AI-driven portfolios leverage machine learning algorithms to analyze vast datasets and adapt to market changes in real time, enhancing predictive accuracy and investment decisions. Quantitative portfolios rely on predefined mathematical models and statistical techniques to identify trading opportunities based on historical data and market patterns. Discover how integrating AI with quantitative strategies can transform your investment approach and optimize returns.

Why it is important

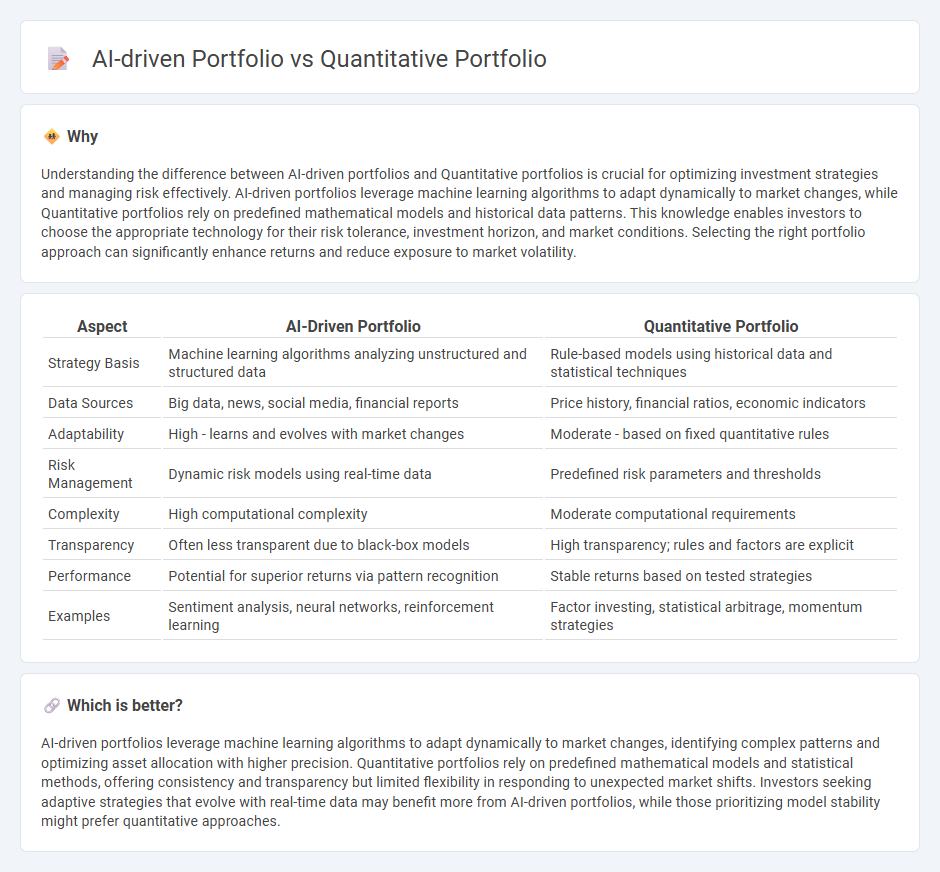

Understanding the difference between AI-driven portfolios and Quantitative portfolios is crucial for optimizing investment strategies and managing risk effectively. AI-driven portfolios leverage machine learning algorithms to adapt dynamically to market changes, while Quantitative portfolios rely on predefined mathematical models and historical data patterns. This knowledge enables investors to choose the appropriate technology for their risk tolerance, investment horizon, and market conditions. Selecting the right portfolio approach can significantly enhance returns and reduce exposure to market volatility.

Comparison Table

| Aspect | AI-Driven Portfolio | Quantitative Portfolio |

|---|---|---|

| Strategy Basis | Machine learning algorithms analyzing unstructured and structured data | Rule-based models using historical data and statistical techniques |

| Data Sources | Big data, news, social media, financial reports | Price history, financial ratios, economic indicators |

| Adaptability | High - learns and evolves with market changes | Moderate - based on fixed quantitative rules |

| Risk Management | Dynamic risk models using real-time data | Predefined risk parameters and thresholds |

| Complexity | High computational complexity | Moderate computational requirements |

| Transparency | Often less transparent due to black-box models | High transparency; rules and factors are explicit |

| Performance | Potential for superior returns via pattern recognition | Stable returns based on tested strategies |

| Examples | Sentiment analysis, neural networks, reinforcement learning | Factor investing, statistical arbitrage, momentum strategies |

Which is better?

AI-driven portfolios leverage machine learning algorithms to adapt dynamically to market changes, identifying complex patterns and optimizing asset allocation with higher precision. Quantitative portfolios rely on predefined mathematical models and statistical methods, offering consistency and transparency but limited flexibility in responding to unexpected market shifts. Investors seeking adaptive strategies that evolve with real-time data may benefit more from AI-driven portfolios, while those prioritizing model stability might prefer quantitative approaches.

Connection

AI-driven portfolios leverage machine learning algorithms to analyze vast datasets, enhancing decision-making processes and risk assessments in quantitative portfolio management. Quantitative portfolios use statistical models and mathematical computations, which are increasingly powered by AI techniques to optimize asset allocation and predict market trends. This integration improves portfolio performance by enabling more accurate and dynamic investment strategies based on real-time data analysis.

Key Terms

**Risk-adjusted return**

Quantitative portfolios utilize statistical models to optimize risk-adjusted returns by analyzing historical data patterns and volatility metrics, aiming to balance returns with measured risk exposure. AI-driven portfolios enhance this approach through machine learning algorithms that adapt to market dynamics in real-time, improving predictive accuracy and portfolio resilience against market fluctuations. Explore the nuances of risk-adjusted return optimization in advanced portfolio strategies to maximize your investment performance.

**Alpha generation**

Quantitative portfolios leverage statistical models and historical market data to identify patterns and generate alpha by exploiting market inefficiencies systematically. AI-driven portfolios enhance alpha generation through machine learning algorithms that adapt to real-time data and uncover complex nonlinear relationships overlooked by traditional models. Explore how these advanced methodologies redefine investment strategies and alpha optimization.

**Feature engineering**

Quantitative portfolios rely heavily on handcrafted feature engineering, where financial experts design indicators based on historical market data and economic variables to optimize predictive models. AI-driven portfolios utilize advanced feature extraction techniques such as deep learning to automatically identify complex patterns and latent factors from vast datasets, improving adaptability and accuracy. Explore the evolving methodologies behind quantitative and AI-driven feature engineering to enhance portfolio performance.

Source and External Links

Guide to Quantitative Portfolios (QPs) - Quantitative Portfolios (QPs) are single investment strategies combining low cost, easy access to investment return drivers, and the customization and tax efficiency of separately managed accounts, with Market Series and Factor-Enhanced Series varieties designed for beta exposure and factor-based excess returns respectively.

Quantitative Portfolio Management Course - This course provides education on portfolio management techniques such as factor investing, risk parity, Kelly criterion, and modern portfolio theory, including coding and backtesting of multi-factor strategies and evaluation of portfolio performance.

QRG | Strategies - QRG Quantitative Portfolios are asset class-specific investments blending beta investing with portfolio customization through managed accounts, offering customizable market exposure, factor-based return enhancement, tax alpha pursuit, and alignment with investor needs.

dowidth.com

dowidth.com