Risk parity portfolios allocate assets based on risk contribution, aiming to balance volatility across equities, bonds, and other asset classes for more stable returns. In contrast, the traditional 60/40 portfolio typically invests 60% in stocks and 40% in bonds, relying on fixed allocations that may expose investors to uneven risk levels. Explore the performance differences and risk management strategies to understand which approach aligns with your financial goals.

Why it is important

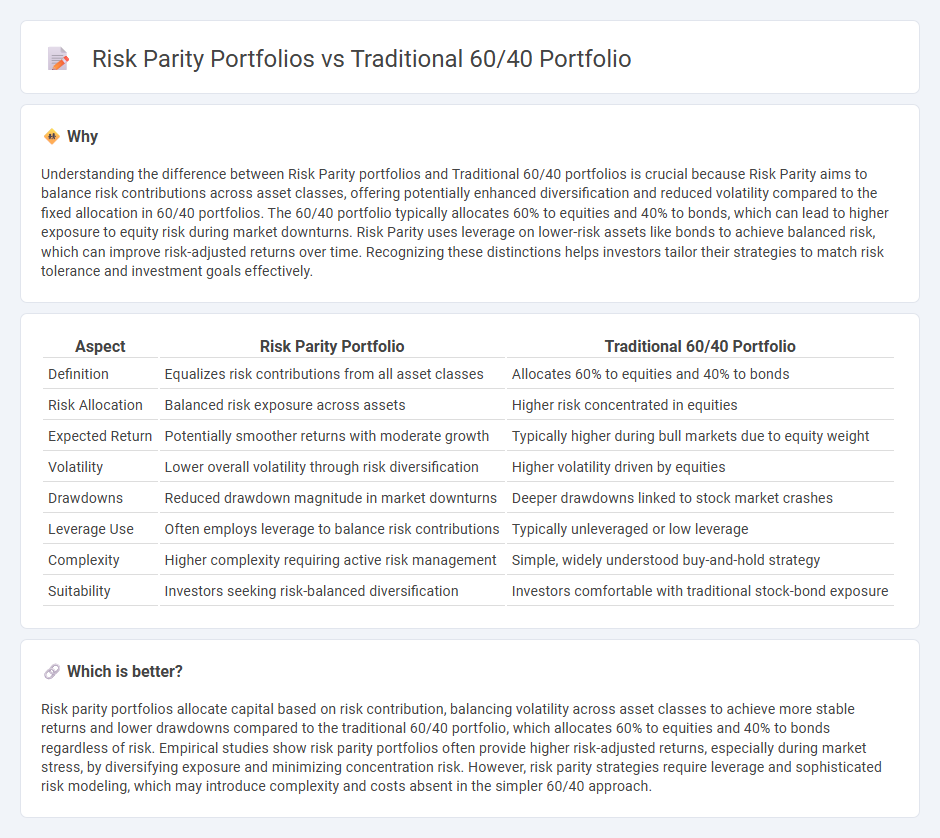

Understanding the difference between Risk Parity portfolios and Traditional 60/40 portfolios is crucial because Risk Parity aims to balance risk contributions across asset classes, offering potentially enhanced diversification and reduced volatility compared to the fixed allocation in 60/40 portfolios. The 60/40 portfolio typically allocates 60% to equities and 40% to bonds, which can lead to higher exposure to equity risk during market downturns. Risk Parity uses leverage on lower-risk assets like bonds to achieve balanced risk, which can improve risk-adjusted returns over time. Recognizing these distinctions helps investors tailor their strategies to match risk tolerance and investment goals effectively.

Comparison Table

| Aspect | Risk Parity Portfolio | Traditional 60/40 Portfolio |

|---|---|---|

| Definition | Equalizes risk contributions from all asset classes | Allocates 60% to equities and 40% to bonds |

| Risk Allocation | Balanced risk exposure across assets | Higher risk concentrated in equities |

| Expected Return | Potentially smoother returns with moderate growth | Typically higher during bull markets due to equity weight |

| Volatility | Lower overall volatility through risk diversification | Higher volatility driven by equities |

| Drawdowns | Reduced drawdown magnitude in market downturns | Deeper drawdowns linked to stock market crashes |

| Leverage Use | Often employs leverage to balance risk contributions | Typically unleveraged or low leverage |

| Complexity | Higher complexity requiring active risk management | Simple, widely understood buy-and-hold strategy |

| Suitability | Investors seeking risk-balanced diversification | Investors comfortable with traditional stock-bond exposure |

Which is better?

Risk parity portfolios allocate capital based on risk contribution, balancing volatility across asset classes to achieve more stable returns and lower drawdowns compared to the traditional 60/40 portfolio, which allocates 60% to equities and 40% to bonds regardless of risk. Empirical studies show risk parity portfolios often provide higher risk-adjusted returns, especially during market stress, by diversifying exposure and minimizing concentration risk. However, risk parity strategies require leverage and sophisticated risk modeling, which may introduce complexity and costs absent in the simpler 60/40 approach.

Connection

Risk parity portfolios and traditional 60/40 portfolios both aim to balance risk and return but differ in asset allocation strategies. While the 60/40 portfolio allocates 60% to equities and 40% to bonds, risk parity portfolios adjust asset weights to equalize risk contributions, often increasing bond exposure with leverage to achieve diversification. This connection highlights a shift from fixed capital allocation to risk-based balancing, enhancing portfolio robustness across varying market conditions.

Key Terms

Asset Allocation

The traditional 60/40 portfolio allocates 60% to equities and 40% to bonds, aiming for growth and income with moderate risk. Risk parity portfolios balance risk exposure by weighting assets based on volatility rather than fixed percentages, resulting in more stable returns across different market conditions. Explore how asset allocation strategies impact portfolio performance and risk management for more insights.

Leverage

Traditional 60/40 portfolios typically allocate 60% to equities and 40% to bonds without employing leverage, resulting in straightforward risk exposure but potential underperformance during market volatility. Risk parity portfolios use leverage to equalize risk contributions across asset classes, adjusting allocations to achieve balanced portfolio volatility and enhance diversification benefits. Explore detailed comparisons of leverage impacts on portfolio performance and risk management strategies to optimize investment outcomes.

Volatility Allocation

Traditional 60/40 portfolios allocate 60% to equities and 40% to bonds, emphasizing fixed capital distribution regardless of volatility differences. Risk parity portfolios allocate assets based on volatility, aiming to equalize risk contribution from each asset class to enhance diversification and reduce portfolio variance. Explore the benefits and implications of volatility-based allocation strategies for more balanced investment outcomes.

Source and External Links

Classic 60-40 Portfolio - The traditional 60/40 portfolio, popularized by John Bogle, allocates 60% to large-cap blend U.S. stocks and 40% to intermediate-term bonds, aiming for growth with reduced volatility through simplicity and low-cost index funds.

The global 60/40 portfolio: Steady as it goes - Vanguard - The 60/40 portfolio, globally diversified with 60% stocks and 40% bonds, has historically provided steady long-term returns and risk moderation despite occasional downturns, making it suitable for investors with moderate risk tolerance.

It's Time to Rethink the "40" in the 60/40 Portfolio | Simplify - While the classic 60/40 portfolio has delivered broad market exposure and risk balance, recent trends suggest incorporating alternative investments could enhance returns and diversification beyond traditional bonds.

dowidth.com

dowidth.com