Carbon trading is a market-based approach where companies buy and sell permits to emit a specified amount of carbon dioxide, incentivizing reductions in greenhouse gas emissions through financial rewards. Carbon tax directly sets a price per ton of emitted carbon, providing predictable costs to emitters and encouraging cleaner production methods. Explore how these mechanisms impact economic and environmental strategies to discover which approach aligns best with sustainability goals.

Why it is important

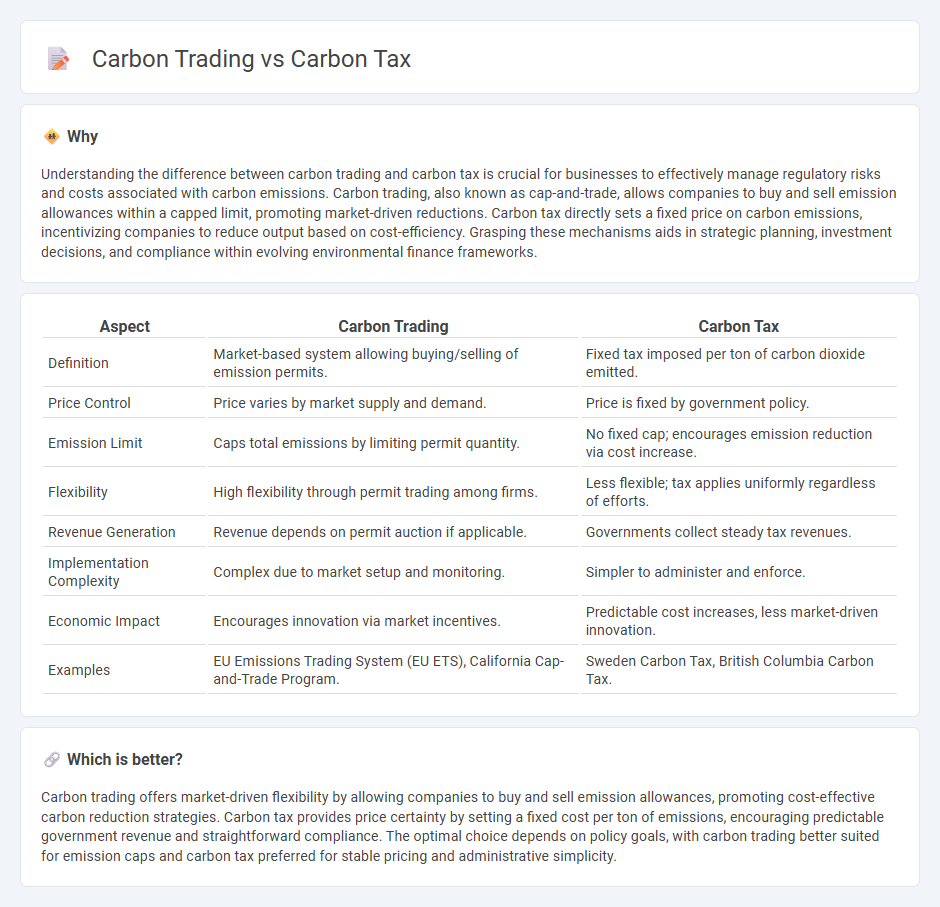

Understanding the difference between carbon trading and carbon tax is crucial for businesses to effectively manage regulatory risks and costs associated with carbon emissions. Carbon trading, also known as cap-and-trade, allows companies to buy and sell emission allowances within a capped limit, promoting market-driven reductions. Carbon tax directly sets a fixed price on carbon emissions, incentivizing companies to reduce output based on cost-efficiency. Grasping these mechanisms aids in strategic planning, investment decisions, and compliance within evolving environmental finance frameworks.

Comparison Table

| Aspect | Carbon Trading | Carbon Tax |

|---|---|---|

| Definition | Market-based system allowing buying/selling of emission permits. | Fixed tax imposed per ton of carbon dioxide emitted. |

| Price Control | Price varies by market supply and demand. | Price is fixed by government policy. |

| Emission Limit | Caps total emissions by limiting permit quantity. | No fixed cap; encourages emission reduction via cost increase. |

| Flexibility | High flexibility through permit trading among firms. | Less flexible; tax applies uniformly regardless of efforts. |

| Revenue Generation | Revenue depends on permit auction if applicable. | Governments collect steady tax revenues. |

| Implementation Complexity | Complex due to market setup and monitoring. | Simpler to administer and enforce. |

| Economic Impact | Encourages innovation via market incentives. | Predictable cost increases, less market-driven innovation. |

| Examples | EU Emissions Trading System (EU ETS), California Cap-and-Trade Program. | Sweden Carbon Tax, British Columbia Carbon Tax. |

Which is better?

Carbon trading offers market-driven flexibility by allowing companies to buy and sell emission allowances, promoting cost-effective carbon reduction strategies. Carbon tax provides price certainty by setting a fixed cost per ton of emissions, encouraging predictable government revenue and straightforward compliance. The optimal choice depends on policy goals, with carbon trading better suited for emission caps and carbon tax preferred for stable pricing and administrative simplicity.

Connection

Carbon trading and carbon tax are interconnected mechanisms designed to reduce greenhouse gas emissions by assigning a cost to carbon output. Carbon trading sets a cap on emissions and allows companies to buy or sell allowances, creating a market-driven incentive to lower emissions. Carbon tax directly imposes a fee on each ton of emitted carbon, providing a predictable price signal that complements the market flexibility of carbon trading systems.

Key Terms

Emissions Cap

Emissions cap is a core component in carbon trading, setting a limit on total greenhouse gas emissions allowed, creating a market for emission permits that companies can buy or sell to meet the cap. In contrast, a carbon tax directly sets a price per unit of carbon emitted, providing a fixed cost but no guaranteed emissions limit. Explore further to understand the efficiency and impact of emissions cap strategies in carbon management.

Allowances

Carbon tax directly sets a fixed price on carbon emissions, while carbon trading, also known as cap-and-trade, uses allowances as tradable permits that limit the total emissions. Each allowance typically represents the right to emit one ton of carbon dioxide, creating a market-driven price for carbon based on supply and demand. Explore more to understand how these mechanisms impact emission reduction strategies and economic flexibility.

Carbon Pricing

Carbon pricing strategies include carbon tax and carbon trading, both designed to reduce greenhouse gas emissions by assigning a cost to carbon dioxide output. A carbon tax sets a fixed price per ton of emitted CO2, providing certainty in costs but varying emission reductions, whereas carbon trading establishes a cap on emissions and allows market trading of permits, promoting cost-effective emission cuts. Explore how these mechanisms impact businesses and environmental goals in detail.

Source and External Links

What is a carbon tax? | Tax Policy Center - A carbon tax sets a price on carbon dioxide emissions to encourage reductions, and its revenues can be used to offset impacts on households, lower other taxes, reduce deficits, or fund clean energy investments.

What You Need to Know About a Federal Carbon Tax in the United States | Columbia Energy Policy - A carbon tax imposes a fee on greenhouse gas emissions to provide financial incentives for emitters to shift to lower-carbon alternatives, with expected substantial emissions reductions especially in the power sector.

Canada's carbon pricing (a.k.a. "carbon tax") explained | David Suzuki Foundation - Carbon pricing charges emitters for greenhouse gas pollution, motivating households and businesses to adopt cleaner technologies and practices to reduce climate impact.

dowidth.com

dowidth.com