Decentralized over-the-counter (OTC) trading facilitates direct asset exchanges without centralized intermediaries, enhancing transparency and reducing counterparty risks in cryptocurrency markets. Peer-to-peer (P2P) trading allows participants to transact directly through platforms that match buyers and sellers, often providing greater privacy but with increased trust requirements. Explore the nuances of these trading models to better understand their impact on financial markets and trading strategies.

Why it is important

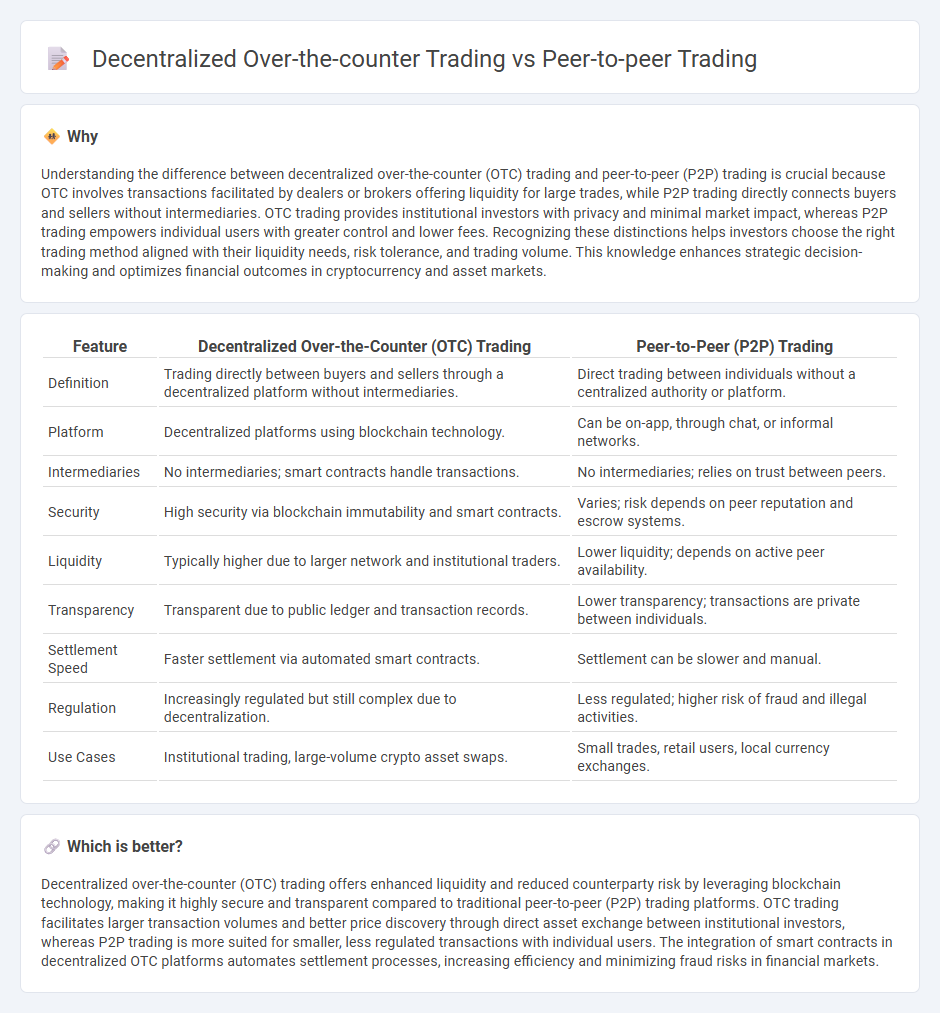

Understanding the difference between decentralized over-the-counter (OTC) trading and peer-to-peer (P2P) trading is crucial because OTC involves transactions facilitated by dealers or brokers offering liquidity for large trades, while P2P trading directly connects buyers and sellers without intermediaries. OTC trading provides institutional investors with privacy and minimal market impact, whereas P2P trading empowers individual users with greater control and lower fees. Recognizing these distinctions helps investors choose the right trading method aligned with their liquidity needs, risk tolerance, and trading volume. This knowledge enhances strategic decision-making and optimizes financial outcomes in cryptocurrency and asset markets.

Comparison Table

| Feature | Decentralized Over-the-Counter (OTC) Trading | Peer-to-Peer (P2P) Trading |

|---|---|---|

| Definition | Trading directly between buyers and sellers through a decentralized platform without intermediaries. | Direct trading between individuals without a centralized authority or platform. |

| Platform | Decentralized platforms using blockchain technology. | Can be on-app, through chat, or informal networks. |

| Intermediaries | No intermediaries; smart contracts handle transactions. | No intermediaries; relies on trust between peers. |

| Security | High security via blockchain immutability and smart contracts. | Varies; risk depends on peer reputation and escrow systems. |

| Liquidity | Typically higher due to larger network and institutional traders. | Lower liquidity; depends on active peer availability. |

| Transparency | Transparent due to public ledger and transaction records. | Lower transparency; transactions are private between individuals. |

| Settlement Speed | Faster settlement via automated smart contracts. | Settlement can be slower and manual. |

| Regulation | Increasingly regulated but still complex due to decentralization. | Less regulated; higher risk of fraud and illegal activities. |

| Use Cases | Institutional trading, large-volume crypto asset swaps. | Small trades, retail users, local currency exchanges. |

Which is better?

Decentralized over-the-counter (OTC) trading offers enhanced liquidity and reduced counterparty risk by leveraging blockchain technology, making it highly secure and transparent compared to traditional peer-to-peer (P2P) trading platforms. OTC trading facilitates larger transaction volumes and better price discovery through direct asset exchange between institutional investors, whereas P2P trading is more suited for smaller, less regulated transactions with individual users. The integration of smart contracts in decentralized OTC platforms automates settlement processes, increasing efficiency and minimizing fraud risks in financial markets.

Connection

Decentralized over-the-counter (OTC) trading and peer-to-peer (P2P) trading both facilitate direct asset exchanges without intermediaries, enhancing privacy and reducing counterparty risk. These methods leverage blockchain technology and smart contracts to enable secure, transparent transactions between participants. By removing central authorities, decentralized OTC and P2P trading foster greater market accessibility and liquidity for digital assets.

Key Terms

Counterparty Risk

Peer-to-peer (P2P) trading minimizes counterparty risk by directly connecting buyers and sellers, eliminating intermediaries who could default or manipulate transactions. Decentralized over-the-counter (OTC) trading platforms often implement smart contracts and blockchain transparency to further reduce counterparty risk, ensuring trustless execution and settlement. Explore these trading mechanisms in detail to understand their impact on transaction security and risk management.

Liquidity

Peer-to-peer (P2P) trading enables direct transactions between users, often limited by the number of active participants, affecting overall liquidity. Decentralized over-the-counter (OTC) trading platforms aggregate multiple liquidity providers, resulting in deeper liquidity pools and reduced slippage for large orders. Explore how these models impact market efficiency and user experience in decentralized finance.

Intermediation

Peer-to-peer (P2P) trading eliminates intermediaries by enabling direct asset exchanges between users, enhancing privacy and reducing transaction fees. Decentralized over-the-counter (OTC) trading, while also removing traditional brokers, often involves smart contracts or decentralized platforms to facilitate trustless transactions with greater liquidity and regulatory compliance. Explore in-depth comparisons to understand how intermediation differs in these cutting-edge trading models.

Source and External Links

What Is Peer-To-Peer Trading and How Do People Use It? - Peer-to-peer (P2P) trading is the direct buying and selling of cryptocurrencies between users without intermediaries, supported by escrow, rating systems, and offering global access, multiple payment options, and zero transaction fees, although it tends to have slower speeds and lower liquidity than centralized exchanges.

What is P2P Crypto Exchange and How Does Peer-to-Peer Trading Work? - P2P crypto trading allows users to trade cryptocurrencies directly without a third party, providing multiple payment methods and relying on reputation systems for security, making it popular in regions with regulatory restrictions.

Top 10 Peer-To-Peer Exchanges: Crypto Exchanges for 2025 - P2P crypto exchanges connect buyers and sellers to set trade terms such as price and payment method, use escrow services to hold funds securely, and offer features like dispute resolution and reputation ratings to ensure safe and transparent transactions.

dowidth.com

dowidth.com