Special Purpose Acquisition Companies (SPACs) offer a streamlined approach to going public by raising capital through an IPO and then acquiring a private company, bypassing traditional initial public offering complexities. Mergers and Acquisitions (M&A) involve the direct purchase or consolidation of companies to enhance market share, diversify offerings, or achieve synergies. Explore deeper insights into the advantages, risks, and strategic applications of SPACs versus M&A to optimize financial decision-making.

Why it is important

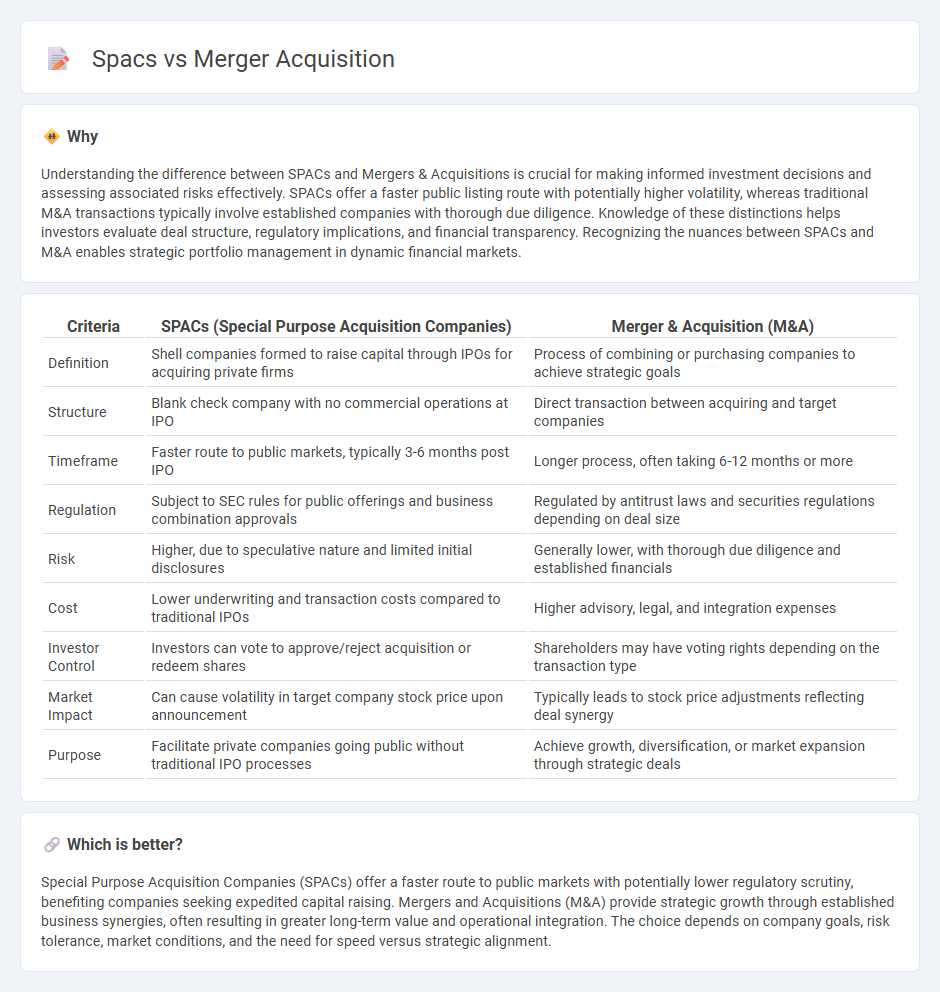

Understanding the difference between SPACs and Mergers & Acquisitions is crucial for making informed investment decisions and assessing associated risks effectively. SPACs offer a faster public listing route with potentially higher volatility, whereas traditional M&A transactions typically involve established companies with thorough due diligence. Knowledge of these distinctions helps investors evaluate deal structure, regulatory implications, and financial transparency. Recognizing the nuances between SPACs and M&A enables strategic portfolio management in dynamic financial markets.

Comparison Table

| Criteria | SPACs (Special Purpose Acquisition Companies) | Merger & Acquisition (M&A) |

|---|---|---|

| Definition | Shell companies formed to raise capital through IPOs for acquiring private firms | Process of combining or purchasing companies to achieve strategic goals |

| Structure | Blank check company with no commercial operations at IPO | Direct transaction between acquiring and target companies |

| Timeframe | Faster route to public markets, typically 3-6 months post IPO | Longer process, often taking 6-12 months or more |

| Regulation | Subject to SEC rules for public offerings and business combination approvals | Regulated by antitrust laws and securities regulations depending on deal size |

| Risk | Higher, due to speculative nature and limited initial disclosures | Generally lower, with thorough due diligence and established financials |

| Cost | Lower underwriting and transaction costs compared to traditional IPOs | Higher advisory, legal, and integration expenses |

| Investor Control | Investors can vote to approve/reject acquisition or redeem shares | Shareholders may have voting rights depending on the transaction type |

| Market Impact | Can cause volatility in target company stock price upon announcement | Typically leads to stock price adjustments reflecting deal synergy |

| Purpose | Facilitate private companies going public without traditional IPO processes | Achieve growth, diversification, or market expansion through strategic deals |

Which is better?

Special Purpose Acquisition Companies (SPACs) offer a faster route to public markets with potentially lower regulatory scrutiny, benefiting companies seeking expedited capital raising. Mergers and Acquisitions (M&A) provide strategic growth through established business synergies, often resulting in greater long-term value and operational integration. The choice depends on company goals, risk tolerance, market conditions, and the need for speed versus strategic alignment.

Connection

Special Purpose Acquisition Companies (SPACs) serve as financial vehicles designed to facilitate mergers and acquisitions by raising capital through initial public offerings to acquire private companies, effectively streamlining the traditional M&A process. This connection allows target firms to gain public market access rapidly and with less regulatory scrutiny compared to conventional IPOs, making SPAC mergers a favored alternative financing strategy in the financial sector. The integration of SPACs within merger and acquisition frameworks reflects a strategic shift towards innovative capital-raising methods that enhance transactional efficiency and liquidity in competitive markets.

Key Terms

Due Diligence

Due diligence in mergers and acquisitions involves comprehensive evaluation of financial statements, legal liabilities, and operational risks to ensure accurate valuation and risk mitigation. In contrast, SPACs rely heavily on the sponsor's reputation and streamlined due diligence processes, often resulting in faster transactions but increased uncertainty. Explore detailed comparisons to understand the nuances and optimize your investment strategies.

Valuation

Merger and acquisition valuations often rely on tangible assets, cash flow analysis, and EBITDA multiples, providing detailed insight into a company's financial health. Special Purpose Acquisition Companies (SPACs) typically base valuations on projections and market sentiment, leading to potential volatility and speculation. Explore in-depth valuation methodologies to understand the nuanced differences between M&A and SPAC deals.

PIPE (Private Investment in Public Equity)

PIPEs (Private Investment in Public Equity) play a pivotal role in both mergers and acquisitions (M&A) and SPAC transactions by providing essential capital from private investors to public companies at often discounted prices. In M&A deals, PIPE investments are commonly used to finance the purchase or refinance existing debt, enabling smoother deal execution and shareholder value preservation. Explore deeper insights on how PIPEs strategically fuel growth and liquidity in these high-stakes financial deals.

Source and External Links

Mergers and acquisitions - Mergers and acquisitions (M&A) are business transactions where the ownership of companies or their operating units is transferred or consolidated, often to achieve growth, downsizing, or a change in competitive position, and typically involve merging two entities into one or one company acquiring another.

Joint Venture vs Merger vs Acquisition - A merger occurs when two or more companies combine to form a new entity, while an acquisition happens when one company buys and takes control of another, and a joint venture involves companies collaborating on a specific project while remaining separate.

Merge and acquire businesses - Mergers create a new legal entity from two separate businesses, whereas acquisitions do not form a new company but instead absorb the purchased company into the acquiring one, sometimes leading to the liquidation of the acquired business.

dowidth.com

dowidth.com