Trader funding programs provide traders with capital to trade financial markets without risking personal funds, often sharing profits based on performance metrics and risk management rules. Private equity involves investing substantial capital in companies or assets to achieve long-term growth and value creation, usually requiring significant upfront investment and longer time horizons. Discover more about the distinctions, benefits, and suitability of each for your financial goals.

Why it is important

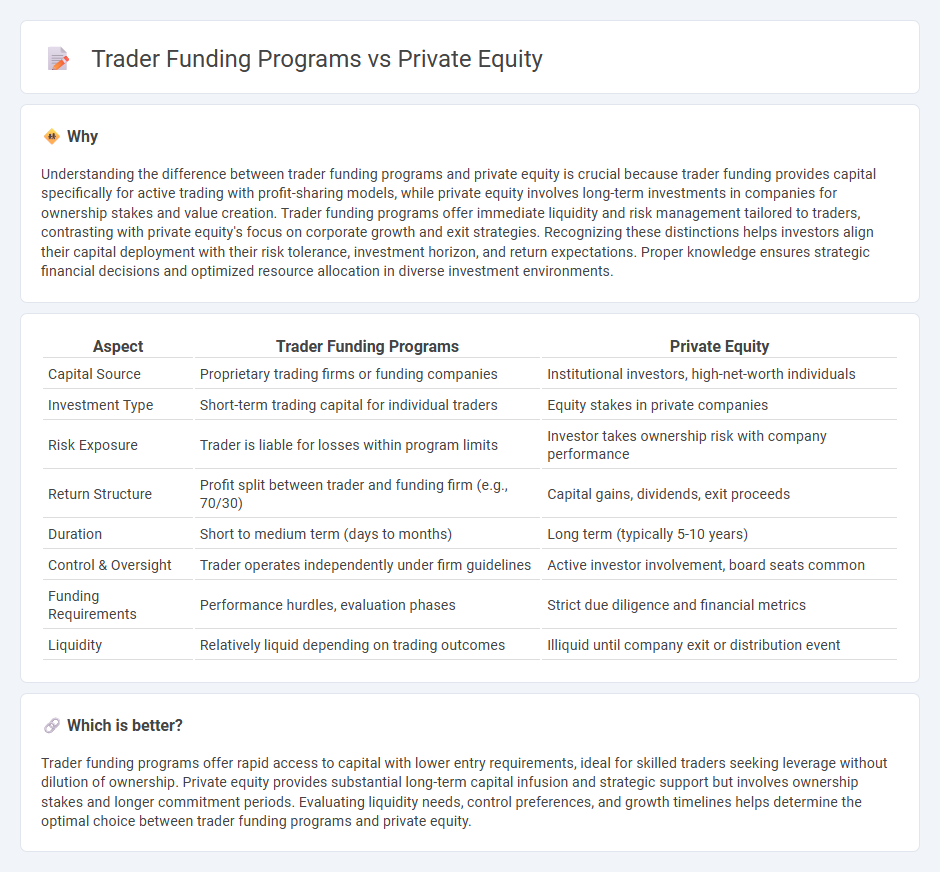

Understanding the difference between trader funding programs and private equity is crucial because trader funding provides capital specifically for active trading with profit-sharing models, while private equity involves long-term investments in companies for ownership stakes and value creation. Trader funding programs offer immediate liquidity and risk management tailored to traders, contrasting with private equity's focus on corporate growth and exit strategies. Recognizing these distinctions helps investors align their capital deployment with their risk tolerance, investment horizon, and return expectations. Proper knowledge ensures strategic financial decisions and optimized resource allocation in diverse investment environments.

Comparison Table

| Aspect | Trader Funding Programs | Private Equity |

|---|---|---|

| Capital Source | Proprietary trading firms or funding companies | Institutional investors, high-net-worth individuals |

| Investment Type | Short-term trading capital for individual traders | Equity stakes in private companies |

| Risk Exposure | Trader is liable for losses within program limits | Investor takes ownership risk with company performance |

| Return Structure | Profit split between trader and funding firm (e.g., 70/30) | Capital gains, dividends, exit proceeds |

| Duration | Short to medium term (days to months) | Long term (typically 5-10 years) |

| Control & Oversight | Trader operates independently under firm guidelines | Active investor involvement, board seats common |

| Funding Requirements | Performance hurdles, evaluation phases | Strict due diligence and financial metrics |

| Liquidity | Relatively liquid depending on trading outcomes | Illiquid until company exit or distribution event |

Which is better?

Trader funding programs offer rapid access to capital with lower entry requirements, ideal for skilled traders seeking leverage without dilution of ownership. Private equity provides substantial long-term capital infusion and strategic support but involves ownership stakes and longer commitment periods. Evaluating liquidity needs, control preferences, and growth timelines helps determine the optimal choice between trader funding programs and private equity.

Connection

Trader funding programs offer capital to skilled traders, enabling them to manage larger positions without risking personal funds. Private equity firms invest in these programs to diversify portfolios and access high-return opportunities in financial markets. This symbiotic relationship enhances liquidity and risk management strategies for both traders and investors.

Key Terms

Equity Ownership

Private equity funding programs emphasize acquiring significant equity ownership, allowing investors to influence company operations and benefit from long-term capital appreciation. Trader funding programs typically provide capital without equity stakes, focusing on profit-sharing based on trading performance rather than ownership. Explore detailed comparisons to understand which funding model aligns best with your financial goals and control preferences.

Leverage

Private equity firms typically utilize leverage by securing long-term debt to amplify returns on acquisitions, often targeting established companies with stable cash flows. Trader funding programs, conversely, provide capital to individual traders, employing leverage to maximize potential gains in short-term market positions, with risk management integrated into funding terms. Explore detailed comparisons and risk assessments to understand which approach aligns best with your financial strategies.

Profit Sharing

Private equity funding programs typically involve a profit-sharing model where investors receive equity stakes and share in the long-term profits of the companies they invest in, aligning interests through ownership. Trader funding programs often emphasize profit sharing based on trading gains, where traders utilize firm capital and split profits, incentivizing performance without transferring ownership. Explore the nuances of profit-sharing structures in both models to identify which aligns best with your financial goals.

Source and External Links

What is Private Equity? - BVCA - Private equity involves medium to long-term financing in exchange for equity in unquoted companies, focusing on operational improvements and active management to drive growth, typically holding investments for 4 to 7 years before exiting through sales or stock markets.

Private equity - Wikipedia - Private equity comprises investments in private companies by funds raised from institutional investors, aiming to generate returns through strategies like revenue growth, margin expansion, and improving corporate governance over a typical 4-7 year horizon.

Private Equity: What You Need to Know - KKR - Private equity investments focus on enhancing the performance of non-public companies by strengthening management, refining strategies, improving operations, and optimizing capital structure to create value and diversify portfolios.

dowidth.com

dowidth.com