Shadow banking encompasses non-bank financial intermediaries providing credit outside traditional banking regulations, often involving hedge funds, money market funds, and private equity firms. Crowdfunding platforms facilitate direct financing by connecting startups or projects with individual investors through online portals, bypassing conventional financial institutions. Explore our comprehensive analysis to understand the risks, benefits, and regulatory differences between these alternative finance mechanisms.

Why it is important

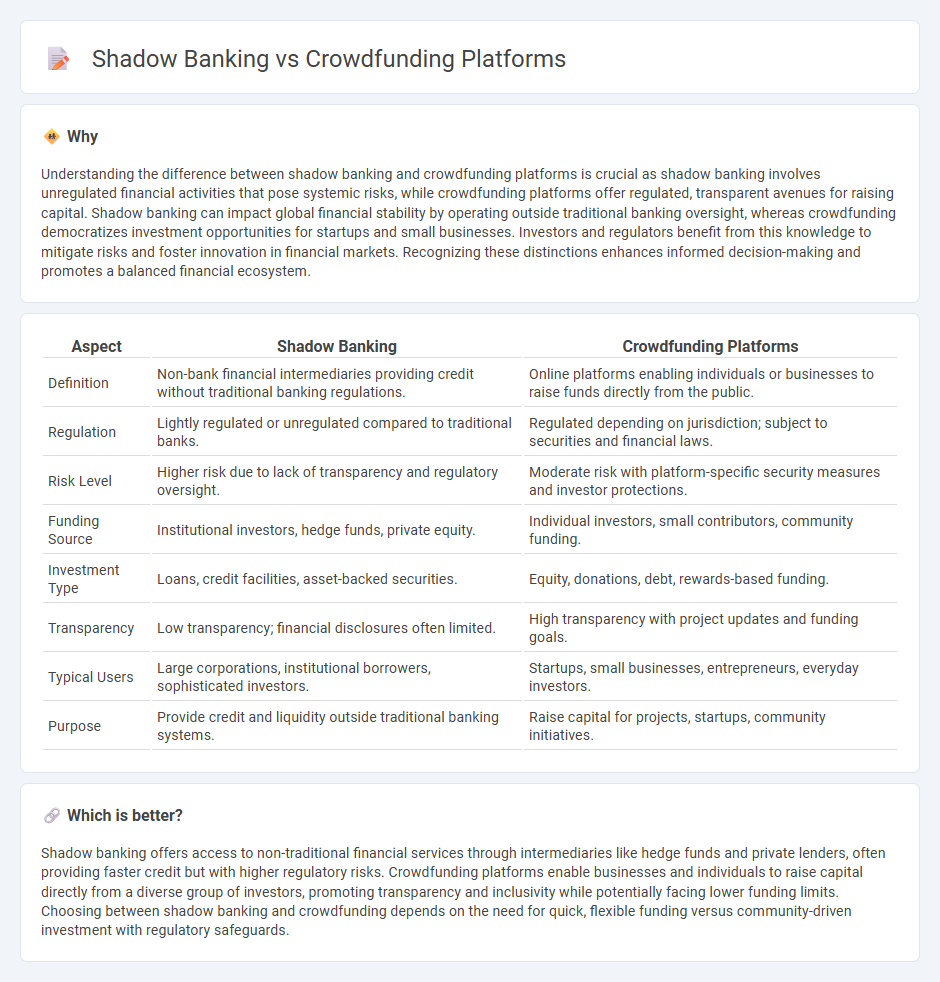

Understanding the difference between shadow banking and crowdfunding platforms is crucial as shadow banking involves unregulated financial activities that pose systemic risks, while crowdfunding platforms offer regulated, transparent avenues for raising capital. Shadow banking can impact global financial stability by operating outside traditional banking oversight, whereas crowdfunding democratizes investment opportunities for startups and small businesses. Investors and regulators benefit from this knowledge to mitigate risks and foster innovation in financial markets. Recognizing these distinctions enhances informed decision-making and promotes a balanced financial ecosystem.

Comparison Table

| Aspect | Shadow Banking | Crowdfunding Platforms |

|---|---|---|

| Definition | Non-bank financial intermediaries providing credit without traditional banking regulations. | Online platforms enabling individuals or businesses to raise funds directly from the public. |

| Regulation | Lightly regulated or unregulated compared to traditional banks. | Regulated depending on jurisdiction; subject to securities and financial laws. |

| Risk Level | Higher risk due to lack of transparency and regulatory oversight. | Moderate risk with platform-specific security measures and investor protections. |

| Funding Source | Institutional investors, hedge funds, private equity. | Individual investors, small contributors, community funding. |

| Investment Type | Loans, credit facilities, asset-backed securities. | Equity, donations, debt, rewards-based funding. |

| Transparency | Low transparency; financial disclosures often limited. | High transparency with project updates and funding goals. |

| Typical Users | Large corporations, institutional borrowers, sophisticated investors. | Startups, small businesses, entrepreneurs, everyday investors. |

| Purpose | Provide credit and liquidity outside traditional banking systems. | Raise capital for projects, startups, community initiatives. |

Which is better?

Shadow banking offers access to non-traditional financial services through intermediaries like hedge funds and private lenders, often providing faster credit but with higher regulatory risks. Crowdfunding platforms enable businesses and individuals to raise capital directly from a diverse group of investors, promoting transparency and inclusivity while potentially facing lower funding limits. Choosing between shadow banking and crowdfunding depends on the need for quick, flexible funding versus community-driven investment with regulatory safeguards.

Connection

Shadow banking and crowdfunding platforms share a connection through their roles in providing alternative finance solutions outside traditional banking systems. Shadow banking involves non-bank financial intermediaries that facilitate credit creation, while crowdfunding platforms enable individuals or businesses to raise funds directly from the public, both bypassing conventional regulatory frameworks. This parallel function highlights their impact on increasing access to capital and diversifying financial intermediation in the global economy.

Key Terms

Crowdfunding Platforms:

Crowdfunding platforms have emerged as accessible online venues allowing individuals and businesses to raise capital directly from a broad base of small investors, bypassing traditional financial institutions. These platforms leverage digital technology to facilitate transparent funding campaigns across various sectors, including technology, healthcare, and creative industries, fostering innovation and entrepreneurial growth. Explore more about how crowdfunding platforms are reshaping investment landscapes and financing opportunities.

Peer-to-peer lending

Peer-to-peer (P2P) lending on crowdfunding platforms offers direct borrower-to-lender transactions, bypassing traditional financial institutions, contrasting sharply with shadow banking systems that operate with less regulatory oversight and higher systemic risk. Crowdfunding platforms enhance transparency, facilitate risk assessment through credit scoring, and democratize access to capital for individuals and SMEs. Explore the evolving dynamics between P2P crowdfunding and shadow banking to understand their impact on financial innovation and market stability.

Equity crowdfunding

Equity crowdfunding platforms enable startups and small businesses to raise capital from a broad base of investors through online portals, contrasting with shadow banking's opaque, non-bank financial intermediaries operating outside traditional regulatory frameworks. While equity crowdfunding offers transparent, democratized investment opportunities with regulatory oversight, shadow banking involves higher risks due to less stringent supervision and potential systemic vulnerabilities. Explore how equity crowdfunding reshapes capital markets and investor access by learning more about its growing impact.

Source and External Links

10 Best Crowdfunding Sites and Platforms in 2025 - Shopify - Indiegogo is a notable crowdfunding platform with flexible or fixed funding options and ongoing fundraising capabilities, charging a 5% fee plus transaction fees, supporting businesses, artists, and nonprofits.

How to Choose the Best Crowdfunding Website for Your Next ... - GoFundMe is ideal for personal fundraising and nonprofits, offering a no-fee start with a 2.9% + $0.30 transaction fee, plus GoFundMe Pro tailored for nonprofit fundraising needs.

Top 10 US Crowdfunding Platforms (Reward and Equity) - Kickstarter and Indiegogo dominate the US reward crowdfunding market, while Patreon focuses on creators with recurring funding models; fees and success rates vary between platforms.

dowidth.com

dowidth.com