Copy trading platforms offer real-time replication of experienced investors' strategies, providing instant market exposure and flexibility without requiring deep financial knowledge. Mutual funds pool capital from numerous investors to be managed by professional fund managers, focusing on diversified portfolios and long-term growth stability. Explore how these investment options align with your financial goals to make informed decisions.

Why it is important

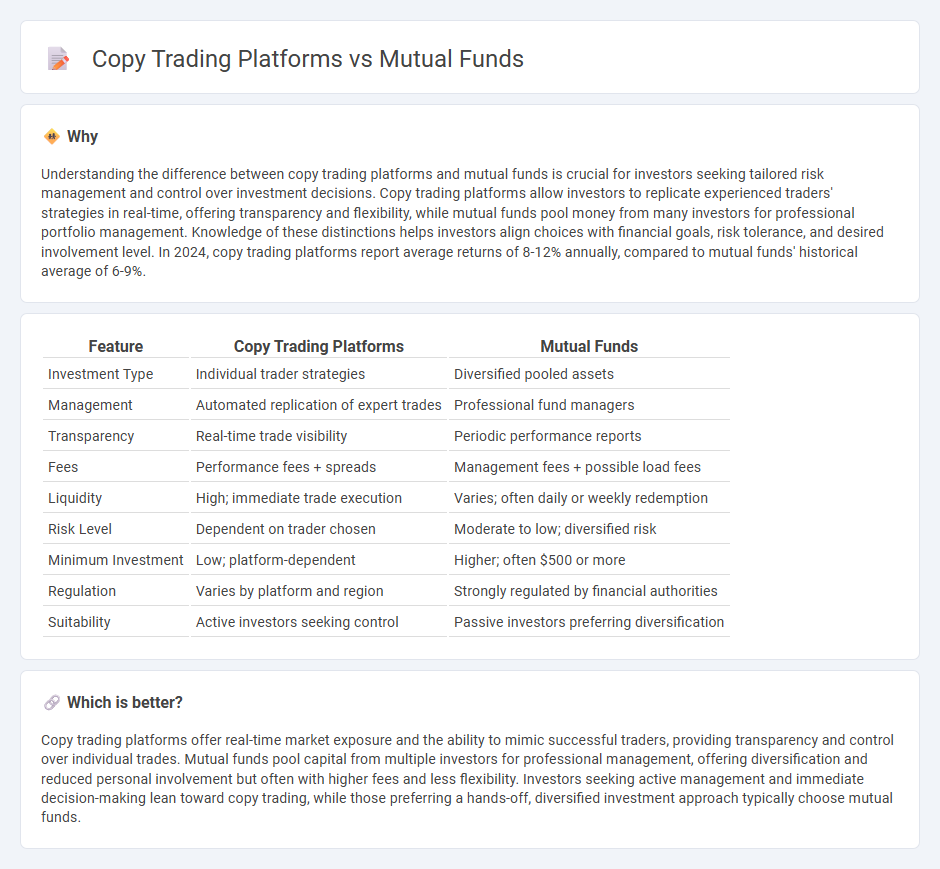

Understanding the difference between copy trading platforms and mutual funds is crucial for investors seeking tailored risk management and control over investment decisions. Copy trading platforms allow investors to replicate experienced traders' strategies in real-time, offering transparency and flexibility, while mutual funds pool money from many investors for professional portfolio management. Knowledge of these distinctions helps investors align choices with financial goals, risk tolerance, and desired involvement level. In 2024, copy trading platforms report average returns of 8-12% annually, compared to mutual funds' historical average of 6-9%.

Comparison Table

| Feature | Copy Trading Platforms | Mutual Funds |

|---|---|---|

| Investment Type | Individual trader strategies | Diversified pooled assets |

| Management | Automated replication of expert trades | Professional fund managers |

| Transparency | Real-time trade visibility | Periodic performance reports |

| Fees | Performance fees + spreads | Management fees + possible load fees |

| Liquidity | High; immediate trade execution | Varies; often daily or weekly redemption |

| Risk Level | Dependent on trader chosen | Moderate to low; diversified risk |

| Minimum Investment | Low; platform-dependent | Higher; often $500 or more |

| Regulation | Varies by platform and region | Strongly regulated by financial authorities |

| Suitability | Active investors seeking control | Passive investors preferring diversification |

Which is better?

Copy trading platforms offer real-time market exposure and the ability to mimic successful traders, providing transparency and control over individual trades. Mutual funds pool capital from multiple investors for professional management, offering diversification and reduced personal involvement but often with higher fees and less flexibility. Investors seeking active management and immediate decision-making lean toward copy trading, while those preferring a hands-off, diversified investment approach typically choose mutual funds.

Connection

Copy trading platforms and mutual funds both enable investors to access diversified portfolios managed by experienced professionals, offering an alternative to individual stock picking. Copy trading platforms utilize real-time replication of top traders' strategies, providing transparency and flexibility, while mutual funds pool assets under professional management with regulatory oversight and formal investment structures. Both methods aim to reduce risk through diversification and professional expertise, catering to investors seeking passive income streams and portfolio growth.

Key Terms

Diversification

Mutual funds offer built-in diversification by pooling investors' money to invest across a broad range of assets, reducing individual risk exposure. Copy trading platforms enable investors to replicate the trades of experienced traders but may carry higher risk concentration depending on the trader's portfolio choices. Explore the strengths and limitations of these investment options to optimize your diversification strategy.

Management fees

Mutual funds typically charge management fees ranging from 0.5% to 2% annually, depending on the fund's strategy and size, which cover portfolio management and administrative costs. Copy trading platforms, on the other hand, often impose fees based on performance or a fixed percentage of copied investments, with some charging lower base fees but additional success fees for profitable trades. Explore more about how these fee structures impact your investment returns and choose the best option for your financial goals.

Investor control

Mutual funds offer limited investor control as professional managers make all investment decisions on behalf of shareholders, whereas copy trading platforms empower investors to choose and automatically replicate the strategies of experienced traders, resulting in greater autonomy. Investor control on copy trading platforms allows customization in selecting traders based on risk tolerance, trading style, and performance metrics, providing a transparent and flexible investment approach. Explore our detailed comparison to understand how control differences impact your investment strategy outcomes.

Source and External Links

Mutual Funds - Mutual funds are SEC-registered investment companies that pool money from many investors to invest in stocks, bonds, and other securities, offering professional management and diversification.

Mutual Fund - A mutual fund is an investment fund that pools money from many investors to purchase securities, often classified by investments like equity, bond, or money market funds.

What Are Mutual Funds? - Mutual funds allow investors to pool their money together to purchase a collection of investments, offering diversification and professional management.

dowidth.com

dowidth.com