Risk parity portfolios allocate assets based on risk contribution, aiming for balanced volatility across asset classes to enhance diversification and reduce portfolio risk. Target date funds adjust asset allocation dynamically over time, shifting from higher-risk investments to more conservative ones as the target retirement date approaches. Explore the advantages and suitability of each strategy to optimize your investment approach.

Why it is important

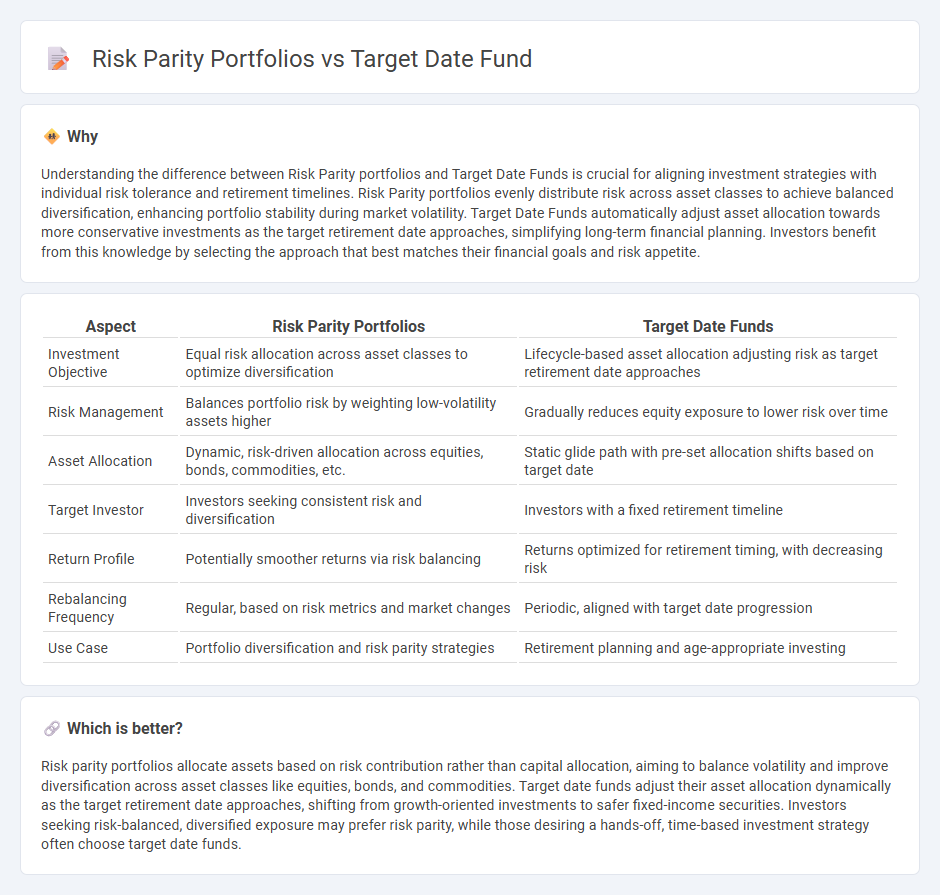

Understanding the difference between Risk Parity portfolios and Target Date Funds is crucial for aligning investment strategies with individual risk tolerance and retirement timelines. Risk Parity portfolios evenly distribute risk across asset classes to achieve balanced diversification, enhancing portfolio stability during market volatility. Target Date Funds automatically adjust asset allocation towards more conservative investments as the target retirement date approaches, simplifying long-term financial planning. Investors benefit from this knowledge by selecting the approach that best matches their financial goals and risk appetite.

Comparison Table

| Aspect | Risk Parity Portfolios | Target Date Funds |

|---|---|---|

| Investment Objective | Equal risk allocation across asset classes to optimize diversification | Lifecycle-based asset allocation adjusting risk as target retirement date approaches |

| Risk Management | Balances portfolio risk by weighting low-volatility assets higher | Gradually reduces equity exposure to lower risk over time |

| Asset Allocation | Dynamic, risk-driven allocation across equities, bonds, commodities, etc. | Static glide path with pre-set allocation shifts based on target date |

| Target Investor | Investors seeking consistent risk and diversification | Investors with a fixed retirement timeline |

| Return Profile | Potentially smoother returns via risk balancing | Returns optimized for retirement timing, with decreasing risk |

| Rebalancing Frequency | Regular, based on risk metrics and market changes | Periodic, aligned with target date progression |

| Use Case | Portfolio diversification and risk parity strategies | Retirement planning and age-appropriate investing |

Which is better?

Risk parity portfolios allocate assets based on risk contribution rather than capital allocation, aiming to balance volatility and improve diversification across asset classes like equities, bonds, and commodities. Target date funds adjust their asset allocation dynamically as the target retirement date approaches, shifting from growth-oriented investments to safer fixed-income securities. Investors seeking risk-balanced, diversified exposure may prefer risk parity, while those desiring a hands-off, time-based investment strategy often choose target date funds.

Connection

Risk parity portfolios and target date funds share a common goal of diversifying asset allocation to manage risk over time, with risk parity focusing on equalizing risk contributions across asset classes and target date funds adjusting allocations based on the investor's retirement timeline. Both investment strategies utilize dynamic rebalancing to maintain optimal risk exposure and aim to achieve more stable returns. Their connection lies in leveraging diversification and risk management to align investment portfolios with individual financial goals and changing market conditions.

Key Terms

Glide Path

Target date funds employ a predetermined glide path that gradually shifts asset allocation from equities to fixed income as the target retirement date approaches, balancing growth and risk reduction. Risk parity portfolios allocate risk evenly across asset classes, emphasizing diversification and volatility management without a fixed time-based schedule. Explore the nuances of glide path design and risk balancing to enhance portfolio strategy understanding.

Leverage

Target date funds typically adjust asset allocation based on age-related risk tolerance, relying less on leverage and more on diversification across stocks and bonds. Risk parity portfolios employ leverage strategically to balance risk contributions from different asset classes, aiming for more stable returns through equalized volatility exposure. Explore the nuances of leverage use in these portfolio strategies to understand their impact on risk and return profiles.

Asset Allocation

Target date funds allocate assets based on an investor's planned retirement date, gradually shifting from equities to fixed income to reduce risk over time. Risk parity portfolios distribute risk equally across asset classes by balancing volatility contributions, often increasing exposure to traditionally less risky assets like bonds and commodities. Explore how these distinct approaches impact long-term portfolio performance and risk management.

Source and External Links

What Is a Target-Date Fund and When Should You Invest in One? - Target-date funds automatically rebalance your portfolio from growth-focused assets to more conservative investments as you approach a specified retirement year, allowing you to "set and forget" your retirement savings.

Target Date Mutual Funds - These mutual funds adjust their asset allocation to become more conservative as the target date nears, serving as an all-in-one portfolio solution that eliminates the need for manual rebalancing as an investor ages.

Target Date Funds - Designed for long-term goals like retirement or college, target-date funds gradually shift from a stock-heavy mix to a bond-heavy mix as the target date approaches, with the fund's name typically reflecting the expected year of withdrawal.

dowidth.com

dowidth.com