Dark pool routing involves executing large financial orders privately within non-transparent trading venues, minimizing market impact and price fluctuation. Internalization occurs when brokers fill client orders using their own inventory instead of routing them to external markets, often securing better pricing but raising concerns about market fairness. Explore the distinct advantages and implications of dark pool routing versus internalization in today's trading environment.

Why it is important

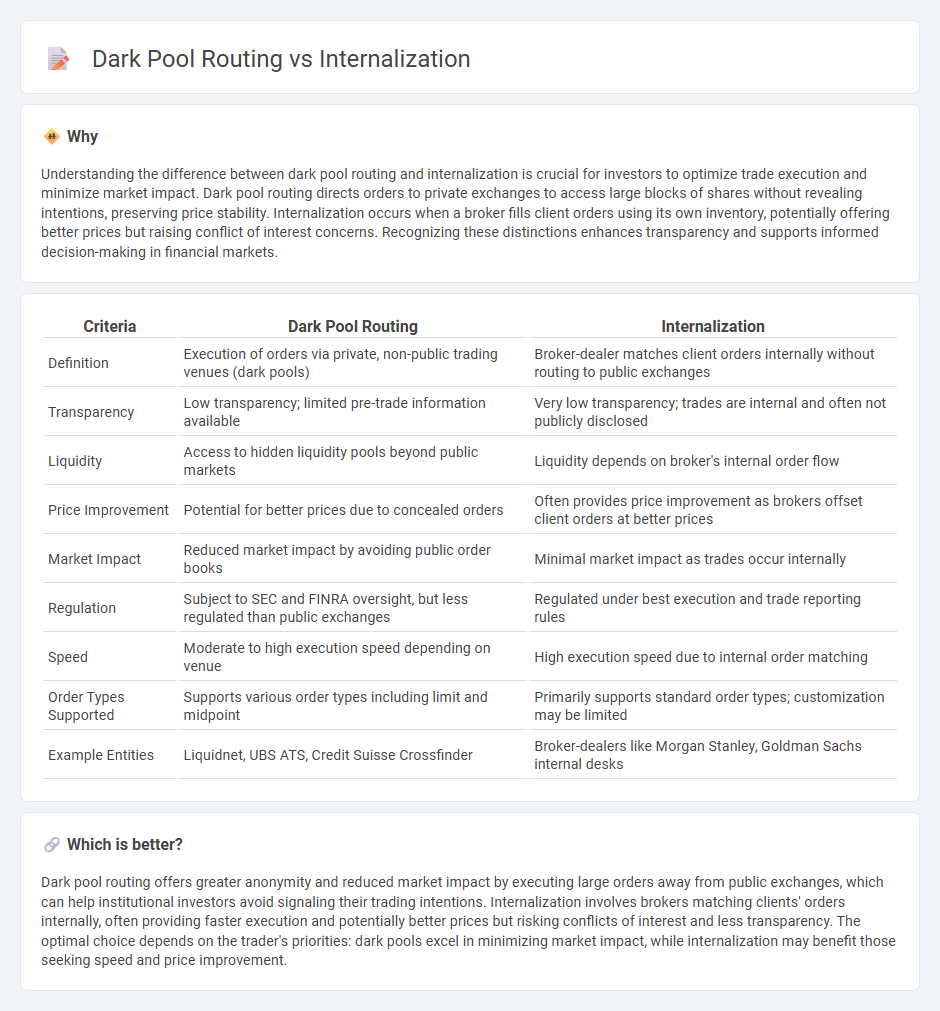

Understanding the difference between dark pool routing and internalization is crucial for investors to optimize trade execution and minimize market impact. Dark pool routing directs orders to private exchanges to access large blocks of shares without revealing intentions, preserving price stability. Internalization occurs when a broker fills client orders using its own inventory, potentially offering better prices but raising conflict of interest concerns. Recognizing these distinctions enhances transparency and supports informed decision-making in financial markets.

Comparison Table

| Criteria | Dark Pool Routing | Internalization |

|---|---|---|

| Definition | Execution of orders via private, non-public trading venues (dark pools) | Broker-dealer matches client orders internally without routing to public exchanges |

| Transparency | Low transparency; limited pre-trade information available | Very low transparency; trades are internal and often not publicly disclosed |

| Liquidity | Access to hidden liquidity pools beyond public markets | Liquidity depends on broker's internal order flow |

| Price Improvement | Potential for better prices due to concealed orders | Often provides price improvement as brokers offset client orders at better prices |

| Market Impact | Reduced market impact by avoiding public order books | Minimal market impact as trades occur internally |

| Regulation | Subject to SEC and FINRA oversight, but less regulated than public exchanges | Regulated under best execution and trade reporting rules |

| Speed | Moderate to high execution speed depending on venue | High execution speed due to internal order matching |

| Order Types Supported | Supports various order types including limit and midpoint | Primarily supports standard order types; customization may be limited |

| Example Entities | Liquidnet, UBS ATS, Credit Suisse Crossfinder | Broker-dealers like Morgan Stanley, Goldman Sachs internal desks |

Which is better?

Dark pool routing offers greater anonymity and reduced market impact by executing large orders away from public exchanges, which can help institutional investors avoid signaling their trading intentions. Internalization involves brokers matching clients' orders internally, often providing faster execution and potentially better prices but risking conflicts of interest and less transparency. The optimal choice depends on the trader's priorities: dark pools excel in minimizing market impact, while internalization may benefit those seeking speed and price improvement.

Connection

Dark pool routing directs large institutional orders to private exchanges, minimizing market impact and maintaining trade anonymity. Internalization occurs when brokers match client orders within their own inventory or network, bypassing public markets. Both practices aim to enhance execution quality and reduce transaction costs by leveraging off-exchange liquidity.

Key Terms

Order Flow

Internalization involves brokers executing client orders internally without sending them to public exchanges, offering price improvement and reduced market impact. Dark pool routing directs orders to private trading venues where large blocks can be matched anonymously, minimizing market impact but potentially reducing price transparency. Explore how order flow strategies balance execution quality and market dynamics for deeper insights.

Execution Transparency

Internalization involves brokers filling client orders from their own inventory, which can limit execution transparency due to less visible price discovery. Dark pool routing sends orders to private exchanges with anonymized trading, where execution transparency is reduced by restricted access to order data. Explore more to understand how these mechanisms impact market transparency and execution quality.

Market Liquidity

Internalization routes client orders within a brokerage firm, often matching buy and sell orders internally, which may reduce displayed market liquidity on public exchanges. Dark pool routing sends orders to private exchanges where orders are not displayed publicly, preserving anonymity but potentially fragmenting liquidity across multiple venues. Explore detailed comparisons of how these mechanisms impact market liquidity and execution quality.

Source and External Links

Internalization (sociology) - Internalization is the process by which individuals accept norms, values, and attitudes established by others through socialization, integrating them into their own identity and behavior.

Internalization: A Cognitive Process - In psychology, internalization refers to subconsciously adopting and integrating external attitudes, values, and norms so they become part of one's personal identity, motivations, and behavior.

INTERNALIZATION definition | Cambridge English Dictionary - Internalization is the action of accepting or absorbing an idea, opinion, belief, etc., so that it becomes part of your character and guides your behavior.

dowidth.com

dowidth.com