Private credit offers direct lending opportunities with tailored terms and typically lower volatility compared to high-yield bonds, which are debt securities issued by companies with lower credit ratings and higher default risk, but generally provide greater liquidity. Investors seek private credit for steady cash flows and customized risk profiles, while high-yield bonds attract those looking for higher income potential and tradability in secondary markets. Explore the key differences between private credit and high-yield bonds to align investment strategies with your financial goals.

Why it is important

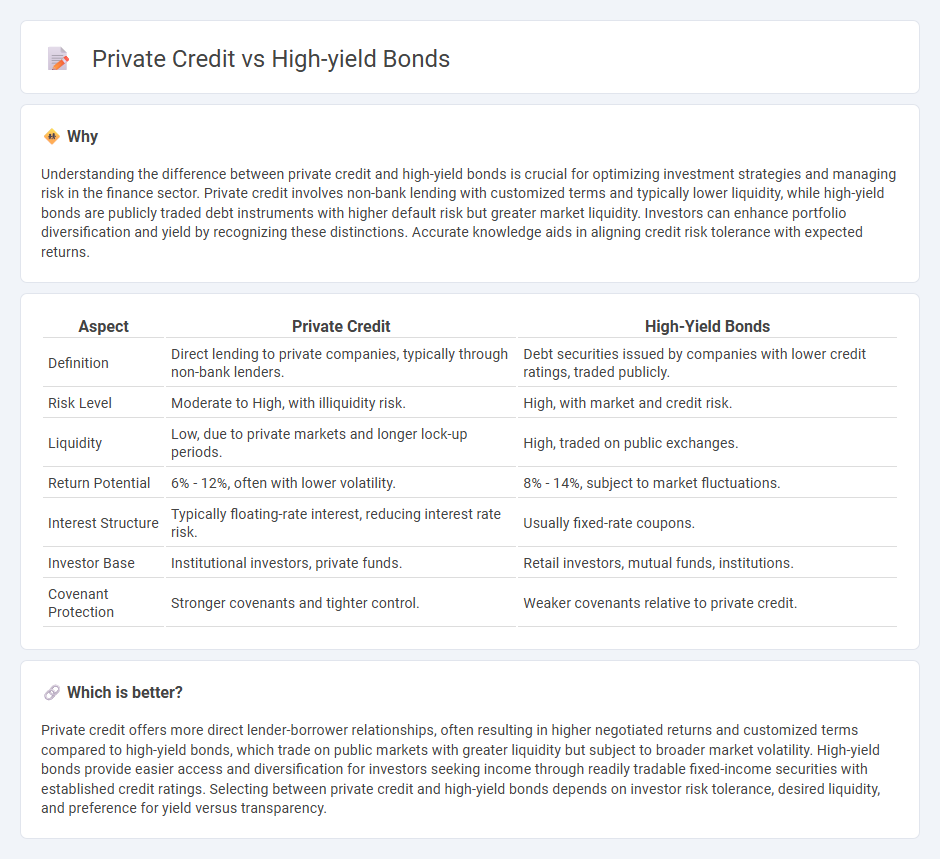

Understanding the difference between private credit and high-yield bonds is crucial for optimizing investment strategies and managing risk in the finance sector. Private credit involves non-bank lending with customized terms and typically lower liquidity, while high-yield bonds are publicly traded debt instruments with higher default risk but greater market liquidity. Investors can enhance portfolio diversification and yield by recognizing these distinctions. Accurate knowledge aids in aligning credit risk tolerance with expected returns.

Comparison Table

| Aspect | Private Credit | High-Yield Bonds |

|---|---|---|

| Definition | Direct lending to private companies, typically through non-bank lenders. | Debt securities issued by companies with lower credit ratings, traded publicly. |

| Risk Level | Moderate to High, with illiquidity risk. | High, with market and credit risk. |

| Liquidity | Low, due to private markets and longer lock-up periods. | High, traded on public exchanges. |

| Return Potential | 6% - 12%, often with lower volatility. | 8% - 14%, subject to market fluctuations. |

| Interest Structure | Typically floating-rate interest, reducing interest rate risk. | Usually fixed-rate coupons. |

| Investor Base | Institutional investors, private funds. | Retail investors, mutual funds, institutions. |

| Covenant Protection | Stronger covenants and tighter control. | Weaker covenants relative to private credit. |

Which is better?

Private credit offers more direct lender-borrower relationships, often resulting in higher negotiated returns and customized terms compared to high-yield bonds, which trade on public markets with greater liquidity but subject to broader market volatility. High-yield bonds provide easier access and diversification for investors seeking income through readily tradable fixed-income securities with established credit ratings. Selecting between private credit and high-yield bonds depends on investor risk tolerance, desired liquidity, and preference for yield versus transparency.

Connection

Private credit and high-yield bonds both serve as alternative financing sources for companies with lower credit ratings or limited access to traditional bank loans. They offer higher returns to investors by compensating for increased risk through debt instruments that are typically used in leveraged buyouts, acquisitions, or refinancing. Market trends show growing institutional interest in private credit as a complementary investment to high-yield bonds, given their potential for diversified income streams and lower correlation to public markets.

Key Terms

Yield

High-yield bonds typically offer yields ranging from 6% to 10%, reflecting their higher credit risk and greater liquidity compared to private credit. Private credit, often accessed through direct lending, can deliver yields between 8% and 12%, driven by illiquidity premiums and customized loan structures. Explore detailed comparisons to understand which investment matches your risk tolerance and income goals.

Credit Risk

High-yield bonds typically involve publicly traded debt with higher credit risk due to lower credit ratings, while private credit consists of non-bank loans made to private companies, often with more customized terms mitigating some default risk. The illiquidity and less transparency of private credit can increase perceived credit risk but also offer enhanced risk premiums compared to high-yield bonds. Explore detailed risk assessments and performance metrics to understand which option aligns best with your credit risk appetite.

Liquidity

High-yield bonds offer greater liquidity as they trade on public markets with daily pricing and established secondary markets, allowing investors to buy or sell relatively quickly. Private credit involves direct lending to private companies, often resulting in limited liquidity due to longer lock-up periods and less frequent valuation events. Explore more insights to understand how liquidity impacts risk and return profiles in these asset classes.

Source and External Links

Understanding High Yield Bonds | PIMCO - High yield bonds are corporate bonds rated below BBB- or Baa3, offering higher coupons and potential price appreciation but with greater risk, often used for portfolio diversification due to low correlation with other fixed income sectors.

5 Best High-Yield Bond Funds - Bankrate - High-yield bonds offer higher returns for investors willing to accept increased credit risk, and mutual funds or ETFs provide diversified exposure to these below-investment-grade bonds.

What Are High-yield Corporate Bonds? | SEC.gov - High-yield corporate bonds pay higher interest to compensate for greater default risk, commonly issued by highly leveraged or financially troubled companies, and are also known as junk bonds.

dowidth.com

dowidth.com