Basis trading involves exploiting price differences between futures contracts and their underlying assets, capitalizing on the convergence of these prices as the contract nears expiration. Pairs trading, a market-neutral strategy, seeks to profit from the relative price movements of two correlated securities by simultaneously buying the undervalued and selling the overvalued asset. Discover more about the nuances and applications of these advanced trading strategies.

Why it is important

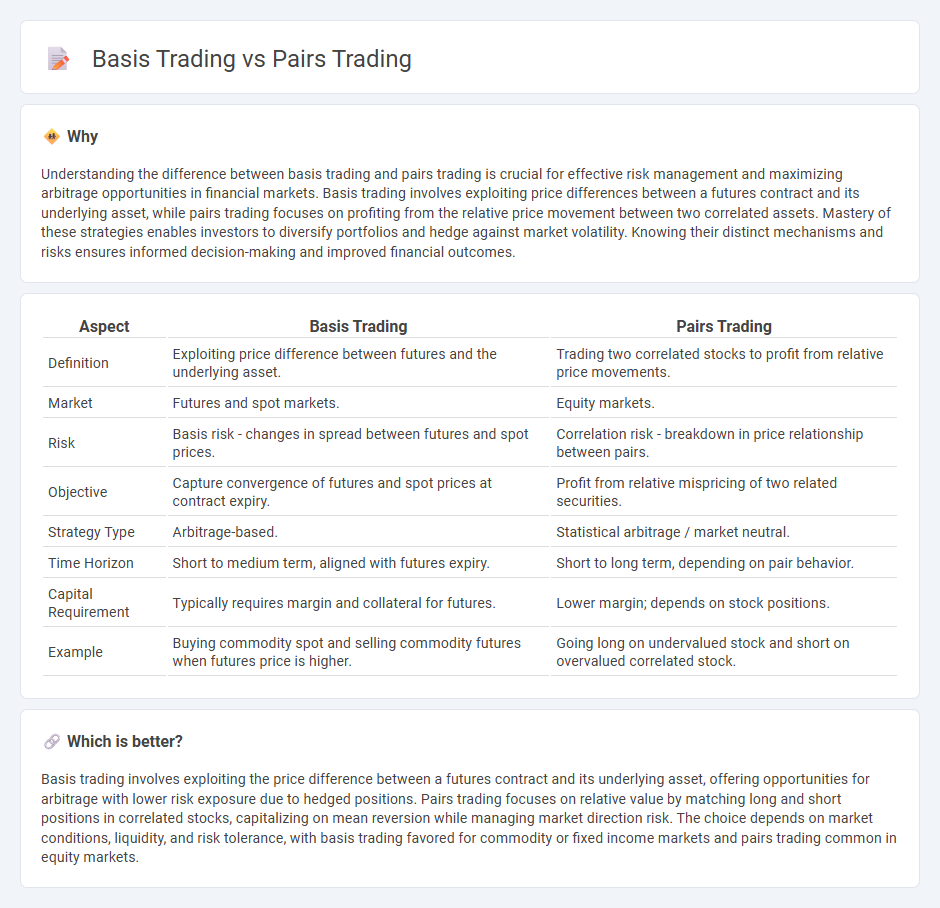

Understanding the difference between basis trading and pairs trading is crucial for effective risk management and maximizing arbitrage opportunities in financial markets. Basis trading involves exploiting price differences between a futures contract and its underlying asset, while pairs trading focuses on profiting from the relative price movement between two correlated assets. Mastery of these strategies enables investors to diversify portfolios and hedge against market volatility. Knowing their distinct mechanisms and risks ensures informed decision-making and improved financial outcomes.

Comparison Table

| Aspect | Basis Trading | Pairs Trading |

|---|---|---|

| Definition | Exploiting price difference between futures and the underlying asset. | Trading two correlated stocks to profit from relative price movements. |

| Market | Futures and spot markets. | Equity markets. |

| Risk | Basis risk - changes in spread between futures and spot prices. | Correlation risk - breakdown in price relationship between pairs. |

| Objective | Capture convergence of futures and spot prices at contract expiry. | Profit from relative mispricing of two related securities. |

| Strategy Type | Arbitrage-based. | Statistical arbitrage / market neutral. |

| Time Horizon | Short to medium term, aligned with futures expiry. | Short to long term, depending on pair behavior. |

| Capital Requirement | Typically requires margin and collateral for futures. | Lower margin; depends on stock positions. |

| Example | Buying commodity spot and selling commodity futures when futures price is higher. | Going long on undervalued stock and short on overvalued correlated stock. |

Which is better?

Basis trading involves exploiting the price difference between a futures contract and its underlying asset, offering opportunities for arbitrage with lower risk exposure due to hedged positions. Pairs trading focuses on relative value by matching long and short positions in correlated stocks, capitalizing on mean reversion while managing market direction risk. The choice depends on market conditions, liquidity, and risk tolerance, with basis trading favored for commodity or fixed income markets and pairs trading common in equity markets.

Connection

Basis trading and pairs trading both exploit price discrepancies between related financial instruments to generate profits. Basis trading focuses on the difference between the spot price and futures price of the same asset, aiming to capitalize on the convergence of these prices over time. Pairs trading involves identifying two correlated securities and taking opposite positions to benefit from temporary deviations in their price relationship.

Key Terms

Cointegration

Pairs trading exploits cointegration by identifying two assets with a stable long-term equilibrium relationship, allowing traders to profit from temporary price divergences. Basis trading, while also leveraging cointegration, typically involves the spread between futures and spot prices to capture mispricing due to factors like carry costs and market inefficiencies. Explore deeper insights into cointegration strategies to enhance your trading edge and risk management.

Spread

Pairs trading exploits price divergences between correlated securities to capture mean-reverting spreads, relying on statistical measures like z-score to identify entry and exit points. Basis trading centers on exploiting disparities between futures prices and their underlying asset spot prices, focusing specifically on the spread caused by cost of carry, interest rates, and dividends. Explore the intricate mechanics and strategic implementations behind each spread-focused trading approach to enhance your market edge.

Arbitrage

Pairs trading exploits price divergences between two correlated assets to generate arbitrage profits by simultaneously buying undervalued and selling overvalued securities. Basis trading, on the other hand, involves arbitraging the difference between the spot price of an asset and its futures price, capturing gains from price convergence at contract expiration. Explore the nuances and applications of these arbitrage strategies to enhance your trading insights.

Source and External Links

Pairs trade - Pairs trading is a market neutral strategy that profits from the convergence of the spread between two historically correlated securities when their prices temporarily diverge, by shorting the outperforming and going long the underperforming stock.

What Is Pairs Trading? - Fidelity Investments - It is a non-directional, relative value investment strategy that identifies two related companies or funds and trades based on the statistical relationship and expected correction of price imbalances between them.

The Comprehensive Introduction to Pairs Trading - Hudson & Thames - Pairs trading exploits mispricings between co-moving assets by simultaneously long one and short the other, assuming the price relationship will revert to equilibrium without needing to forecast individual price directions.

dowidth.com

dowidth.com