Revenue-based financing involves raising capital by promising a percentage of future revenues to investors until a predetermined amount is repaid, aligning repayments directly with business performance. Royalty-based financing requires businesses to pay investors a fixed percentage of sales or profits, often tied to specific products, providing ongoing income without equity dilution. Discover key differences and benefits of each financing model to decide which suits your financial strategy best.

Why it is important

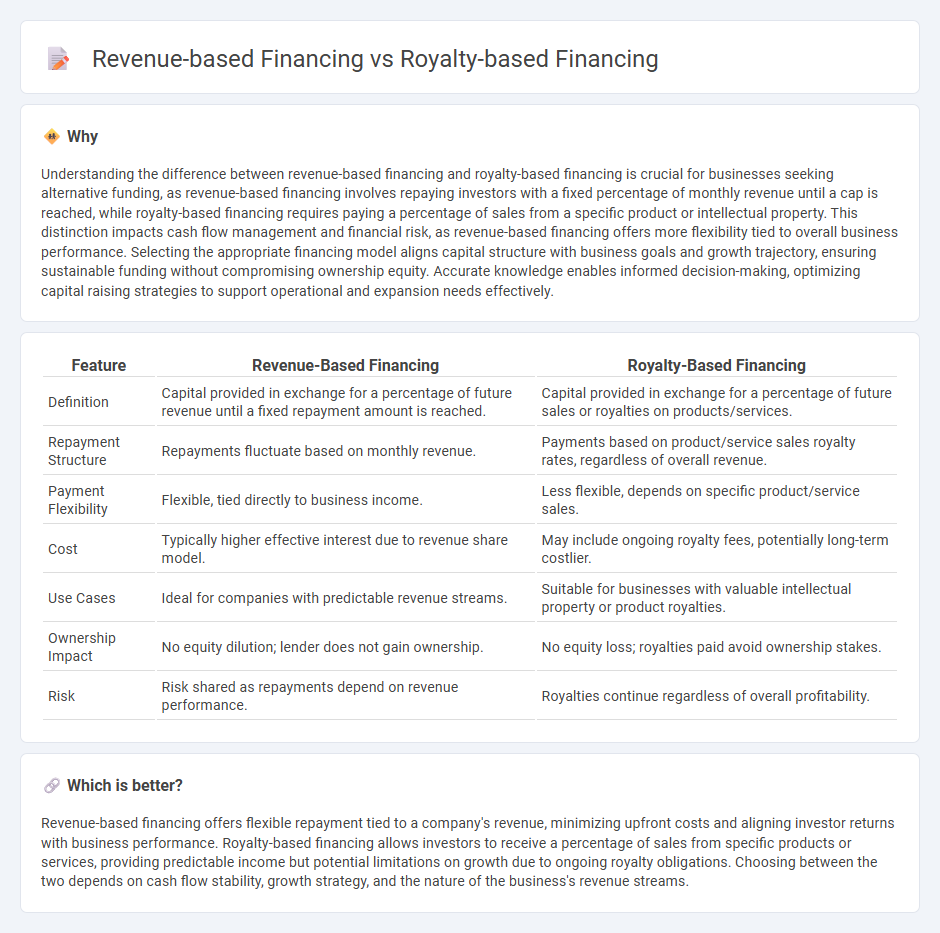

Understanding the difference between revenue-based financing and royalty-based financing is crucial for businesses seeking alternative funding, as revenue-based financing involves repaying investors with a fixed percentage of monthly revenue until a cap is reached, while royalty-based financing requires paying a percentage of sales from a specific product or intellectual property. This distinction impacts cash flow management and financial risk, as revenue-based financing offers more flexibility tied to overall business performance. Selecting the appropriate financing model aligns capital structure with business goals and growth trajectory, ensuring sustainable funding without compromising ownership equity. Accurate knowledge enables informed decision-making, optimizing capital raising strategies to support operational and expansion needs effectively.

Comparison Table

| Feature | Revenue-Based Financing | Royalty-Based Financing |

|---|---|---|

| Definition | Capital provided in exchange for a percentage of future revenue until a fixed repayment amount is reached. | Capital provided in exchange for a percentage of future sales or royalties on products/services. |

| Repayment Structure | Repayments fluctuate based on monthly revenue. | Payments based on product/service sales royalty rates, regardless of overall revenue. |

| Payment Flexibility | Flexible, tied directly to business income. | Less flexible, depends on specific product/service sales. |

| Cost | Typically higher effective interest due to revenue share model. | May include ongoing royalty fees, potentially long-term costlier. |

| Use Cases | Ideal for companies with predictable revenue streams. | Suitable for businesses with valuable intellectual property or product royalties. |

| Ownership Impact | No equity dilution; lender does not gain ownership. | No equity loss; royalties paid avoid ownership stakes. |

| Risk | Risk shared as repayments depend on revenue performance. | Royalties continue regardless of overall profitability. |

Which is better?

Revenue-based financing offers flexible repayment tied to a company's revenue, minimizing upfront costs and aligning investor returns with business performance. Royalty-based financing allows investors to receive a percentage of sales from specific products or services, providing predictable income but potential limitations on growth due to ongoing royalty obligations. Choosing between the two depends on cash flow stability, growth strategy, and the nature of the business's revenue streams.

Connection

Revenue-based financing and royalty-based financing are connected through their shared structure of repayments tied to a percentage of business revenue, allowing investors to receive returns based on company performance rather than fixed interest rates. Both financing methods align investor returns with the operational success of the business, providing flexible capital solutions particularly for startups and growing companies. This alignment minimizes risk for borrowers by linking payment obligations directly to income, unlike traditional debt financing with fixed payment schedules.

Key Terms

Royalties

Royalty-based financing involves investors receiving a percentage of future revenue or sales, aligning returns with the company's performance without diluting ownership. It differs from revenue-based financing by specifically tying payments to royalties generated from intellectual property or product sales. Explore how royalty-based financing can optimize capital structure and benefit both investors and businesses.

Revenue Share

Revenue-based financing involves repaying investors through a fixed percentage of ongoing gross revenues until a predetermined amount is reached, aligning repayments directly with business performance. Royalty-based financing requires payments based on a percentage of revenue generated from specific intellectual properties or products, often without equity dilution. Explore detailed comparisons to determine which revenue share model best suits your business growth strategy.

Intellectual Property

Royalty-based financing leverages intellectual property (IP) by providing funds in exchange for a percentage of future revenues derived specifically from IP assets, creating a direct link between IP value and repayment. Revenue-based financing offers repayments tied to overall business revenue without isolating IP contributions, making it less tailored to the unique cash flows generated by intellectual property. Discover how these financing options impact IP-driven ventures and optimize capital strategy.

Source and External Links

Revenue-Based Financing - Overview, How It Works - Royalty-based financing, or revenue-based financing, is a capital-raising method where investors provide funds to a company in exchange for a fixed percentage of ongoing gross revenues, without equity transfer or collateral requirements, offering a flexible alternative to debt and equity financing.

Revenue-based financing - Also known as royalty financing, this type of financing involves investors receiving a set percentage of a company's gross revenues until a predetermined multiple of the investment is repaid, allowing the company to retain control and avoid equity dilution.

Understanding Royalty Loan Agreements in Business - Royalty financing is utilized in industries with scalable revenue models, providing growth capital without giving up ownership or board control, commonly used in tech, biotech, entertainment, natural resources, and franchise expansion sectors.

dowidth.com

dowidth.com