Tokenization in finance involves converting sensitive data, such as payment information, into unique digital tokens that enhance security and reduce fraud risk. Digitization refers to the process of transforming traditional financial records and services into digital formats to improve efficiency, accessibility, and data management. Explore further to understand how these technologies revolutionize modern finance strategies.

Why it is important

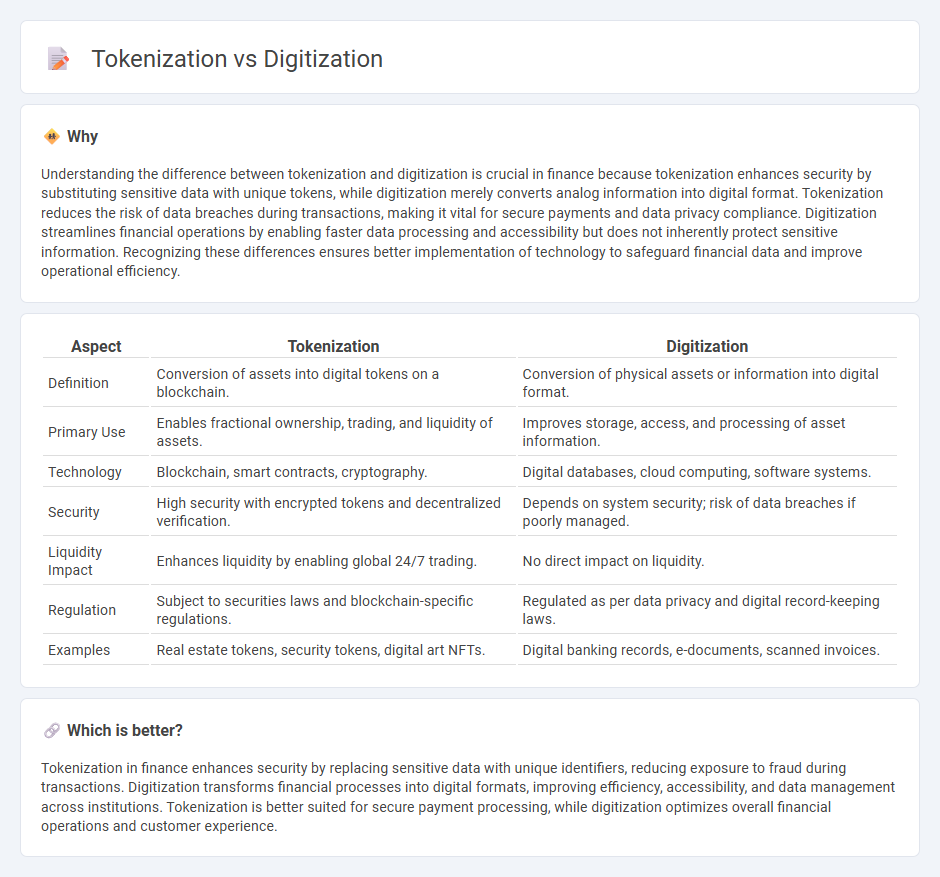

Understanding the difference between tokenization and digitization is crucial in finance because tokenization enhances security by substituting sensitive data with unique tokens, while digitization merely converts analog information into digital format. Tokenization reduces the risk of data breaches during transactions, making it vital for secure payments and data privacy compliance. Digitization streamlines financial operations by enabling faster data processing and accessibility but does not inherently protect sensitive information. Recognizing these differences ensures better implementation of technology to safeguard financial data and improve operational efficiency.

Comparison Table

| Aspect | Tokenization | Digitization |

|---|---|---|

| Definition | Conversion of assets into digital tokens on a blockchain. | Conversion of physical assets or information into digital format. |

| Primary Use | Enables fractional ownership, trading, and liquidity of assets. | Improves storage, access, and processing of asset information. |

| Technology | Blockchain, smart contracts, cryptography. | Digital databases, cloud computing, software systems. |

| Security | High security with encrypted tokens and decentralized verification. | Depends on system security; risk of data breaches if poorly managed. |

| Liquidity Impact | Enhances liquidity by enabling global 24/7 trading. | No direct impact on liquidity. |

| Regulation | Subject to securities laws and blockchain-specific regulations. | Regulated as per data privacy and digital record-keeping laws. |

| Examples | Real estate tokens, security tokens, digital art NFTs. | Digital banking records, e-documents, scanned invoices. |

Which is better?

Tokenization in finance enhances security by replacing sensitive data with unique identifiers, reducing exposure to fraud during transactions. Digitization transforms financial processes into digital formats, improving efficiency, accessibility, and data management across institutions. Tokenization is better suited for secure payment processing, while digitization optimizes overall financial operations and customer experience.

Connection

Tokenization transforms financial assets into digital tokens, enabling seamless digitization of ownership and transactions on blockchain platforms. This connection enhances liquidity, transparency, and security by digitizing traditional financial instruments such as equities, bonds, and real estate. Digitization relies on tokenization to break down complex assets into divisible, tradable units, driving efficiency in the finance sector.

Key Terms

Digital Assets

Digitization converts physical assets into digital formats, enabling easier storage and access, while tokenization represents assets as digital tokens on a blockchain, ensuring enhanced security and traceability. Digital assets benefit from tokenization through fractional ownership, immutable records, and streamlined transfers, differentiating it from mere digitization. Explore how tokenization is revolutionizing digital asset management for a comprehensive understanding.

Security Tokens

Digitization converts physical assets into digital formats, while tokenization replaces sensitive data with unique identification symbols to enhance security. Security tokens specifically represent ownership rights in blockchain-based assets, combining digitization benefits with cryptographic protection for secure asset transfer and compliance. Explore how security tokens revolutionize asset management and investor trust in modern finance.

Distributed Ledger

Digitization converts physical assets or information into digital format, enabling easier storage and transfer on distributed ledgers, while tokenization represents these digital assets as cryptographically secured tokens on blockchain networks. In distributed ledger technology (DLT), tokenization enhances asset liquidity, traceability, and security by assigning unique identifiers to assets, whereas digitization primarily facilitates digital record creation. Explore the distinct roles of digitization and tokenization in transforming asset management on distributed ledgers.

Source and External Links

Digitization - Wikipedia - Digitization is the process of converting information, such as images, sound, or documents, into a digital (computer-readable) format, enabling easier processing, storage, and transmission of data, and is a crucial first step in digital preservation efforts.

What is digitization? | Definition from TechTarget - Digitization converts analog information into digital data organized in discrete units, enabling automation, improved communication, and driving digital transformation in industries such as manufacturing, healthcare, and commerce.

Digitization vs Digitalization: Real-life Examples And How to Digitize - Digitization specifically means converting analog assets into digital forms, distinct from digitalization, which involves applying digital technologies to improve and transform business processes and models.

dowidth.com

dowidth.com