Bucket investing segments assets into distinct categories based on time horizons and risk tolerance to achieve targeted financial goals, while ESG investing integrates environmental, social, and governance factors into investment decisions to promote sustainable and ethical outcomes. Both strategies address unique investor priorities, with bucket investing focusing on portfolio structure and risk management, and ESG investing prioritizing impact and responsibility. Explore how these approaches can align with your financial objectives and values.

Why it is important

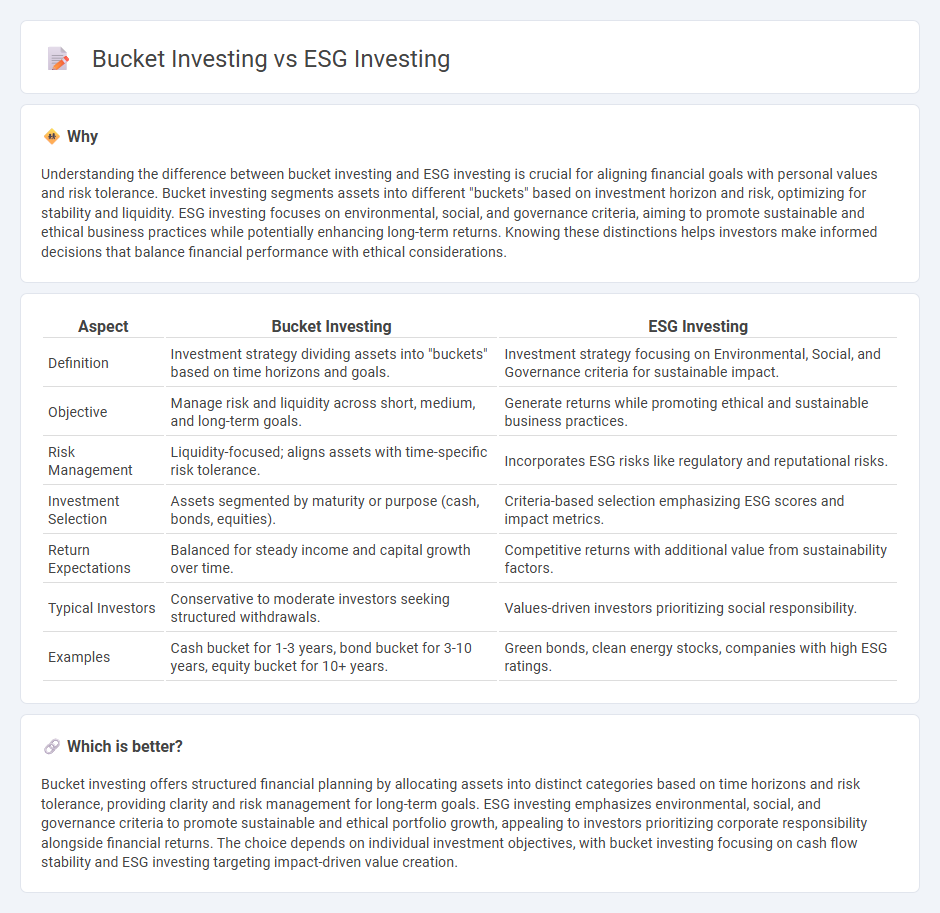

Understanding the difference between bucket investing and ESG investing is crucial for aligning financial goals with personal values and risk tolerance. Bucket investing segments assets into different "buckets" based on investment horizon and risk, optimizing for stability and liquidity. ESG investing focuses on environmental, social, and governance criteria, aiming to promote sustainable and ethical business practices while potentially enhancing long-term returns. Knowing these distinctions helps investors make informed decisions that balance financial performance with ethical considerations.

Comparison Table

| Aspect | Bucket Investing | ESG Investing |

|---|---|---|

| Definition | Investment strategy dividing assets into "buckets" based on time horizons and goals. | Investment strategy focusing on Environmental, Social, and Governance criteria for sustainable impact. |

| Objective | Manage risk and liquidity across short, medium, and long-term goals. | Generate returns while promoting ethical and sustainable business practices. |

| Risk Management | Liquidity-focused; aligns assets with time-specific risk tolerance. | Incorporates ESG risks like regulatory and reputational risks. |

| Investment Selection | Assets segmented by maturity or purpose (cash, bonds, equities). | Criteria-based selection emphasizing ESG scores and impact metrics. |

| Return Expectations | Balanced for steady income and capital growth over time. | Competitive returns with additional value from sustainability factors. |

| Typical Investors | Conservative to moderate investors seeking structured withdrawals. | Values-driven investors prioritizing social responsibility. |

| Examples | Cash bucket for 1-3 years, bond bucket for 3-10 years, equity bucket for 10+ years. | Green bonds, clean energy stocks, companies with high ESG ratings. |

Which is better?

Bucket investing offers structured financial planning by allocating assets into distinct categories based on time horizons and risk tolerance, providing clarity and risk management for long-term goals. ESG investing emphasizes environmental, social, and governance criteria to promote sustainable and ethical portfolio growth, appealing to investors prioritizing corporate responsibility alongside financial returns. The choice depends on individual investment objectives, with bucket investing focusing on cash flow stability and ESG investing targeting impact-driven value creation.

Connection

Bucket investing segments assets into time-based buckets to manage risk and liquidity, aligning investment horizons with financial goals. ESG investing integrates environmental, social, and governance criteria, ensuring portfolio alignment with sustainable and ethical principles. Combining bucket investing with ESG strategies enables investors to optimize risk-adjusted returns while supporting responsible and values-driven investment decisions.

Key Terms

Sustainability

ESG investing prioritizes companies with strong environmental, social, and governance practices, aiming to generate sustainable returns while promoting positive societal impact. Bucket investing, on the other hand, segments assets into different "buckets" based on time horizons and risk tolerance, focusing on meeting financial goals through diversification. Explore the key differences and advantages of these strategies to align your portfolio with both sustainability and financial security.

Asset Allocation

ESG investing prioritizes environmental, social, and governance criteria within asset allocation to promote sustainable and ethical investment portfolios. Bucket investing segments assets into distinct categories based on time horizons and risk tolerance, ensuring a tailored approach to liquidity and income needs. Discover how integrating ESG principles with bucket strategies can optimize your asset allocation.

Risk Profile

ESG investing integrates environmental, social, and governance factors to align portfolios with sustainable values while managing risk through ethical criteria. Bucket investing segments assets into different "buckets" based on time horizons and risk tolerance to optimize cash flow and capital preservation. Explore more about how these strategies cater to different risk profiles and investment goals.

Source and External Links

Embracing Sustainable Investment Practices with ESG Investing - ESG investing is an investment strategy that considers environmental, social, and governance (ESG) risks, aiming for positive impacts on climate change, social justice, and company governance, and has shown strong growth and resilience in financial markets.

What is ESG Investing? - ESG investing, also known as sustainable or socially responsible investing, integrates environmental, social, and governance factors into investment decisions to support long-term financial and societal wellbeing, with roots tracing back to ethical investment traditions and formalized by the UN Principles for Responsible Investment.

What is ESG investing? - Deutsche Bank Wealth Management - ESG investing involves evaluating investments not only on financial returns but also on how they impact the environment, society, and corporate governance, with over $35 trillion assets globally managed under ESG criteria by 2020, reflecting its mainstream adoption.

dowidth.com

dowidth.com