Perpetual futures provide traders continuous exposure to asset price movements without expiration dates, enabling leveraged positions with funding rates to maintain price parity with the underlying asset. Binary options offer fixed payouts dependent on a yes/no proposition about an asset's price at expiration, appealing to traders seeking straightforward risk-reward scenarios. Explore the distinct mechanisms and strategic benefits of perpetual futures and binary options to enhance your financial trading acumen.

Why it is important

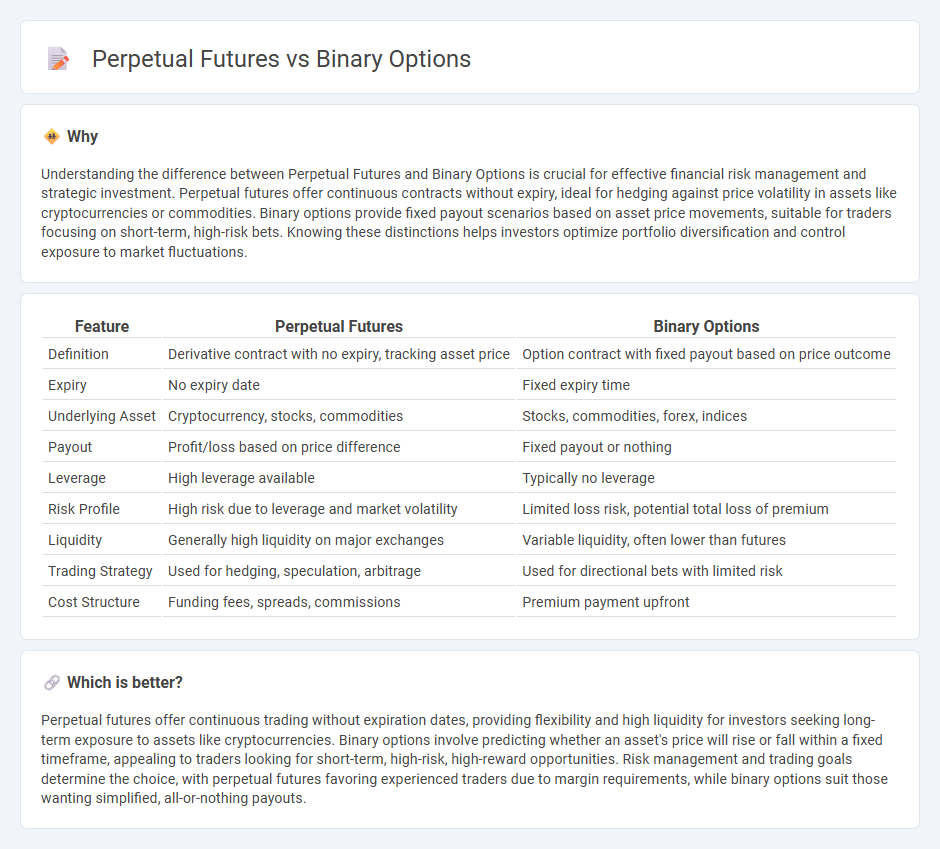

Understanding the difference between Perpetual Futures and Binary Options is crucial for effective financial risk management and strategic investment. Perpetual futures offer continuous contracts without expiry, ideal for hedging against price volatility in assets like cryptocurrencies or commodities. Binary options provide fixed payout scenarios based on asset price movements, suitable for traders focusing on short-term, high-risk bets. Knowing these distinctions helps investors optimize portfolio diversification and control exposure to market fluctuations.

Comparison Table

| Feature | Perpetual Futures | Binary Options |

|---|---|---|

| Definition | Derivative contract with no expiry, tracking asset price | Option contract with fixed payout based on price outcome |

| Expiry | No expiry date | Fixed expiry time |

| Underlying Asset | Cryptocurrency, stocks, commodities | Stocks, commodities, forex, indices |

| Payout | Profit/loss based on price difference | Fixed payout or nothing |

| Leverage | High leverage available | Typically no leverage |

| Risk Profile | High risk due to leverage and market volatility | Limited loss risk, potential total loss of premium |

| Liquidity | Generally high liquidity on major exchanges | Variable liquidity, often lower than futures |

| Trading Strategy | Used for hedging, speculation, arbitrage | Used for directional bets with limited risk |

| Cost Structure | Funding fees, spreads, commissions | Premium payment upfront |

Which is better?

Perpetual futures offer continuous trading without expiration dates, providing flexibility and high liquidity for investors seeking long-term exposure to assets like cryptocurrencies. Binary options involve predicting whether an asset's price will rise or fall within a fixed timeframe, appealing to traders looking for short-term, high-risk, high-reward opportunities. Risk management and trading goals determine the choice, with perpetual futures favoring experienced traders due to margin requirements, while binary options suit those wanting simplified, all-or-nothing payouts.

Connection

Perpetual futures and binary options are connected through their role as derivative financial instruments used for speculation and hedging in modern markets. Both enable traders to leverage price movements without owning the underlying asset, with perpetual futures offering continuous contract trading and binary options providing fixed payoff outcomes based on price thresholds. Their shared reliance on market volatility and risk management strategies links these products within the broader landscape of speculative finance.

Key Terms

Expiry Date

Binary options have a fixed expiry date at which the option either finishes in or out of the money, leading to a predetermined payout or loss. Perpetual futures, unlike traditional futures contracts, do not have an expiry date and can be held indefinitely, with funding rates periodically exchanged between long and short positions to maintain the price close to the underlying asset. Explore the details to understand how expiry impacts your trading strategy and risk management.

Leverage

Binary options typically offer fixed leverage, often limited to smaller multiples such as 1:10, restricting exposure and risk. Perpetual futures provide significantly higher leverage, sometimes reaching 1:100 or more, enabling traders to amplify potential returns while increasing risk exposure. Explore detailed comparisons and leverage strategies to optimize your trading approach.

Payout Structure

Binary options feature a fixed payout structure where traders either receive a predetermined amount if the option expires in the money or lose the initial investment if it expires out of the money. Perpetual futures offer variable payouts influenced by the market price movements and leverage, with no expiry date, allowing holders to gain or lose based on price fluctuations and funding rates. Explore the detailed differences in payout structures to determine which instrument aligns best with your trading strategy.

Source and External Links

What are Binary Options and How to Trade? | Dukascopy Bank SA - Binary options are a financial instrument where you predict whether the price of an asset will be above or below a set price at a specified time, earning a fixed payout if correct and losing the investment if wrong.

Binary options | Investor.gov - A binary option pays out a fixed amount or nothing based on the outcome of a yes/no proposition regarding the price movement of an underlying asset, automatically exercised at expiration without the right to buy or sell the asset itself.

What are Binary Options and How Do They Work? - Nadex - Binary options are short-term contracts priced between $0 and $10 that offer a capped risk and fixed profit or loss depending on whether the market price is above a certain strike price when the contract expires.

dowidth.com

dowidth.com