Sovereign debt restructuring involves renegotiating the terms of a country's debt obligations to restore fiscal sustainability, often including debt reduction or extended payment schedules. Standstill agreements temporarily halt debt repayments to prevent default and provide time for negotiation without immediate financial pressure. Explore the distinctions and implications of these approaches to better understand their impact on global financial stability.

Why it is important

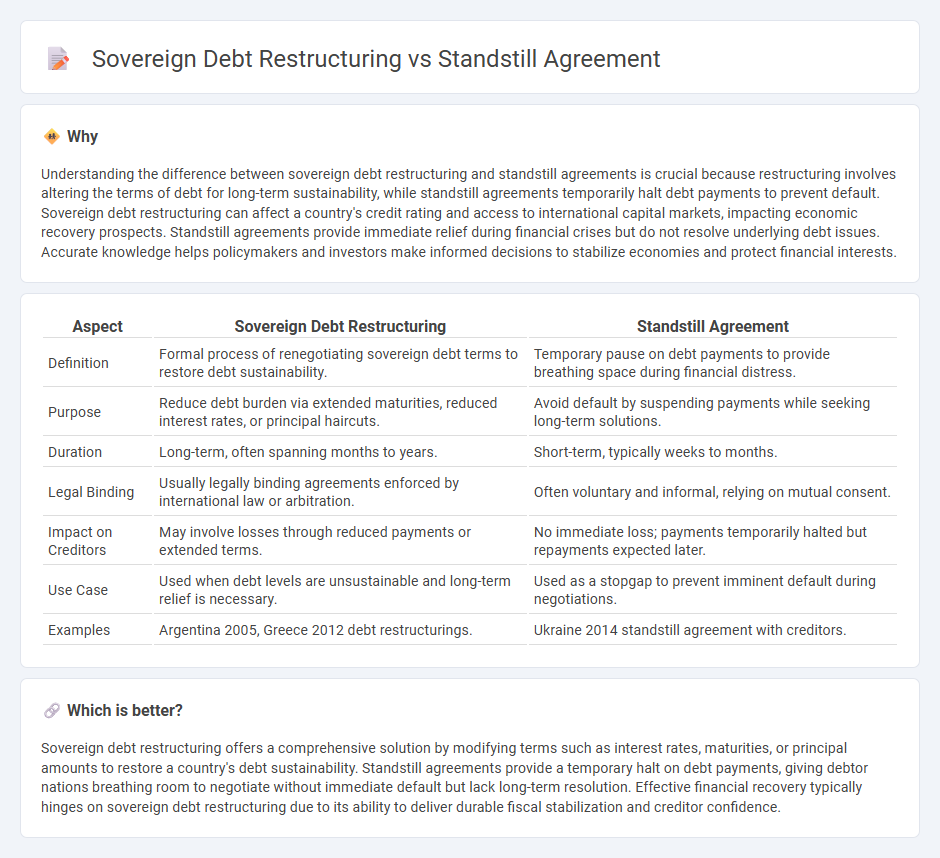

Understanding the difference between sovereign debt restructuring and standstill agreements is crucial because restructuring involves altering the terms of debt for long-term sustainability, while standstill agreements temporarily halt debt payments to prevent default. Sovereign debt restructuring can affect a country's credit rating and access to international capital markets, impacting economic recovery prospects. Standstill agreements provide immediate relief during financial crises but do not resolve underlying debt issues. Accurate knowledge helps policymakers and investors make informed decisions to stabilize economies and protect financial interests.

Comparison Table

| Aspect | Sovereign Debt Restructuring | Standstill Agreement |

|---|---|---|

| Definition | Formal process of renegotiating sovereign debt terms to restore debt sustainability. | Temporary pause on debt payments to provide breathing space during financial distress. |

| Purpose | Reduce debt burden via extended maturities, reduced interest rates, or principal haircuts. | Avoid default by suspending payments while seeking long-term solutions. |

| Duration | Long-term, often spanning months to years. | Short-term, typically weeks to months. |

| Legal Binding | Usually legally binding agreements enforced by international law or arbitration. | Often voluntary and informal, relying on mutual consent. |

| Impact on Creditors | May involve losses through reduced payments or extended terms. | No immediate loss; payments temporarily halted but repayments expected later. |

| Use Case | Used when debt levels are unsustainable and long-term relief is necessary. | Used as a stopgap to prevent imminent default during negotiations. |

| Examples | Argentina 2005, Greece 2012 debt restructurings. | Ukraine 2014 standstill agreement with creditors. |

Which is better?

Sovereign debt restructuring offers a comprehensive solution by modifying terms such as interest rates, maturities, or principal amounts to restore a country's debt sustainability. Standstill agreements provide a temporary halt on debt payments, giving debtor nations breathing room to negotiate without immediate default but lack long-term resolution. Effective financial recovery typically hinges on sovereign debt restructuring due to its ability to deliver durable fiscal stabilization and creditor confidence.

Connection

Sovereign debt restructuring involves renegotiating the terms of a country's outstanding debt to restore financial stability and ensure sustainable repayment conditions. A standstill agreement temporarily halts debt payments, providing the debtor nation with breathing room to negotiate restructuring terms without triggering defaults or creditor enforcement actions. This connection enables debtor countries to avoid immediate financial distress while formulating effective debt relief solutions during restructuring processes.

Key Terms

Moratorium

A standstill agreement temporarily halts debt repayments to provide sovereign borrowers relief while preserving creditor negotiations without altering original terms. Sovereign debt restructuring, often involving a moratorium, legally suspends debt obligations to address insolvency and may include extending maturities, reducing principal, or lowering interest rates. Explore how moratoriums function as a critical tool in sovereign debt crises and their impact on global financial stability.

Haircut

A standstill agreement temporarily halts debt repayments, providing breathing room without reducing the principal owed, whereas sovereign debt restructuring often involves a "haircut," which is a negotiated reduction in the outstanding debt's face value to restore fiscal sustainability. The haircut percentage reflects the actual debt relief granted to the debtor country, impacting creditor recoveries and future access to capital markets. Explore more details to understand how haircuts shape sovereign debt negotiations and economic recovery.

Creditor committee

A standstill agreement temporarily halts creditor actions to allow negotiations without enforcement pressure, improving cooperation within the creditor committee during sovereign debt distress. Sovereign debt restructuring involves formal modifications to debt terms, requiring creditor committee consensus to balance debtor repayment capacity and creditor recoveries. Explore deeper insights into creditor committee roles in these frameworks for enhanced debt resolution strategies.

Source and External Links

Standstill agreement - Wikipedia - A standstill agreement is a contract to delay or limit certain actions, often used to prevent hostile takeovers by restricting a bidder's stock acquisitions or to suspend the time limit for legal claims, giving parties more time for negotiation or resolution.

Everything You Need to Know About Standstill Agreements - This agreement freezes certain actions for a specific period (usually 18-24 months) to protect the target company in mergers or acquisitions, often preventing hostile takeover attempts and misuse of confidential due diligence information.

What is a standstill agreement? A guide for businesses - In business disputes, standstill agreements voluntarily extend legal time limits to allow parties to seek alternative dispute resolution without court proceedings, offering more time to assess claims or defenses without needing court orders.

dowidth.com

dowidth.com