Liquid staking allows crypto holders to earn rewards by locking assets while retaining liquidity through tokenized derivatives, enhancing capital efficiency on decentralized finance platforms. Liquidity mining incentivizes users to provide assets to liquidity pools, boosting trading volume and earning additional tokens as rewards. Explore the differences between these strategies to optimize your decentralized finance investments.

Why it is important

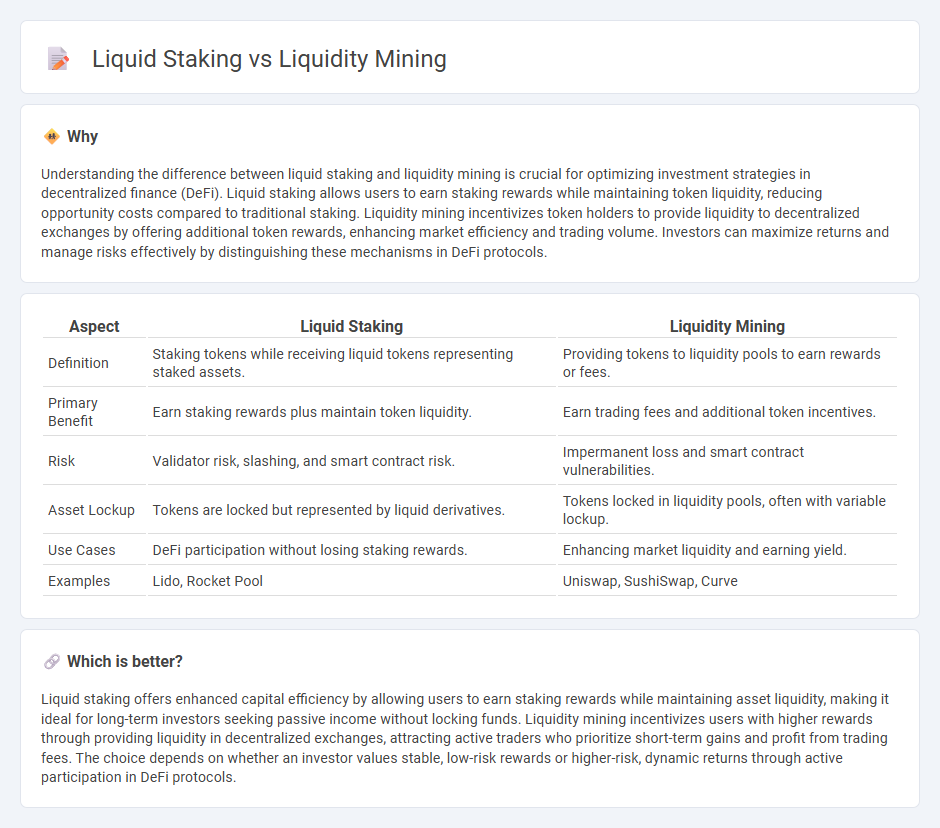

Understanding the difference between liquid staking and liquidity mining is crucial for optimizing investment strategies in decentralized finance (DeFi). Liquid staking allows users to earn staking rewards while maintaining token liquidity, reducing opportunity costs compared to traditional staking. Liquidity mining incentivizes token holders to provide liquidity to decentralized exchanges by offering additional token rewards, enhancing market efficiency and trading volume. Investors can maximize returns and manage risks effectively by distinguishing these mechanisms in DeFi protocols.

Comparison Table

| Aspect | Liquid Staking | Liquidity Mining |

|---|---|---|

| Definition | Staking tokens while receiving liquid tokens representing staked assets. | Providing tokens to liquidity pools to earn rewards or fees. |

| Primary Benefit | Earn staking rewards plus maintain token liquidity. | Earn trading fees and additional token incentives. |

| Risk | Validator risk, slashing, and smart contract risk. | Impermanent loss and smart contract vulnerabilities. |

| Asset Lockup | Tokens are locked but represented by liquid derivatives. | Tokens locked in liquidity pools, often with variable lockup. |

| Use Cases | DeFi participation without losing staking rewards. | Enhancing market liquidity and earning yield. |

| Examples | Lido, Rocket Pool | Uniswap, SushiSwap, Curve |

Which is better?

Liquid staking offers enhanced capital efficiency by allowing users to earn staking rewards while maintaining asset liquidity, making it ideal for long-term investors seeking passive income without locking funds. Liquidity mining incentivizes users with higher rewards through providing liquidity in decentralized exchanges, attracting active traders who prioritize short-term gains and profit from trading fees. The choice depends on whether an investor values stable, low-risk rewards or higher-risk, dynamic returns through active participation in DeFi protocols.

Connection

Liquid staking enhances liquidity mining by allowing staked assets to remain transferable and usable within DeFi protocols, thereby increasing liquidity provision opportunities. Both mechanisms aim to maximize asset utilization; liquid staking unlocks staked tokens for liquidity mining without sacrificing staking rewards. This synergy boosts capital efficiency and optimizes yield generation within decentralized finance ecosystems.

Key Terms

Yield (Rewards/APY)

Liquidity mining typically offers higher yields by incentivizing users with trading fees and native token rewards, often reaching APYs above 50% depending on the platform and pool volatility. Liquid staking provides steadier returns by allowing users to stake assets and receive liquid tokens representing staked positions, with APYs generally ranging from 5% to 15% and reduced impermanent loss risk. Explore detailed comparisons of liquidity mining and liquid staking to optimize your yield strategies effectively.

Liquidity Pools

Liquidity mining involves providing assets to liquidity pools to earn rewards in tokens, enhancing decentralized exchange efficiency. Liquid staking allows users to stake assets while receiving liquid tokens representing their staked assets, enabling additional DeFi participation without losing staking rewards. Explore the distinctions in risk, yield, and protocol incentives between liquidity mining and liquid staking in liquidity pools.

Staking Derivatives

Liquidity mining allows users to earn rewards by providing crypto assets to decentralized finance (DeFi) protocols, boosting market liquidity, whereas liquid staking enables asset holders to stake tokens and receive staking derivatives that retain liquidity. Staking derivatives represent staked assets, permitting holders to use them in DeFi applications without losing staking rewards, enhancing capital efficiency and flexibility. Explore the benefits and risks of staking derivatives to optimize your DeFi investment strategies.

Source and External Links

Liquidity Mining - What It Means and How It Works? - Token Metrics - Liquidity mining is a process where investors earn cryptocurrency rewards by providing liquidity to exchanges or decentralized applications, earning passive income through fees and token incentives while enhancing token liquidity.

Staking vs Yield Farming vs Liquidity Mining - Blockchain Council - Liquidity mining incentivizes users to supply liquidity to decentralized exchanges via liquidity pools, rewarding them with platform tokens and fees, which is essential to DeFi ecosystem functionality.

What is Yield Farming and Liquidity Mining in DeFi? - Openware - Liquidity mining involves providing assets to DEX liquidity pools to earn trading fees and incentive tokens, playing a key role in enabling smooth decentralized trading, distinct but related to yield farming.

dowidth.com

dowidth.com