Buy Now Pay Later (BNPL) services offer consumers the convenience of splitting purchases into interest-free payments over a short period, typically weeks to months, enhancing cash flow management. Installment loans provide longer-term financing with fixed payments and interest, suitable for larger expenses requiring extended repayment timelines. Discover the key differences and benefits of each option to choose the financial solution that best fits your needs.

Why it is important

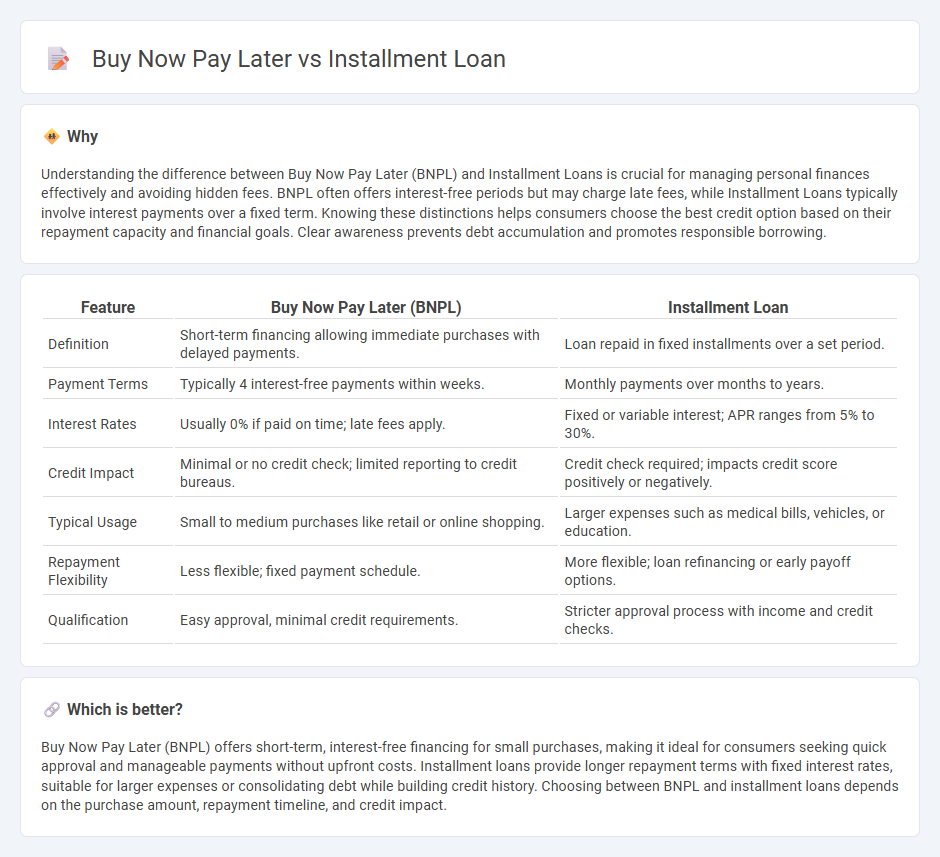

Understanding the difference between Buy Now Pay Later (BNPL) and Installment Loans is crucial for managing personal finances effectively and avoiding hidden fees. BNPL often offers interest-free periods but may charge late fees, while Installment Loans typically involve interest payments over a fixed term. Knowing these distinctions helps consumers choose the best credit option based on their repayment capacity and financial goals. Clear awareness prevents debt accumulation and promotes responsible borrowing.

Comparison Table

| Feature | Buy Now Pay Later (BNPL) | Installment Loan |

|---|---|---|

| Definition | Short-term financing allowing immediate purchases with delayed payments. | Loan repaid in fixed installments over a set period. |

| Payment Terms | Typically 4 interest-free payments within weeks. | Monthly payments over months to years. |

| Interest Rates | Usually 0% if paid on time; late fees apply. | Fixed or variable interest; APR ranges from 5% to 30%. |

| Credit Impact | Minimal or no credit check; limited reporting to credit bureaus. | Credit check required; impacts credit score positively or negatively. |

| Typical Usage | Small to medium purchases like retail or online shopping. | Larger expenses such as medical bills, vehicles, or education. |

| Repayment Flexibility | Less flexible; fixed payment schedule. | More flexible; loan refinancing or early payoff options. |

| Qualification | Easy approval, minimal credit requirements. | Stricter approval process with income and credit checks. |

Which is better?

Buy Now Pay Later (BNPL) offers short-term, interest-free financing for small purchases, making it ideal for consumers seeking quick approval and manageable payments without upfront costs. Installment loans provide longer repayment terms with fixed interest rates, suitable for larger expenses or consolidating debt while building credit history. Choosing between BNPL and installment loans depends on the purchase amount, repayment timeline, and credit impact.

Connection

Buy Now Pay Later (BNPL) and installment loans are connected through their shared function of enabling consumers to finance purchases over time by breaking payments into scheduled amounts. Both financial products improve cash flow management by allowing borrowers to spread costs without bearing the full expense upfront. Key distinctions lie in BNPL's typical short-term, interest-free periods versus installment loans often involving longer repayment terms with interest charges.

Key Terms

Principal

Installment loans typically require borrowers to repay a fixed principal amount over a specified period with interest, promoting structured debt management and credit building. Buy Now Pay Later (BNPL) services often split purchases into interest-free principal payments due in short intervals, prioritizing convenience but sometimes lacking credit reporting benefits. Explore detailed differences in principal handling and its impact on credit health to make an informed financial choice.

Interest Rate

Installment loans typically feature fixed interest rates spread over a predetermined term, offering predictable monthly payments and total cost transparency. Buy Now Pay Later (BNPL) services often promote zero-interest offers if paid within a short period but can incur high fees or interest if payments are missed or extended. Explore detailed comparisons on interest structures to make informed borrowing choices tailored to your financial needs.

Repayment Schedule

Installment loans feature a fixed repayment schedule with equal payments spread over months or years, providing predictability and helping manage long-term finances. Buy Now Pay Later (BNPL) plans typically divide the total cost into a few interest-free installments due within weeks or months, offering short-term flexibility but less impact on credit scores. Explore detailed comparisons to understand which repayment schedule best suits your financial goals.

Source and External Links

What Is an Installment Loan & How Does It Work? - An installment loan is a closed-end debt where you receive a lump sum and repay it in fixed, regular payments over a set period, with examples including personal loans, auto loans, mortgages, and student loans.

Personal Installment Loans Online - An installment loan is a personal loan repaid in equal monthly installments until the full amount is paid back, and it can be used for emergencies, debt consolidation, medical bills, or major purchases.

Installment Loans with Flexible Repayment - These loans allow you to borrow small amounts (typically $100-$1,000) with flexible repayment schedules, often requiring no credit check and offering quick in-person or online application and funding.

dowidth.com

dowidth.com