Finfluencers leverage social media platforms to simplify complex financial concepts and provide accessible investment advice to diverse audiences. Investment bankers focus on high-stakes financial services such as mergers, acquisitions, and capital raising for corporate clients. Discover more about the evolving roles shaping the finance industry today.

Why it is important

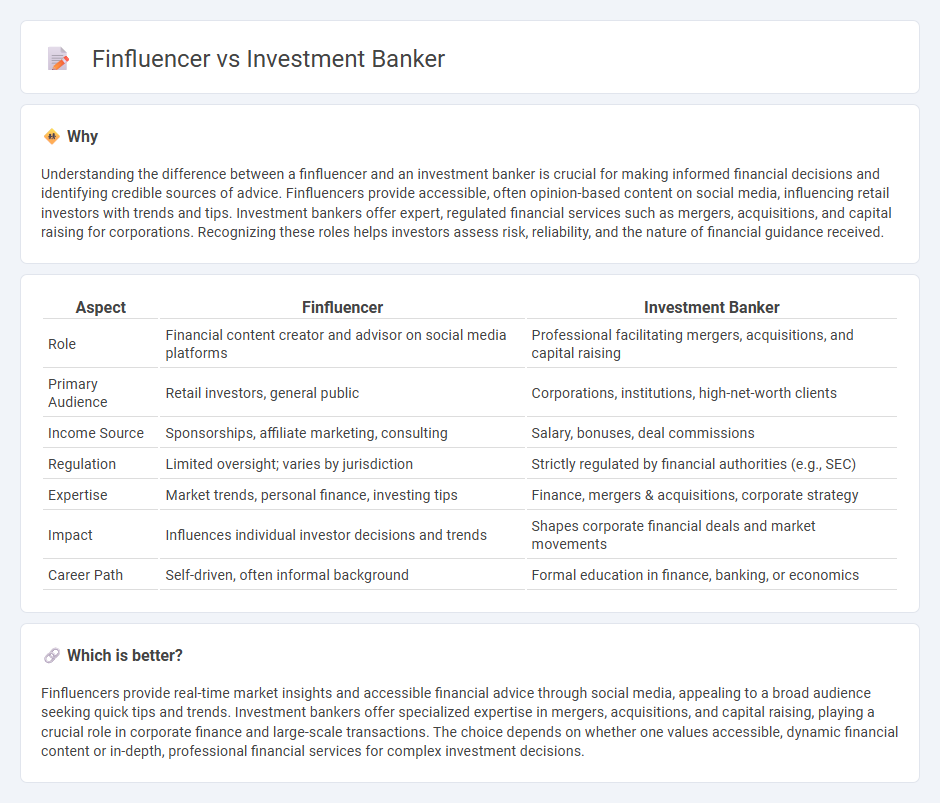

Understanding the difference between a finfluencer and an investment banker is crucial for making informed financial decisions and identifying credible sources of advice. Finfluencers provide accessible, often opinion-based content on social media, influencing retail investors with trends and tips. Investment bankers offer expert, regulated financial services such as mergers, acquisitions, and capital raising for corporations. Recognizing these roles helps investors assess risk, reliability, and the nature of financial guidance received.

Comparison Table

| Aspect | Finfluencer | Investment Banker |

|---|---|---|

| Role | Financial content creator and advisor on social media platforms | Professional facilitating mergers, acquisitions, and capital raising |

| Primary Audience | Retail investors, general public | Corporations, institutions, high-net-worth clients |

| Income Source | Sponsorships, affiliate marketing, consulting | Salary, bonuses, deal commissions |

| Regulation | Limited oversight; varies by jurisdiction | Strictly regulated by financial authorities (e.g., SEC) |

| Expertise | Market trends, personal finance, investing tips | Finance, mergers & acquisitions, corporate strategy |

| Impact | Influences individual investor decisions and trends | Shapes corporate financial deals and market movements |

| Career Path | Self-driven, often informal background | Formal education in finance, banking, or economics |

Which is better?

Finfluencers provide real-time market insights and accessible financial advice through social media, appealing to a broad audience seeking quick tips and trends. Investment bankers offer specialized expertise in mergers, acquisitions, and capital raising, playing a crucial role in corporate finance and large-scale transactions. The choice depends on whether one values accessible, dynamic financial content or in-depth, professional financial services for complex investment decisions.

Connection

Finfluencers leverage social media platforms to demystify complex financial concepts and influence individual investment decisions, often drawing upon insights similar to those used by investment bankers. Investment bankers analyze market trends, company valuations, and financial data to facilitate mergers, acquisitions, and capital raising, providing content that finfluencers may simplify for retail investors. Together, they shape public perception and participation in financial markets by sharing expertise and actionable investment strategies.

Key Terms

**Investment Banker:**

Investment bankers specialize in facilitating mergers, acquisitions, and capital raising for corporations, leveraging deep financial expertise and market knowledge. Their role involves structuring complex financial transactions and advising clients on strategic investment decisions to maximize value. Discover more about the distinct skills and impact of investment bankers in today's financial industry.

Underwriting

Investment bankers specialize in underwriting by assessing risk, pricing securities, and facilitating capital raising for corporations through initial public offerings (IPOs) and bond issuance. Finfluencers, on the other hand, provide educational content and market insights but do not engage directly in underwriting processes or regulatory compliance. Discover more about how underwriting impacts financial markets and the key roles played by investment bankers.

Mergers & Acquisitions (M&A)

Investment bankers specializing in Mergers & Acquisitions (M&A) provide expert advisory services on deal structuring, valuation, and negotiation to facilitate corporate transactions. Finfluencers, while influential in spreading financial trends and market insights on social media, typically lack the specialized legal and financial expertise essential for executing complex M&A deals. Discover how professional M&A guidance can maximize transaction success and mitigate risks.

Source and External Links

What is an Investment Banker? | CFA Institute - Investment bankers are financial professionals who support clients in capital raising, mergers and acquisitions, and various corporate finance services, often working in a demanding but well-compensated environment.

Investment banking - Wikipedia - Investment banking provides advisory financial services such as issuing securities and risk management for institutional investors, corporations, and governments, encompassing front, middle, and back office activities.

How to Become an Investment Banker | Investment Banking Education - Investment banking includes specializations like mergers and acquisitions, underwriting, trading, private equity, and corporate finance, each requiring specific skills and educational background.

dowidth.com

dowidth.com