Collateralized reinsurance involves agreements secured by collateral that assures timely payment of claims, reducing counterparty risk in reinsurance transactions. Finite risk reinsurance focuses on risk-sharing with limited loss exposure and incorporates experience refunds or profit-sharing mechanisms to manage long-tailed risks. Explore the nuances and advantages of these reinsurance types to optimize your risk management strategy.

Why it is important

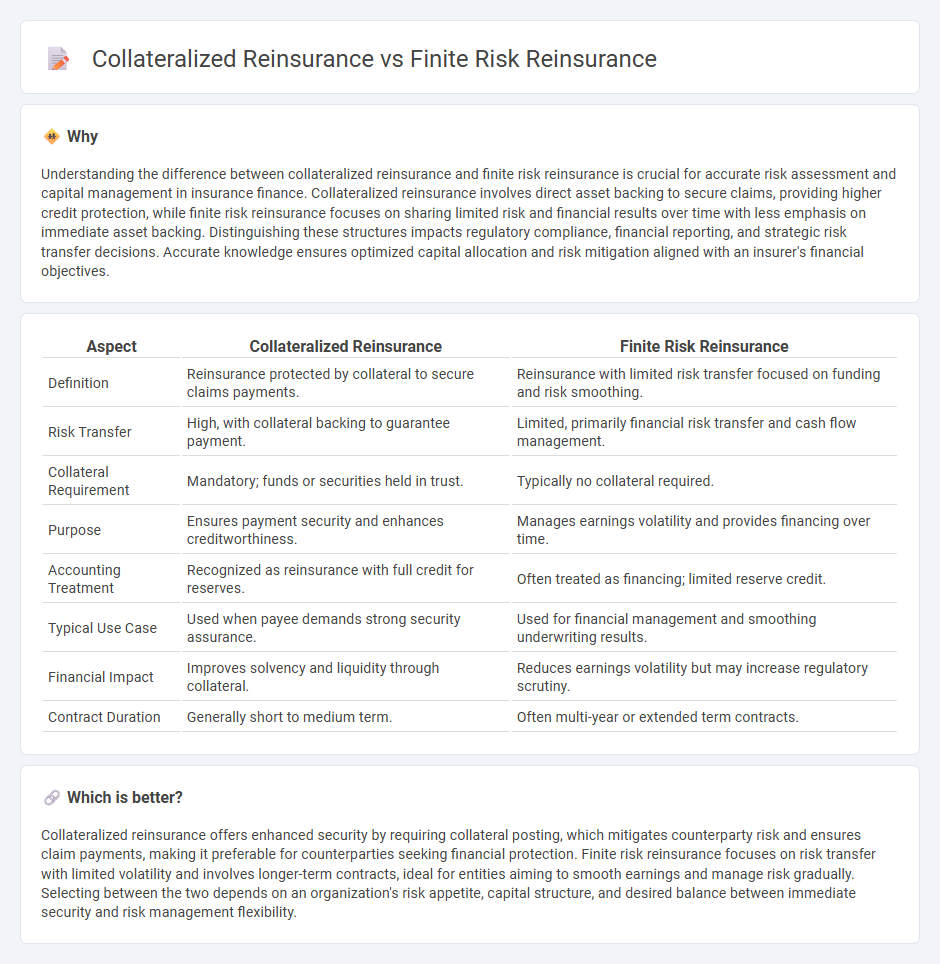

Understanding the difference between collateralized reinsurance and finite risk reinsurance is crucial for accurate risk assessment and capital management in insurance finance. Collateralized reinsurance involves direct asset backing to secure claims, providing higher credit protection, while finite risk reinsurance focuses on sharing limited risk and financial results over time with less emphasis on immediate asset backing. Distinguishing these structures impacts regulatory compliance, financial reporting, and strategic risk transfer decisions. Accurate knowledge ensures optimized capital allocation and risk mitigation aligned with an insurer's financial objectives.

Comparison Table

| Aspect | Collateralized Reinsurance | Finite Risk Reinsurance |

|---|---|---|

| Definition | Reinsurance protected by collateral to secure claims payments. | Reinsurance with limited risk transfer focused on funding and risk smoothing. |

| Risk Transfer | High, with collateral backing to guarantee payment. | Limited, primarily financial risk transfer and cash flow management. |

| Collateral Requirement | Mandatory; funds or securities held in trust. | Typically no collateral required. |

| Purpose | Ensures payment security and enhances creditworthiness. | Manages earnings volatility and provides financing over time. |

| Accounting Treatment | Recognized as reinsurance with full credit for reserves. | Often treated as financing; limited reserve credit. |

| Typical Use Case | Used when payee demands strong security assurance. | Used for financial management and smoothing underwriting results. |

| Financial Impact | Improves solvency and liquidity through collateral. | Reduces earnings volatility but may increase regulatory scrutiny. |

| Contract Duration | Generally short to medium term. | Often multi-year or extended term contracts. |

Which is better?

Collateralized reinsurance offers enhanced security by requiring collateral posting, which mitigates counterparty risk and ensures claim payments, making it preferable for counterparties seeking financial protection. Finite risk reinsurance focuses on risk transfer with limited volatility and involves longer-term contracts, ideal for entities aiming to smooth earnings and manage risk gradually. Selecting between the two depends on an organization's risk appetite, capital structure, and desired balance between immediate security and risk management flexibility.

Connection

Collateralized reinsurance and finite risk reinsurance are connected through their shared focus on risk transfer with enhanced financial security and cash flow management. Collateralized reinsurance involves posting collateral to secure obligations, reducing credit risk for the ceding insurer, while finite risk reinsurance limits risk exposure and smoothens earnings over time by integrating underwriting risk with financial considerations. Both structures optimize capital efficiency and stability for insurers by blending insurance protection with financial instruments.

Key Terms

Risk Transfer

Finite risk reinsurance involves limited risk transfer with predefined risk retention and typically includes profit-sharing clauses, whereas collateralized reinsurance fully secures the reinsurer's obligation with posted collateral, ensuring more transparent risk transfer. The degree of risk transfer in finite risk agreements is often scrutinized due to embedded risk-sharing features, while collateralized reinsurance provides clearer regulatory compliance through tangible asset backing. Explore detailed comparisons and regulatory impacts of these structures to deepen your understanding.

Collateralization

Collateralized reinsurance involves the reinsurer providing collateral--usually in the form of cash or securities--to secure their obligations, enhancing the ceding insurer's protection by ensuring claim payments irrespective of the reinsurer's financial condition. Finite risk reinsurance typically integrates risk transfer with financial elements like financing or risk-sharing, but does not usually require collateralization, making collateralized reinsurance a more secure option for minimizing counterparty credit risk. Explore comprehensive insights on how collateralization impacts risk mitigation and reinsurance agreements to optimize your risk management strategy.

Loss Retention

Finite risk reinsurance involves ceding some risk while retaining a significant portion of potential losses, often with predefined loss retention limits to control financial exposure. Collateralized reinsurance requires securing reinsured obligations with collateral, ensuring funds are available for loss payouts, thereby limiting the ceding company's credit risk but potentially altering loss retention dynamics. Explore deeper insights into how these structures impact loss retention strategies and risk management.

Source and External Links

Finite Risk Reinsurance | III - Insurance Information Institute - Finite risk reinsurance is a multi-year form of reinsurance that spreads risk over time, incorporating the time value of money and investment income, with limited risk transfer compared to traditional reinsurance.

Finite risk insurance - Wikipedia - Finite risk insurance is a multi-year alternative risk transfer product where the insurer bears limited underwriting and timing risk, often sharing profits with the insured and including retrospective rating features.

The Uses and Abuses of Finite Risk Reinsurance - Finite risk reinsurance typically involves limited risk transfer and helps companies manage timing, funding, and insurance risks by pre-funding expected losses with structured insurance products.

dowidth.com

dowidth.com