Tokenization of real-world assets transforms physical investments like real estate and art into digital tokens on blockchain platforms, enhancing liquidity and accessibility for investors worldwide. Crowdfunding pools capital directly from a broad audience, often relying on traditional financial instruments and regulatory frameworks. Explore how these innovative funding methods are reshaping the financial landscape and investment opportunities.

Why it is important

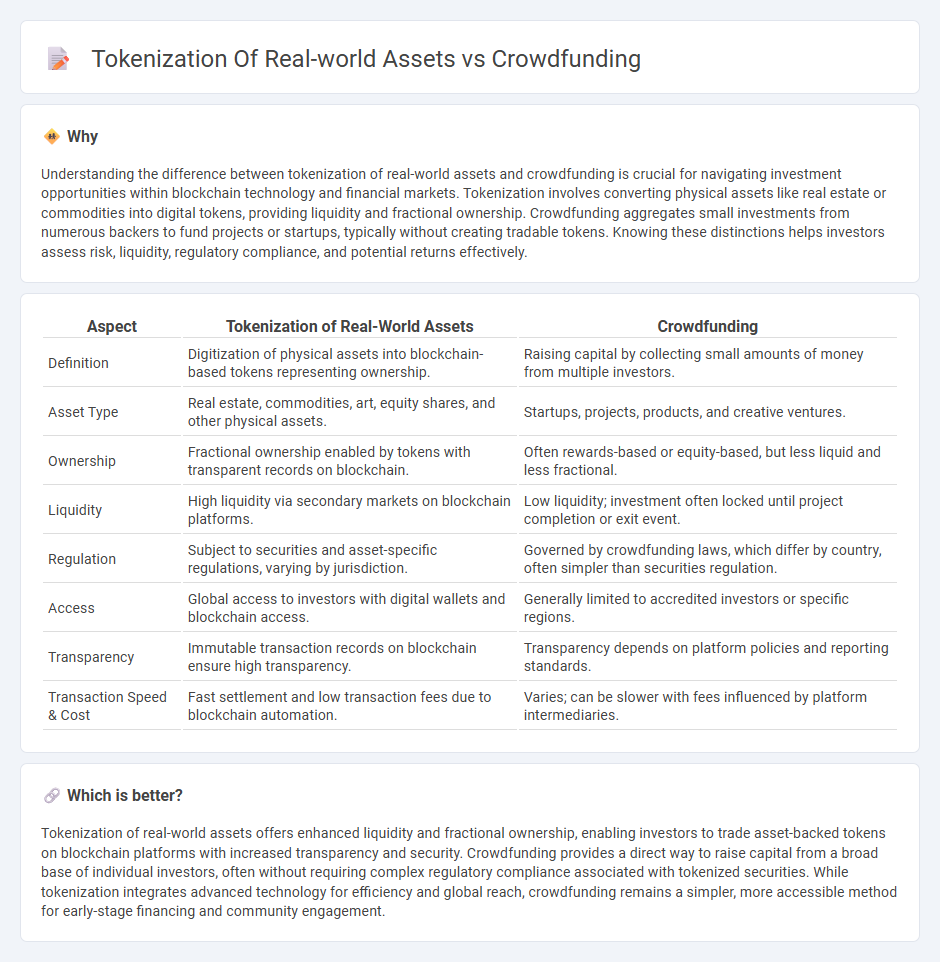

Understanding the difference between tokenization of real-world assets and crowdfunding is crucial for navigating investment opportunities within blockchain technology and financial markets. Tokenization involves converting physical assets like real estate or commodities into digital tokens, providing liquidity and fractional ownership. Crowdfunding aggregates small investments from numerous backers to fund projects or startups, typically without creating tradable tokens. Knowing these distinctions helps investors assess risk, liquidity, regulatory compliance, and potential returns effectively.

Comparison Table

| Aspect | Tokenization of Real-World Assets | Crowdfunding |

|---|---|---|

| Definition | Digitization of physical assets into blockchain-based tokens representing ownership. | Raising capital by collecting small amounts of money from multiple investors. |

| Asset Type | Real estate, commodities, art, equity shares, and other physical assets. | Startups, projects, products, and creative ventures. |

| Ownership | Fractional ownership enabled by tokens with transparent records on blockchain. | Often rewards-based or equity-based, but less liquid and less fractional. |

| Liquidity | High liquidity via secondary markets on blockchain platforms. | Low liquidity; investment often locked until project completion or exit event. |

| Regulation | Subject to securities and asset-specific regulations, varying by jurisdiction. | Governed by crowdfunding laws, which differ by country, often simpler than securities regulation. |

| Access | Global access to investors with digital wallets and blockchain access. | Generally limited to accredited investors or specific regions. |

| Transparency | Immutable transaction records on blockchain ensure high transparency. | Transparency depends on platform policies and reporting standards. |

| Transaction Speed & Cost | Fast settlement and low transaction fees due to blockchain automation. | Varies; can be slower with fees influenced by platform intermediaries. |

Which is better?

Tokenization of real-world assets offers enhanced liquidity and fractional ownership, enabling investors to trade asset-backed tokens on blockchain platforms with increased transparency and security. Crowdfunding provides a direct way to raise capital from a broad base of individual investors, often without requiring complex regulatory compliance associated with tokenized securities. While tokenization integrates advanced technology for efficiency and global reach, crowdfunding remains a simpler, more accessible method for early-stage financing and community engagement.

Connection

Tokenization of real-world assets digitizes physical investments into blockchain-based tokens, enabling fractional ownership and enhanced liquidity. Crowdfunding leverages this technology by allowing multiple investors to collectively fund projects through token purchases, expanding access to capital. This synergy democratizes investment opportunities and streamlines the fundraising process within the financial ecosystem.

Key Terms

Capital Raising

Crowdfunding enables multiple investors to pool small amounts of capital, providing startups and projects with accessible funding and broad community support. Tokenization of real-world assets transforms physical or financial assets into digital tokens on a blockchain, offering enhanced liquidity, fractional ownership, and increased transparency for capital raising. Explore the key differences and benefits to determine the best strategy for your fundraising needs.

Asset Ownership

Crowdfunding enables multiple investors to pool funds and collectively own a project, but ownership rights are often limited and less liquid compared to tokenization. Tokenization of real-world assets digitizes ownership via blockchain, allowing fractional ownership with enhanced transparency, liquidity, and real-time transferability. Explore the benefits of asset tokenization for optimized ownership and investment opportunities.

Liquidity

Tokenization of real-world assets significantly enhances liquidity by enabling fractional ownership and seamless trading on digital platforms, unlike traditional crowdfunding which often locks investors until project completion. Real-world asset tokens can be traded 24/7 on secondary markets, providing investors with greater flexibility and faster access to capital. Discover how tokenization revolutionizes asset liquidity and investment opportunities.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the internet, and it serves as an alternative finance method that bypasses traditional financial intermediaries.

What is crowdfunding? Here are four types to know - Crowdfunding is a popular funding method for startups, involving collective effort via social media and platforms to raise money from a wide network rather than a few traditional investors.

Crowdfunding explained - European Commission - Crowdfunding allows fundraisers to collect money from many people online, often used by startups and SMEs as an innovative alternative funding source, with platforms usually charging fees for successful campaigns.

dowidth.com

dowidth.com