Insurtech revolutionizes the insurance industry by integrating advanced technologies like AI and blockchain to enhance risk assessment, claims processing, and customer experience. Wealthtech focuses on digital innovations such as robo-advisors and personalized financial planning tools to optimize investment management and wealth accumulation. Explore the evolving landscape of Insurtech and Wealthtech to understand their unique impacts on the future of finance.

Why it is important

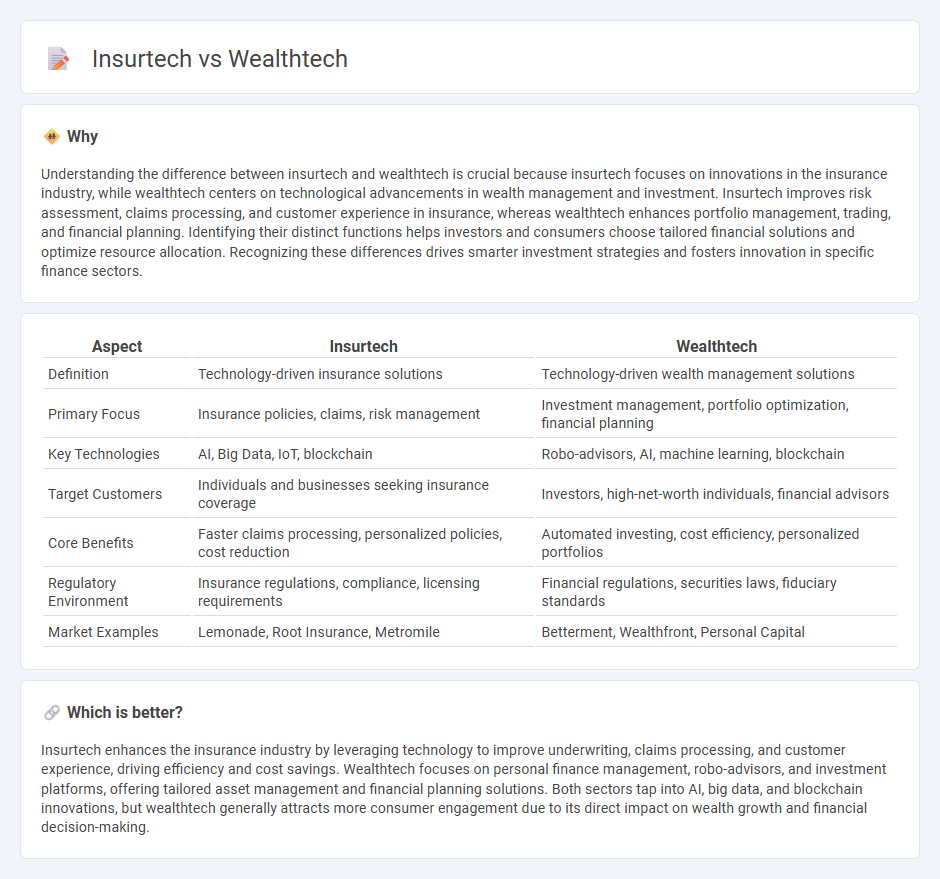

Understanding the difference between insurtech and wealthtech is crucial because insurtech focuses on innovations in the insurance industry, while wealthtech centers on technological advancements in wealth management and investment. Insurtech improves risk assessment, claims processing, and customer experience in insurance, whereas wealthtech enhances portfolio management, trading, and financial planning. Identifying their distinct functions helps investors and consumers choose tailored financial solutions and optimize resource allocation. Recognizing these differences drives smarter investment strategies and fosters innovation in specific finance sectors.

Comparison Table

| Aspect | Insurtech | Wealthtech |

|---|---|---|

| Definition | Technology-driven insurance solutions | Technology-driven wealth management solutions |

| Primary Focus | Insurance policies, claims, risk management | Investment management, portfolio optimization, financial planning |

| Key Technologies | AI, Big Data, IoT, blockchain | Robo-advisors, AI, machine learning, blockchain |

| Target Customers | Individuals and businesses seeking insurance coverage | Investors, high-net-worth individuals, financial advisors |

| Core Benefits | Faster claims processing, personalized policies, cost reduction | Automated investing, cost efficiency, personalized portfolios |

| Regulatory Environment | Insurance regulations, compliance, licensing requirements | Financial regulations, securities laws, fiduciary standards |

| Market Examples | Lemonade, Root Insurance, Metromile | Betterment, Wealthfront, Personal Capital |

Which is better?

Insurtech enhances the insurance industry by leveraging technology to improve underwriting, claims processing, and customer experience, driving efficiency and cost savings. Wealthtech focuses on personal finance management, robo-advisors, and investment platforms, offering tailored asset management and financial planning solutions. Both sectors tap into AI, big data, and blockchain innovations, but wealthtech generally attracts more consumer engagement due to its direct impact on wealth growth and financial decision-making.

Connection

Insurtech and wealthtech intersect through their shared reliance on advanced data analytics and artificial intelligence to enhance financial decision-making and risk management. Both sectors leverage digital platforms to provide personalized services, improving customer experience and operational efficiency in insurance and wealth management industries. Integration of insurtech's risk assessment capabilities with wealthtech's investment strategies is driving innovation in holistic financial solutions.

Key Terms

**Wealthtech:**

Wealthtech leverages advanced technologies such as AI, big data, and blockchain to optimize investment management, portfolio analysis, and personalized financial advisory services. This sector focuses on delivering innovative solutions to enhance wealth creation, streamline asset management, and improve client engagement through automation and data-driven insights. Discover more about how wealthtech is transforming the future of financial services and investment strategies.

Robo-advisors

Wealthtech platforms leverage robo-advisors to provide personalized investment management through AI-driven algorithms, optimizing portfolio allocation and minimizing fees for retail investors. In contrast, insurtech integrates robo-advisor features primarily to tailor insurance product recommendations and streamline claims processing using predictive analytics. Explore detailed comparisons and advancements in robo-advisor technologies shaping wealthtech and insurtech sectors.

Portfolio management

Wealthtech platforms leverage advanced algorithms and AI-driven analytics to optimize portfolio management by providing personalized investment strategies and real-time performance tracking. Insurtech, while primarily focused on insurance products, incorporates portfolio management to assess risk, optimize underwriting processes, and create tailored insurance portfolios. Discover more about how these technologies revolutionize financial services through data-driven portfolio solutions.

Source and External Links

Top Wealthtech Companies to Watch in 2025 - Wealthtech is a technology-driven approach combining wealth management and technology to automate and improve investment advisory services, using AI and analytics to help users make smarter financial decisions and streamline wealth management processes.

WealthTech in Asia-Pacific: Financial innovation - Wealthtech includes digital solutions that enhance wealth management for financial institutions and advisers, focusing on efficiency, integration, and scalability, especially through platforms that enable customers to track investments digitally and streamline adviser workflows.

What is Wealthtech? Technology Tools for Advisors and Wealth Management - Wealthtech companies offer financial technology tools designed to increase efficiencies and accelerate growth for financial advisors and wealth managers by streamlining client data, optimizing portfolios, and improving marketing and back-end processes.

dowidth.com

dowidth.com