Climate-linked derivatives are financial instruments designed to hedge risks associated with climate variables, such as temperature or rainfall fluctuations affecting agricultural yields or energy demand. Carbon credits represent tradable permits allowing companies to emit a specific amount of greenhouse gases, incentivizing emission reductions under cap-and-trade systems. Explore the distinctions and applications of these innovative financial tools in driving sustainable investment strategies.

Why it is important

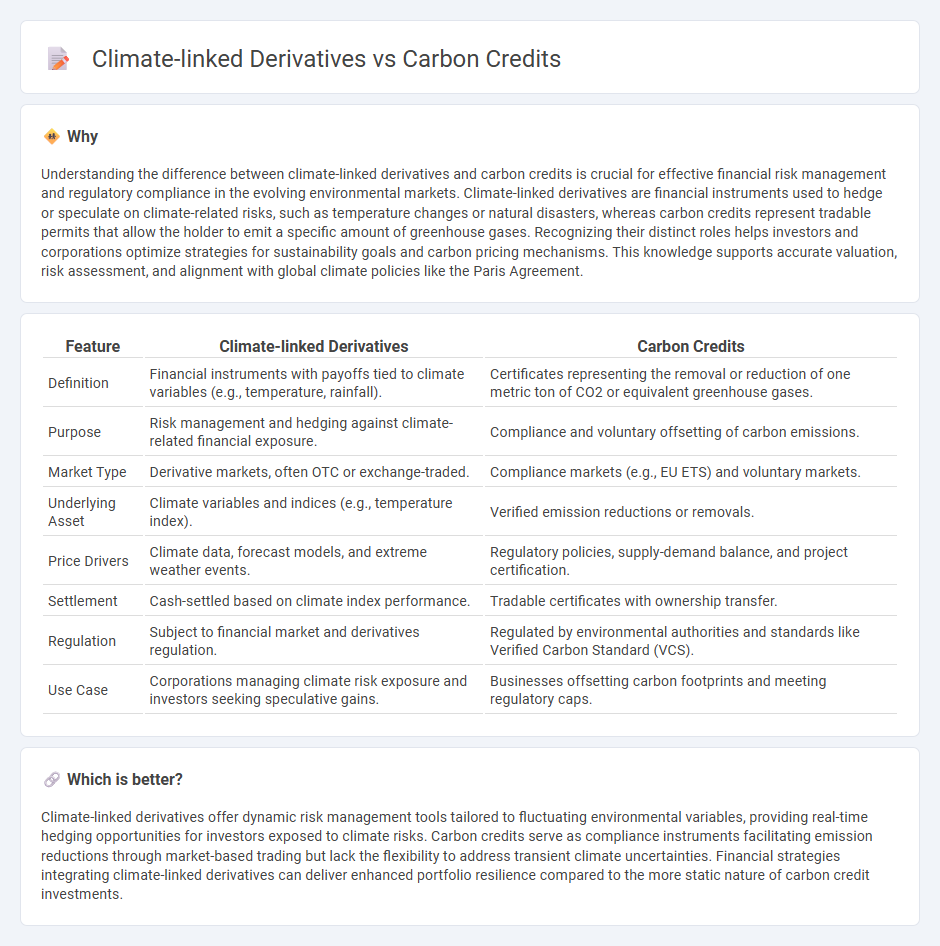

Understanding the difference between climate-linked derivatives and carbon credits is crucial for effective financial risk management and regulatory compliance in the evolving environmental markets. Climate-linked derivatives are financial instruments used to hedge or speculate on climate-related risks, such as temperature changes or natural disasters, whereas carbon credits represent tradable permits that allow the holder to emit a specific amount of greenhouse gases. Recognizing their distinct roles helps investors and corporations optimize strategies for sustainability goals and carbon pricing mechanisms. This knowledge supports accurate valuation, risk assessment, and alignment with global climate policies like the Paris Agreement.

Comparison Table

| Feature | Climate-linked Derivatives | Carbon Credits |

|---|---|---|

| Definition | Financial instruments with payoffs tied to climate variables (e.g., temperature, rainfall). | Certificates representing the removal or reduction of one metric ton of CO2 or equivalent greenhouse gases. |

| Purpose | Risk management and hedging against climate-related financial exposure. | Compliance and voluntary offsetting of carbon emissions. |

| Market Type | Derivative markets, often OTC or exchange-traded. | Compliance markets (e.g., EU ETS) and voluntary markets. |

| Underlying Asset | Climate variables and indices (e.g., temperature index). | Verified emission reductions or removals. |

| Price Drivers | Climate data, forecast models, and extreme weather events. | Regulatory policies, supply-demand balance, and project certification. |

| Settlement | Cash-settled based on climate index performance. | Tradable certificates with ownership transfer. |

| Regulation | Subject to financial market and derivatives regulation. | Regulated by environmental authorities and standards like Verified Carbon Standard (VCS). |

| Use Case | Corporations managing climate risk exposure and investors seeking speculative gains. | Businesses offsetting carbon footprints and meeting regulatory caps. |

Which is better?

Climate-linked derivatives offer dynamic risk management tools tailored to fluctuating environmental variables, providing real-time hedging opportunities for investors exposed to climate risks. Carbon credits serve as compliance instruments facilitating emission reductions through market-based trading but lack the flexibility to address transient climate uncertainties. Financial strategies integrating climate-linked derivatives can deliver enhanced portfolio resilience compared to the more static nature of carbon credit investments.

Connection

Climate-linked derivatives are financial instruments designed to hedge risks associated with climate change, such as extreme weather impacts on agriculture or energy production, which directly affect carbon credit markets by influencing supply and demand. Carbon credits represent measurable reductions in greenhouse gas emissions that companies trade to meet regulatory requirements or voluntary sustainability goals, creating underlying assets for derivatives that reflect carbon price fluctuations. The interplay between these derivatives and carbon credits facilitates risk management and price discovery, driving investment in environmentally sustainable projects.

Key Terms

Emissions Allowance

Carbon credits represent permits that allow companies to emit a certain amount of greenhouse gases, often traded under cap-and-trade systems to incentivize emission reductions. Climate-linked derivatives, such as emissions allowances futures and options, provide financial instruments for hedging risks associated with fluctuating carbon prices and regulatory changes. Explore how emissions allowances impact market dynamics and investment strategies by diving deeper into their roles in climate finance.

Hedging

Carbon credits provide a direct mechanism for companies to offset their greenhouse gas emissions by purchasing verified allowances, making them a straightforward tool for compliance and environmental responsibility. Climate-linked derivatives, such as weather derivatives or catastrophe bonds, offer financial instruments that help firms hedge risks associated with climate variability and extreme weather events, providing risk management beyond direct emissions. Explore further to understand how these tools integrate into comprehensive climate risk strategies.

Price Benchmark

Carbon credits serve as verified permits representing one ton of CO2 emissions reduction, commonly used to meet regulatory emission targets and establish transparent price benchmarks in environmental markets. Climate-linked derivatives, including futures and options, derive their value from underlying climate variables such as carbon prices or weather events, providing tools for risk management and price discovery but lacking standardized benchmarks. Explore how the evolving frameworks for price benchmarking in these instruments influence climate finance strategies.

Source and External Links

Carbon Credits Explained | Climate Impact Partners - Carbon credits represent one tonne of carbon dioxide emissions avoided or removed, enabling businesses to offset emissions they cannot reduce by investing in verified carbon reduction projects worldwide.

What Are Carbon Credits? | CarbonNeutral - Carbon credits assign a monetary value to one tonne of CO2 or equivalent emissions removed or reduced, allowing companies to finance climate projects and contribute to a net global emissions reduction.

Carbon offsets and credits - Wikipedia - One carbon credit corresponds to the reduction or removal of one metric tonne of greenhouse gases, serving as a tradable unit within carbon pricing systems to compensate for emissions released elsewhere.

dowidth.com

dowidth.com