Impact investing directs capital toward ventures generating measurable financial returns alongside positive social or environmental outcomes, emphasizing sustainable and scalable impact. Philanthropy focuses on donating resources without expecting financial return, aiming primarily to support charitable causes and immediate relief efforts. Explore further to understand which approach better aligns with your financial goals and social values.

Why it is important

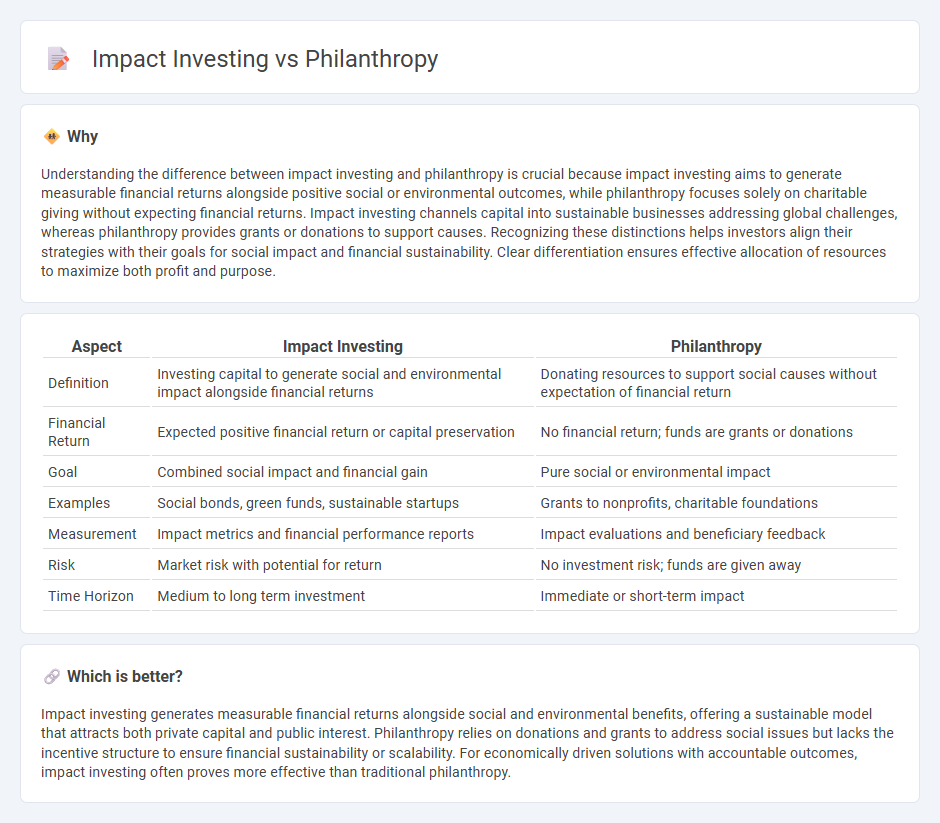

Understanding the difference between impact investing and philanthropy is crucial because impact investing aims to generate measurable financial returns alongside positive social or environmental outcomes, while philanthropy focuses solely on charitable giving without expecting financial returns. Impact investing channels capital into sustainable businesses addressing global challenges, whereas philanthropy provides grants or donations to support causes. Recognizing these distinctions helps investors align their strategies with their goals for social impact and financial sustainability. Clear differentiation ensures effective allocation of resources to maximize both profit and purpose.

Comparison Table

| Aspect | Impact Investing | Philanthropy |

|---|---|---|

| Definition | Investing capital to generate social and environmental impact alongside financial returns | Donating resources to support social causes without expectation of financial return |

| Financial Return | Expected positive financial return or capital preservation | No financial return; funds are grants or donations |

| Goal | Combined social impact and financial gain | Pure social or environmental impact |

| Examples | Social bonds, green funds, sustainable startups | Grants to nonprofits, charitable foundations |

| Measurement | Impact metrics and financial performance reports | Impact evaluations and beneficiary feedback |

| Risk | Market risk with potential for return | No investment risk; funds are given away |

| Time Horizon | Medium to long term investment | Immediate or short-term impact |

Which is better?

Impact investing generates measurable financial returns alongside social and environmental benefits, offering a sustainable model that attracts both private capital and public interest. Philanthropy relies on donations and grants to address social issues but lacks the incentive structure to ensure financial sustainability or scalability. For economically driven solutions with accountable outcomes, impact investing often proves more effective than traditional philanthropy.

Connection

Impact investing and philanthropy are connected through their shared goal of generating positive social and environmental outcomes alongside financial returns. Both approaches prioritize funding projects that address issues like poverty, climate change, and education, leveraging capital to create measurable impact. The integration of impact investing principles into philanthropic strategies enhances accountability and scalability, bridging traditional charitable giving with market-driven solutions.

Key Terms

Social Return on Investment (SROI)

Philanthropy focuses on charitable giving without expecting financial returns, emphasizing social benefits and community well-being. Impact investing strategically deploys capital to generate measurable Social Return on Investment (SROI) alongside financial gains, targeting scalable social or environmental impact. Explore further to understand how SROI metrics drive the effectiveness of these approaches.

Grantmaking

Philanthropy centers on grantmaking, providing unconditional donations to nonprofit organizations aimed at social good, without expectation of financial returns. Impact investing, in contrast, targets social or environmental impact alongside financial returns, often involving investments in for-profit ventures. Explore the distinctions between philanthropy and impact investing to optimize your social contribution strategy.

ESG (Environmental, Social, and Governance)

Philanthropy focuses on charitable giving to address social and environmental issues, while impact investing strategically allocates capital to generate measurable ESG (Environmental, Social, and Governance) outcomes alongside financial returns. ESG criteria guide impact investors in evaluating corporate practices related to environmental sustainability, social responsibility, and governance standards to align investments with sustainable development goals. Discover how integrating ESG factors in impact investing drives scalable change beyond traditional philanthropy.

Source and External Links

Philanthropy - Stanford Encyclopedia of Philosophy - Philanthropy is the voluntary contribution of money or resources for broadly public purposes, determined by the donor's discretion rather than coercion.

Philanthropy - Philanthropy is a form of altruism involving private initiatives for the public good, focusing on improving quality of life, distinct from business or government activities.

What is a Philanthropist? | Fidelity - A philanthropist is anyone who donates time, money, experience, skills, or talent to help create a better world, regardless of their wealth or status.

dowidth.com

dowidth.com