Impact investing focuses on generating measurable social and environmental benefits alongside financial returns, targeting projects with explicit positive outcomes like renewable energy or affordable housing. Thematic investing concentrates on broader investment themes such as technology innovation, healthcare advancements, or climate change mitigation, aligning portfolios with long-term trends and economic shifts. Explore deeper insights into how these strategies differ and the unique opportunities they present.

Why it is important

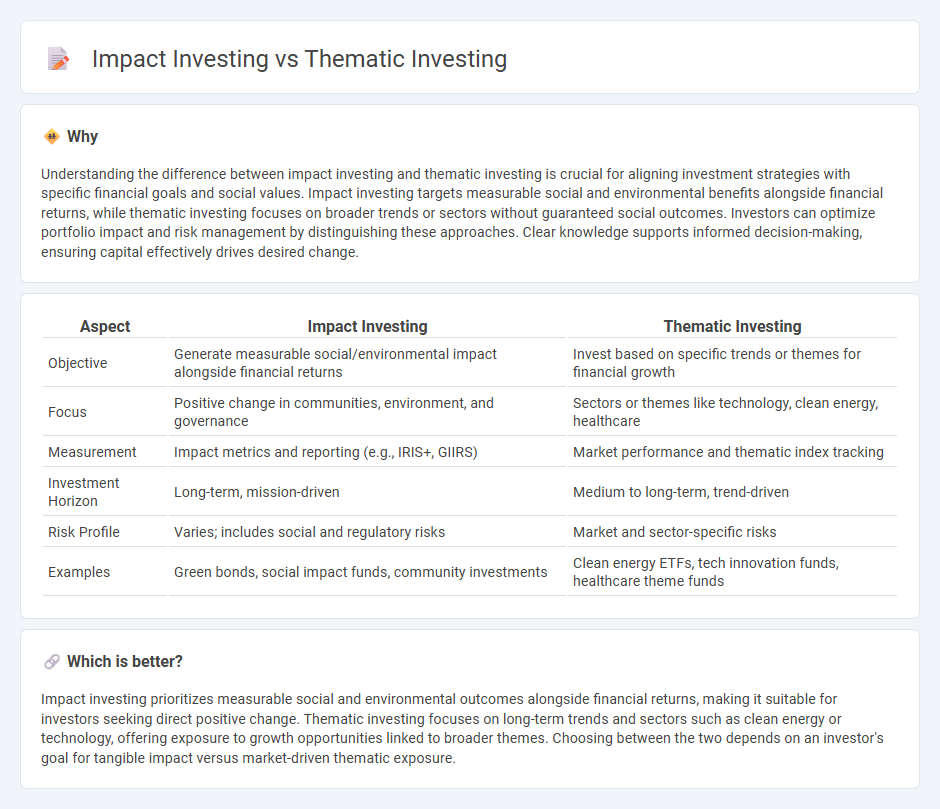

Understanding the difference between impact investing and thematic investing is crucial for aligning investment strategies with specific financial goals and social values. Impact investing targets measurable social and environmental benefits alongside financial returns, while thematic investing focuses on broader trends or sectors without guaranteed social outcomes. Investors can optimize portfolio impact and risk management by distinguishing these approaches. Clear knowledge supports informed decision-making, ensuring capital effectively drives desired change.

Comparison Table

| Aspect | Impact Investing | Thematic Investing |

|---|---|---|

| Objective | Generate measurable social/environmental impact alongside financial returns | Invest based on specific trends or themes for financial growth |

| Focus | Positive change in communities, environment, and governance | Sectors or themes like technology, clean energy, healthcare |

| Measurement | Impact metrics and reporting (e.g., IRIS+, GIIRS) | Market performance and thematic index tracking |

| Investment Horizon | Long-term, mission-driven | Medium to long-term, trend-driven |

| Risk Profile | Varies; includes social and regulatory risks | Market and sector-specific risks |

| Examples | Green bonds, social impact funds, community investments | Clean energy ETFs, tech innovation funds, healthcare theme funds |

Which is better?

Impact investing prioritizes measurable social and environmental outcomes alongside financial returns, making it suitable for investors seeking direct positive change. Thematic investing focuses on long-term trends and sectors such as clean energy or technology, offering exposure to growth opportunities linked to broader themes. Choosing between the two depends on an investor's goal for tangible impact versus market-driven thematic exposure.

Connection

Impact investing and thematic investing intersect by channeling capital toward specific social or environmental goals that align with investors' values. Impact investing focuses on generating measurable positive outcomes alongside financial returns, often targeting sectors like renewable energy or affordable housing. Thematic investing, by selecting trends such as clean technology or sustainable agriculture, inherently supports impact-driven objectives by concentrating investments on areas with potential long-term societal benefits.

Key Terms

Investment strategy

Thematic investing targets specific trends or sectors, such as technology or clean energy, to capitalize on growth opportunities aligned with long-term themes. Impact investing prioritizes measurable social or environmental outcomes alongside financial returns, often supporting projects in renewable energy, affordable housing, or education. Discover how these distinct investment strategies can align with your financial goals and values by exploring further insights.

Social/environmental outcomes

Thematic investing targets broad trends such as renewable energy and clean technology to capture growth opportunities aligned with social and environmental shifts. Impact investing prioritizes measurable social and environmental outcomes, directing capital to projects and companies demonstrating tangible positive effects in areas like affordable housing or carbon reduction. Explore deeper insights into how these investment strategies drive sustainable change and portfolio performance.

Performance measurement

Thematic investing targets long-term trends such as clean energy or technology, emphasizing financial returns driven by sector growth and innovation, while impact investing measures success through both financial performance and quantifiable social or environmental outcomes. Performance measurement in thematic investing relies heavily on market benchmarks and sector-specific indices, whereas impact investing requires metrics like the Impact Reporting and Investment Standards (IRIS) or the Global Impact Investing Network (GIIN) frameworks to gauge non-financial results. Explore more about how these approaches balance profitability and purpose for your investment strategy.

Source and External Links

What is Thematic Investing? - Thematic investing involves targeting broad ideas or trends that transcend traditional sectors by grouping relevant companies, allowing investors to align with values or emerging technologies such as AI, with investment products like ETFs or mutual funds built around these themes.

Thematic Investing: Tomorrow's themes, today - BlackRock - Thematic investing focuses on identifying persistent, evolving themes that influence equity market returns across sectors, leveraging data-driven approaches to capture market opportunities from trends shaping the future economy, with thematic funds growing substantially in assets over the past decade.

Thematic investing - Wikipedia - Thematic investing assembles portfolios around macro trends like demographic shifts or technological revolutions, investing in companies across various industries tied to the theme, although it is advised to apply rigorous methodology beyond marketing narratives when selecting funds.

dowidth.com

dowidth.com