Finfluencers leverage social media platforms to provide accessible financial advice, targeting a broad audience with simplified investment tips and market insights. Portfolio managers focus on actively managing investment portfolios, using expertise and data-driven strategies to optimize returns for individual or institutional clients. Explore the distinctions in their roles, approaches, and impact on personal finance and investing.

Why it is important

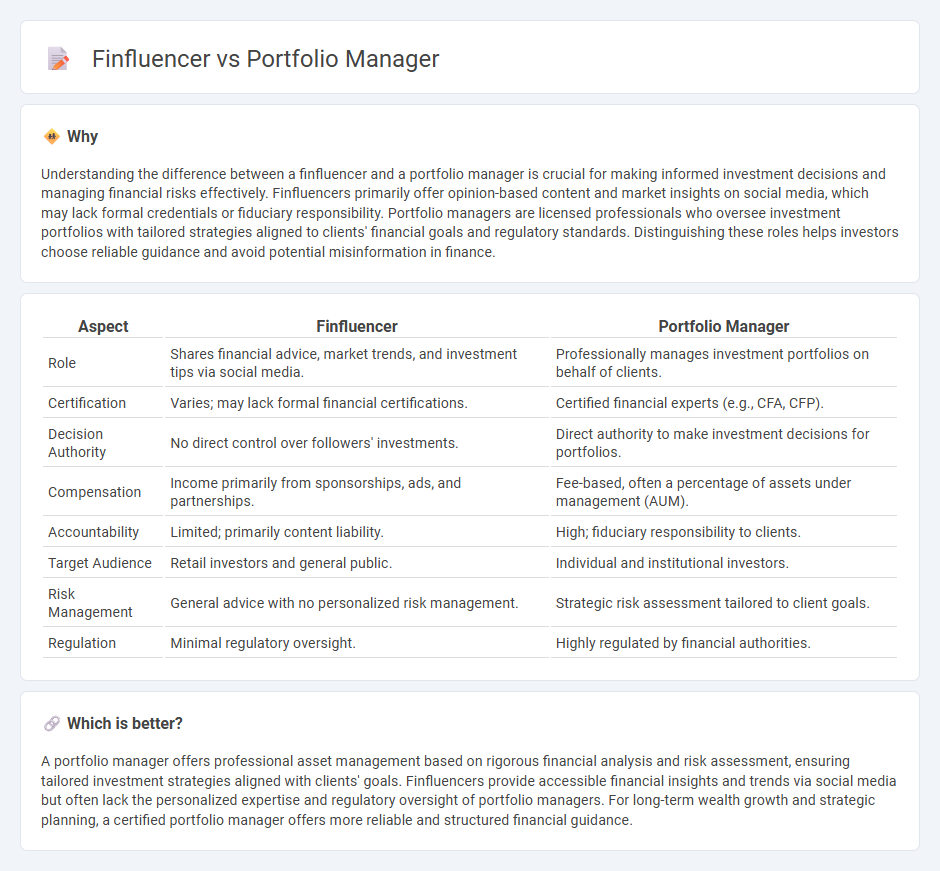

Understanding the difference between a finfluencer and a portfolio manager is crucial for making informed investment decisions and managing financial risks effectively. Finfluencers primarily offer opinion-based content and market insights on social media, which may lack formal credentials or fiduciary responsibility. Portfolio managers are licensed professionals who oversee investment portfolios with tailored strategies aligned to clients' financial goals and regulatory standards. Distinguishing these roles helps investors choose reliable guidance and avoid potential misinformation in finance.

Comparison Table

| Aspect | Finfluencer | Portfolio Manager |

|---|---|---|

| Role | Shares financial advice, market trends, and investment tips via social media. | Professionally manages investment portfolios on behalf of clients. |

| Certification | Varies; may lack formal financial certifications. | Certified financial experts (e.g., CFA, CFP). |

| Decision Authority | No direct control over followers' investments. | Direct authority to make investment decisions for portfolios. |

| Compensation | Income primarily from sponsorships, ads, and partnerships. | Fee-based, often a percentage of assets under management (AUM). |

| Accountability | Limited; primarily content liability. | High; fiduciary responsibility to clients. |

| Target Audience | Retail investors and general public. | Individual and institutional investors. |

| Risk Management | General advice with no personalized risk management. | Strategic risk assessment tailored to client goals. |

| Regulation | Minimal regulatory oversight. | Highly regulated by financial authorities. |

Which is better?

A portfolio manager offers professional asset management based on rigorous financial analysis and risk assessment, ensuring tailored investment strategies aligned with clients' goals. Finfluencers provide accessible financial insights and trends via social media but often lack the personalized expertise and regulatory oversight of portfolio managers. For long-term wealth growth and strategic planning, a certified portfolio manager offers more reliable and structured financial guidance.

Connection

Finfluencers leverage social media platforms to educate and influence individual investors, often sharing insights about portfolio management strategies. Portfolio managers analyze market trends and asset allocations to maximize investment returns, frequently using data-driven approaches that finfluencers highlight to their audiences. The connection between finfluencers and portfolio managers lies in the dissemination and practical application of financial expertise to optimize investment portfolios.

Key Terms

**Portfolio Manager:**

A Portfolio Manager oversees diversified investment portfolios, employing deep financial analysis and risk management to maximize returns for clients or institutions. Their expertise lies in asset allocation, market trends, and strategic decision-making backed by regulatory compliance and fiduciary responsibility. Discover how a Portfolio Manager's disciplined approach can enhance wealth growth and stability in complex markets.

Asset Allocation

Portfolio managers strategically allocate assets based on risk tolerance, market conditions, and investment goals to optimize long-term returns. Finfluencers often share generalized asset allocation tips and trends, leveraging social media reach rather than personalized portfolio management. Explore the distinct roles and methodologies behind asset allocation in portfolio management and finfluencing for deeper insights.

Risk Management

Portfolio managers employ advanced risk management strategies, including diversification, asset allocation, and quantitative models to minimize potential losses and optimize returns. Finfluencers often focus on sharing personal investment insights and trends, but may lack rigorous risk assessment frameworks intrinsic to professional portfolio management. Explore the critical differences in how these roles approach risk management to make informed financial decisions.

Source and External Links

Learn About Being a Portfolio Manager (With Video) | Indeed.com - A portfolio manager is a finance professional responsible for managing clients' assets and investments by assessing goals, researching market trends, making buying/selling decisions, and monitoring performance.

A Day in the Life of a Portfolio Manager - Financial Edge Training - Portfolio managers oversee the selection and management of investment portfolios, communicate with analysts and clients, and balance asset allocation and risk management to achieve investment objectives.

Portfolio manager - Wikipedia - A portfolio manager makes investment decisions and manages asset allocation to match investment objectives, balancing risk and performance through active or passive fund management strategies.

dowidth.com

dowidth.com