Altcoin staking involves locking up specific cryptocurrencies to support blockchain operations and earn rewards, often yielding higher returns than traditional crypto savings accounts, which typically offer interest on deposited assets with lower risk. Crypto savings accounts provide liquidity and easier access to funds but generally feature more conservative interest rates compared to staking. Discover the detailed benefits and risks of both options to maximize your digital asset growth.

Why it is important

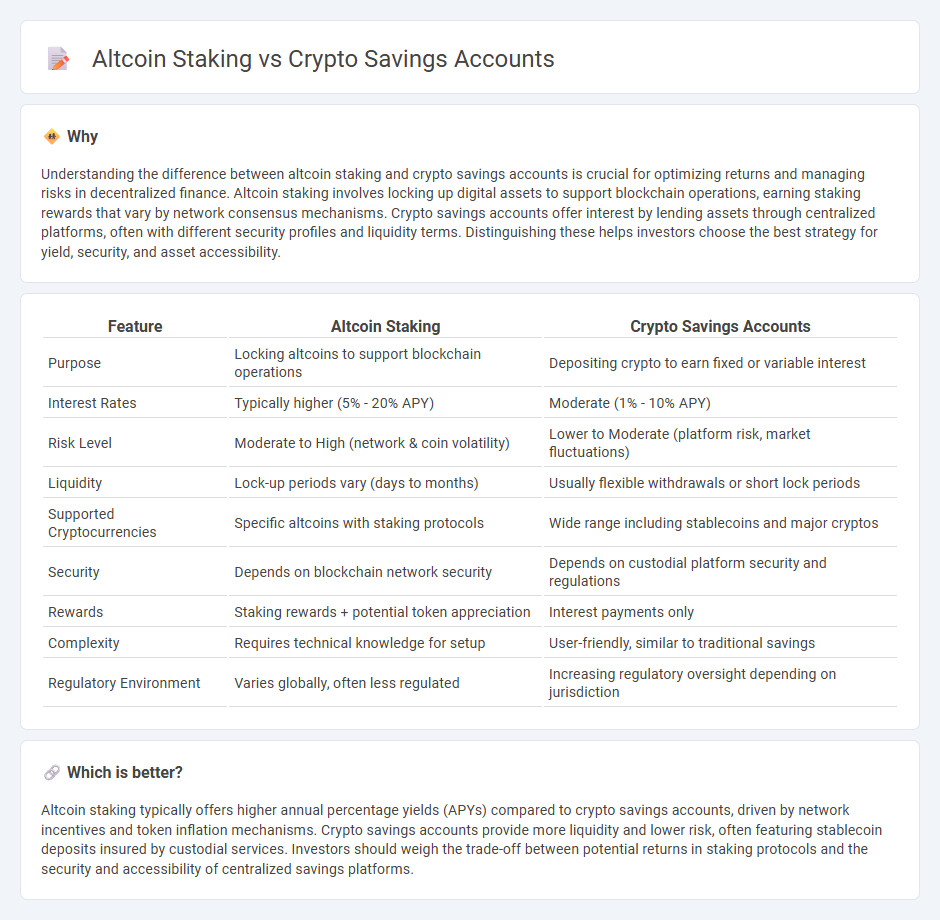

Understanding the difference between altcoin staking and crypto savings accounts is crucial for optimizing returns and managing risks in decentralized finance. Altcoin staking involves locking up digital assets to support blockchain operations, earning staking rewards that vary by network consensus mechanisms. Crypto savings accounts offer interest by lending assets through centralized platforms, often with different security profiles and liquidity terms. Distinguishing these helps investors choose the best strategy for yield, security, and asset accessibility.

Comparison Table

| Feature | Altcoin Staking | Crypto Savings Accounts |

|---|---|---|

| Purpose | Locking altcoins to support blockchain operations | Depositing crypto to earn fixed or variable interest |

| Interest Rates | Typically higher (5% - 20% APY) | Moderate (1% - 10% APY) |

| Risk Level | Moderate to High (network & coin volatility) | Lower to Moderate (platform risk, market fluctuations) |

| Liquidity | Lock-up periods vary (days to months) | Usually flexible withdrawals or short lock periods |

| Supported Cryptocurrencies | Specific altcoins with staking protocols | Wide range including stablecoins and major cryptos |

| Security | Depends on blockchain network security | Depends on custodial platform security and regulations |

| Rewards | Staking rewards + potential token appreciation | Interest payments only |

| Complexity | Requires technical knowledge for setup | User-friendly, similar to traditional savings |

| Regulatory Environment | Varies globally, often less regulated | Increasing regulatory oversight depending on jurisdiction |

Which is better?

Altcoin staking typically offers higher annual percentage yields (APYs) compared to crypto savings accounts, driven by network incentives and token inflation mechanisms. Crypto savings accounts provide more liquidity and lower risk, often featuring stablecoin deposits insured by custodial services. Investors should weigh the trade-off between potential returns in staking protocols and the security and accessibility of centralized savings platforms.

Connection

Altcoin staking and crypto savings accounts both enable investors to earn passive income by leveraging their digital assets within decentralized finance ecosystems. Staking altcoins involves locking tokens to support blockchain operations and earn rewards, while crypto savings accounts offer interest on deposited cryptocurrencies through lending protocols. Both methods increase asset utility, enhance portfolio diversification, and contribute to the growth of decentralized financial services.

Key Terms

Interest Rates

Crypto savings accounts typically offer fixed interest rates ranging from 3% to 12% annually, providing predictable returns with minimal risk. Altcoin staking yields can vary widely, often between 5% and 20%, depending on the specific cryptocurrency and network conditions, but may involve locking tokens and exposure to market volatility. Explore the nuances of both options to maximize your cryptocurrency earning potential.

Lock-up Period

Crypto savings accounts offer flexibility with minimal or no lock-up periods, allowing users to withdraw funds at any time without penalties. Altcoin staking often requires locking up tokens for a fixed duration, enhancing network security but limiting immediate access to assets. Explore the fundamental differences in lock-up terms to make informed decisions on maximizing crypto returns.

Yield Mechanism

Crypto savings accounts generate yield primarily through lending deposited assets to borrowers, earning interest based on market demand and platform rates. Altcoin staking involves locking coins in a blockchain network to support operations like transaction validation, receiving staking rewards proportional to the staked amount and network rules. Explore the mechanics of each yield method to optimize your crypto portfolio's growth potential.

Source and External Links

How to Choose Crypto Saving Account - Crypto savings accounts let users deposit cryptocurrencies and earn rewards by lending or staking these assets, functioning like traditional savings accounts but with crypto-specific dynamics and varying reward structures.

Best Crypto Savings Accounts Of July 2025 - Crypto savings accounts offer higher yields (around 4%-8% or more) than traditional bank accounts but lack federal insurance, may have withdrawal restrictions, and involve lending out your crypto keys to borrowers.

Crypto & Bitcoin Savings Account With High Rewards - Platforms like CEX.IO provide crypto savings accounts with varying interest rates, including up to 12% annual reward for stablecoins like Tether under locked savings accounts, where funds are locked for fixed periods in exchange for higher returns.

dowidth.com

dowidth.com