Dark pool trading involves private exchanges where large blocks of securities are bought and sold without public order books, reducing market impact and price volatility. Over-the-counter (OTC) trading occurs directly between parties, often for less liquid assets or customized contracts, bypassing traditional exchanges and offering greater flexibility. Explore further to understand how each method influences market transparency and liquidity.

Why it is important

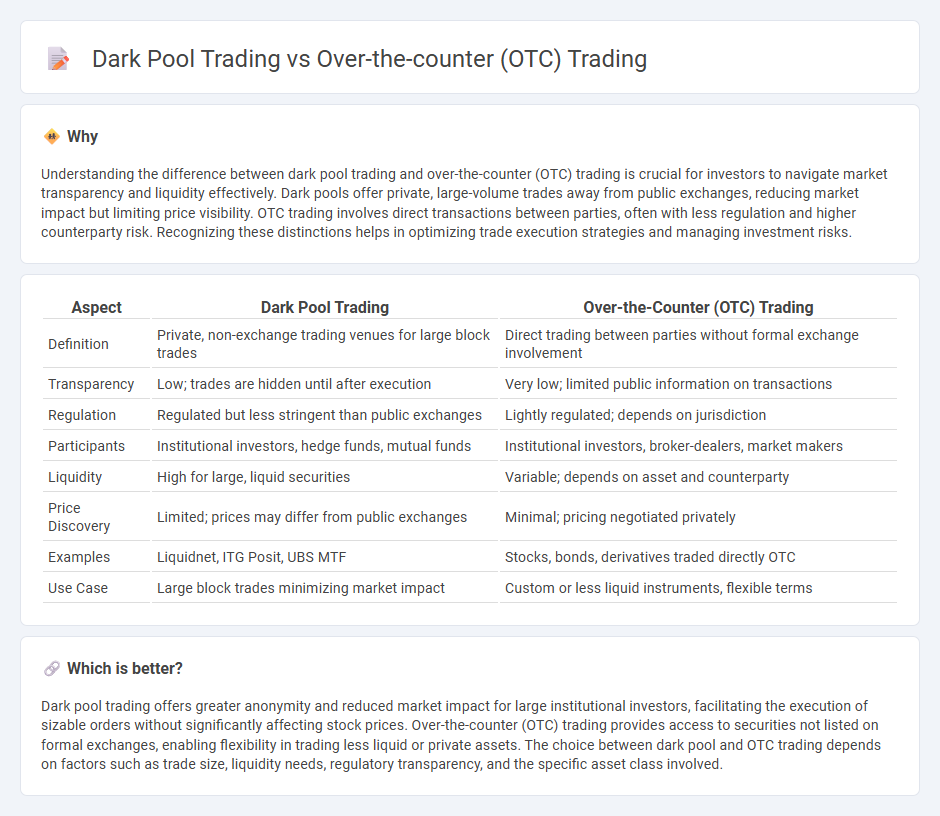

Understanding the difference between dark pool trading and over-the-counter (OTC) trading is crucial for investors to navigate market transparency and liquidity effectively. Dark pools offer private, large-volume trades away from public exchanges, reducing market impact but limiting price visibility. OTC trading involves direct transactions between parties, often with less regulation and higher counterparty risk. Recognizing these distinctions helps in optimizing trade execution strategies and managing investment risks.

Comparison Table

| Aspect | Dark Pool Trading | Over-the-Counter (OTC) Trading |

|---|---|---|

| Definition | Private, non-exchange trading venues for large block trades | Direct trading between parties without formal exchange involvement |

| Transparency | Low; trades are hidden until after execution | Very low; limited public information on transactions |

| Regulation | Regulated but less stringent than public exchanges | Lightly regulated; depends on jurisdiction |

| Participants | Institutional investors, hedge funds, mutual funds | Institutional investors, broker-dealers, market makers |

| Liquidity | High for large, liquid securities | Variable; depends on asset and counterparty |

| Price Discovery | Limited; prices may differ from public exchanges | Minimal; pricing negotiated privately |

| Examples | Liquidnet, ITG Posit, UBS MTF | Stocks, bonds, derivatives traded directly OTC |

| Use Case | Large block trades minimizing market impact | Custom or less liquid instruments, flexible terms |

Which is better?

Dark pool trading offers greater anonymity and reduced market impact for large institutional investors, facilitating the execution of sizable orders without significantly affecting stock prices. Over-the-counter (OTC) trading provides access to securities not listed on formal exchanges, enabling flexibility in trading less liquid or private assets. The choice between dark pool and OTC trading depends on factors such as trade size, liquidity needs, regulatory transparency, and the specific asset class involved.

Connection

Dark pool trading and over-the-counter (OTC) trading are connected through their roles in facilitating large, private transactions away from public stock exchanges. Both platforms enable institutional investors to trade substantial volumes with reduced market impact and enhanced confidentiality. These methods improve liquidity options and price efficiency for assets that might otherwise suffer from market volatility in traditional exchanges.

Key Terms

Transparency

Over-the-counter (OTC) trading offers varying levels of transparency depending on the broker and regulatory requirements, often revealing transaction details post-trade. Dark pool trading maintains low transparency, allowing large trades to be executed anonymously and away from public exchanges, minimizing market impact. Explore how each trading venue affects market transparency and investor confidence for deeper insights.

Liquidity

Over-the-counter (OTC) trading offers increased liquidity by allowing investors to directly trade securities without centralized exchanges, promoting flexible pricing and confidential transactions. Dark pool trading enhances liquidity for large institutional orders by enabling anonymous trades that minimize market impact and prevent price slippage. Explore more about how these trading venues affect liquidity dynamics in financial markets.

Counterparty

Over-the-counter (OTC) trading involves direct transactions between counterparties, often allowing for customized terms and greater flexibility, while dark pool trading occurs within private exchanges where counterparties trade large blocks of securities anonymously to minimize market impact. OTC counterparties typically engage in bilateral negotiations, increasing counterparty risk, whereas dark pools use sophisticated algorithms and intermediaries to match orders, reducing information leakage but maintaining a degree of counterparty anonymity. Explore deeper insights on how counterparty dynamics influence liquidity and price discovery in these distinct trading environments.

Source and External Links

What is OTC trading? How to trade securities over-the-counter - OTC trading is the buying and selling of financial instruments via decentralized networks, typically through a broker, outside of formal exchanges, allowing transactions between counterparties without a centralized exchange.

Over-the-Counter (OTC) - Understand How OTC Trading Works - OTC trading involves securities exchanges between two parties outside of formal exchanges, conducted in decentralized markets through dealer networks, offering greater flexibility but with less public price transparency and possible credit risk.

over-the-counter (OTC) securities - Law.Cornell.Edu - OTC securities are traded through decentralized broker-dealer networks rather than major exchanges, often involving companies that don't meet exchange listing requirements, providing flexible and accessible capital market options with potentially higher investor risks.

dowidth.com

dowidth.com