging faster pollution cuts and rewarding innovation, proven effective in reducing sulfur dioxide and acid rain.

Cap-and-trade programme - An Emission Trading System (ETS), or cap and trade, works by setting a GHG emissions cap, distributing tradable emission permits, and covering sectors such as power and industry, with the carbon price determined by supply and demand of allowances.

dowidth.com

dowidth.com