Insurtech leverages technology to transform insurance services by enhancing risk assessment, policy management, and claims processing through AI and data analytics. Cryptotech focuses on blockchain and cryptocurrencies to enable secure, decentralized financial transactions and innovative investment opportunities. Explore deeper insights into how Insurtech and Cryptotech are reshaping the future of finance.

Why it is important

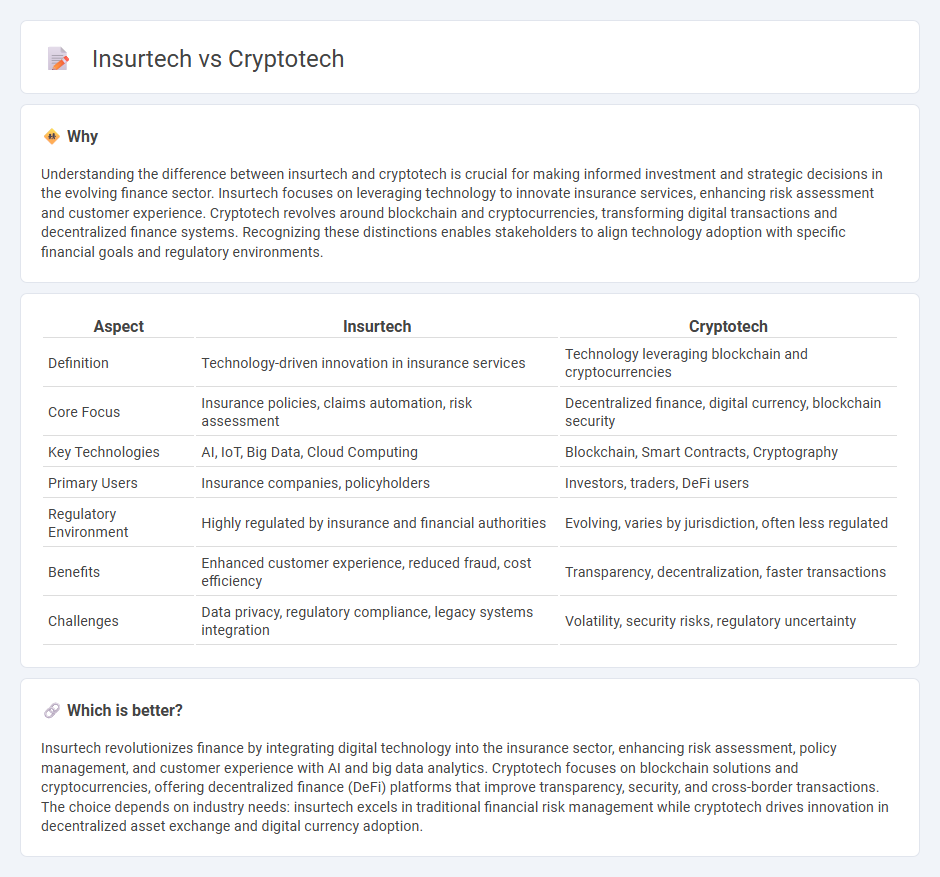

Understanding the difference between insurtech and cryptotech is crucial for making informed investment and strategic decisions in the evolving finance sector. Insurtech focuses on leveraging technology to innovate insurance services, enhancing risk assessment and customer experience. Cryptotech revolves around blockchain and cryptocurrencies, transforming digital transactions and decentralized finance systems. Recognizing these distinctions enables stakeholders to align technology adoption with specific financial goals and regulatory environments.

Comparison Table

| Aspect | Insurtech | Cryptotech |

|---|---|---|

| Definition | Technology-driven innovation in insurance services | Technology leveraging blockchain and cryptocurrencies |

| Core Focus | Insurance policies, claims automation, risk assessment | Decentralized finance, digital currency, blockchain security |

| Key Technologies | AI, IoT, Big Data, Cloud Computing | Blockchain, Smart Contracts, Cryptography |

| Primary Users | Insurance companies, policyholders | Investors, traders, DeFi users |

| Regulatory Environment | Highly regulated by insurance and financial authorities | Evolving, varies by jurisdiction, often less regulated |

| Benefits | Enhanced customer experience, reduced fraud, cost efficiency | Transparency, decentralization, faster transactions |

| Challenges | Data privacy, regulatory compliance, legacy systems integration | Volatility, security risks, regulatory uncertainty |

Which is better?

Insurtech revolutionizes finance by integrating digital technology into the insurance sector, enhancing risk assessment, policy management, and customer experience with AI and big data analytics. Cryptotech focuses on blockchain solutions and cryptocurrencies, offering decentralized finance (DeFi) platforms that improve transparency, security, and cross-border transactions. The choice depends on industry needs: insurtech excels in traditional financial risk management while cryptotech drives innovation in decentralized asset exchange and digital currency adoption.

Connection

Insurtech leverages blockchain and cryptocurrency technologies to enhance transparency, security, and efficiency in insurance processes, enabling smart contracts that automate claims and reduce fraud. Cryptotech provides decentralized digital asset management tools that insurtech integrates to offer innovative policy options and streamline premium payments. The convergence of insurtech and cryptotech accelerates digital transformation in finance by fostering trust and reducing operational costs through decentralized financial ecosystems.

Key Terms

Blockchain

Cryptotech leverages blockchain to enhance cryptocurrency transactions, improve security with decentralized ledgers, and enable smart contracts that automate complex financial agreements. Insurtech incorporates blockchain to streamline claims processing, increase transparency in insurance policies, and reduce fraud through immutable record-keeping. Explore how blockchain transforms these industries by driving innovation and efficiency.

Smart Contracts

Smart contracts in cryptotech enable automated, transparent, and tamper-proof transactions on blockchain networks, revolutionizing digital asset management and decentralized finance. In insurtech, smart contracts streamline claims processing and underwriting by executing pre-defined conditions automatically, enhancing efficiency and reducing fraud. Explore the transformative impact of smart contracts across cryptotech and insurtech for innovative business solutions.

Risk Assessment

Cryptotech enhances risk assessment through blockchain-enabled transparency and smart contracts, improving data accuracy and fraud prevention in financial transactions. Insurtech leverages AI and machine learning algorithms to analyze vast datasets, predicting risk probabilities more precisely for personalized insurance policies. Explore how these innovations revolutionize risk management strategies across industries.

Source and External Links

CryptoTech Solutiona - A pioneering IT company specializing in cutting-edge cybersecurity solutions with over 20 years' expertise, committed to international standards like ISO 27001 to protect systems and data worldwide.

CryptoTech: Home - Offers AI-powered, cloud-based cybersecurity products designed to detect and respond to cyber threats, providing businesses with robust security layers and emergency incident response capabilities.

CryptoTechFin: Automating your crypto investments - A platform for algorithmic crypto investment automation emphasizing security with AES-256 encryption, risk management, and real-time trading decisions to optimize investors' profits.

dowidth.com

dowidth.com