Regenerative finance focuses on sustainable economic models that prioritize environmental health, social equity, and long-term value creation by reinvesting profits into impactful projects. Decentralized finance leverages blockchain technology to create transparent, permissionless financial systems that eliminate intermediaries and enhance accessibility. Explore how these innovative frameworks are reshaping the future of finance.

Why it is important

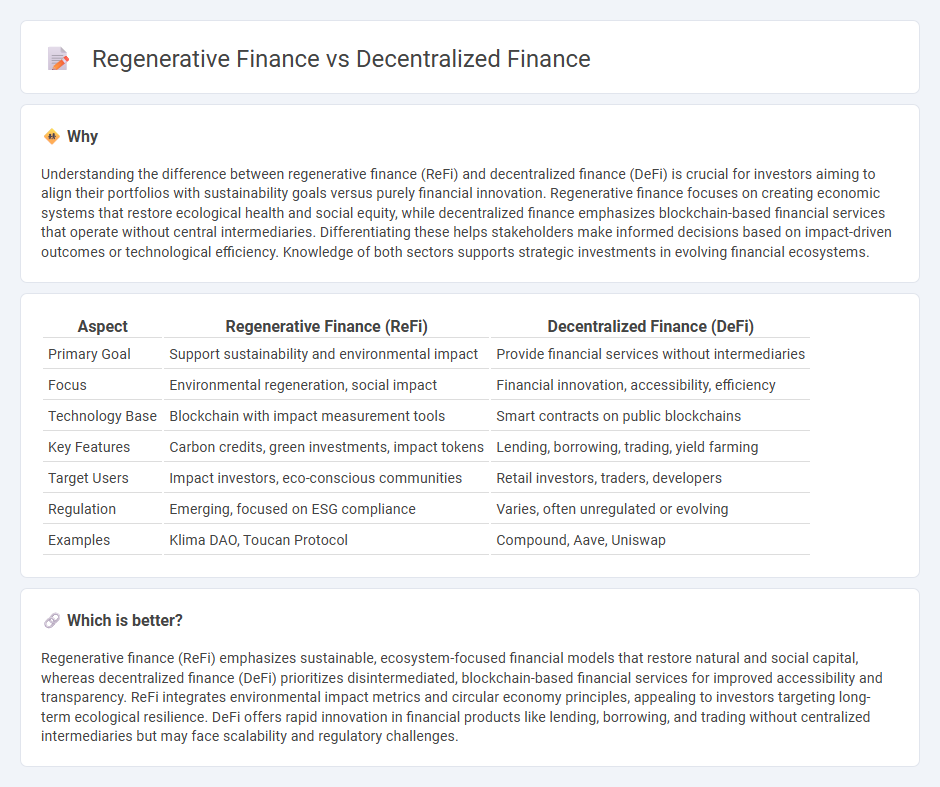

Understanding the difference between regenerative finance (ReFi) and decentralized finance (DeFi) is crucial for investors aiming to align their portfolios with sustainability goals versus purely financial innovation. Regenerative finance focuses on creating economic systems that restore ecological health and social equity, while decentralized finance emphasizes blockchain-based financial services that operate without central intermediaries. Differentiating these helps stakeholders make informed decisions based on impact-driven outcomes or technological efficiency. Knowledge of both sectors supports strategic investments in evolving financial ecosystems.

Comparison Table

| Aspect | Regenerative Finance (ReFi) | Decentralized Finance (DeFi) |

|---|---|---|

| Primary Goal | Support sustainability and environmental impact | Provide financial services without intermediaries |

| Focus | Environmental regeneration, social impact | Financial innovation, accessibility, efficiency |

| Technology Base | Blockchain with impact measurement tools | Smart contracts on public blockchains |

| Key Features | Carbon credits, green investments, impact tokens | Lending, borrowing, trading, yield farming |

| Target Users | Impact investors, eco-conscious communities | Retail investors, traders, developers |

| Regulation | Emerging, focused on ESG compliance | Varies, often unregulated or evolving |

| Examples | Klima DAO, Toucan Protocol | Compound, Aave, Uniswap |

Which is better?

Regenerative finance (ReFi) emphasizes sustainable, ecosystem-focused financial models that restore natural and social capital, whereas decentralized finance (DeFi) prioritizes disintermediated, blockchain-based financial services for improved accessibility and transparency. ReFi integrates environmental impact metrics and circular economy principles, appealing to investors targeting long-term ecological resilience. DeFi offers rapid innovation in financial products like lending, borrowing, and trading without centralized intermediaries but may face scalability and regulatory challenges.

Connection

Regenerative finance (ReFi) leverages decentralized finance (DeFi) protocols to create transparent, community-driven economic models that prioritize sustainability and social impact. DeFi platforms enable ReFi projects to tokenize environmental assets and facilitate peer-to-peer transactions without intermediaries, enhancing trust and efficiency. The integration of blockchain technology ensures immutable records and programmable smart contracts, which are essential for validating regenerative outcomes and distributing rewards in ReFi systems.

Key Terms

Smart Contracts

Smart contracts automate and enforce decentralized finance (DeFi) transactions, enhancing transparency and security across blockchain platforms. Regenerative finance (ReFi) leverages smart contracts to promote sustainable and ethical investment practices by embedding environmental and social impact metrics directly into financial agreements. Explore how smart contracts revolutionize these financial systems and drive the future of ethical investing.

Tokenization

Decentralized finance (DeFi) leverages blockchain technology to enable peer-to-peer financial transactions without intermediaries, emphasizing tokenization for creating digital assets and liquidity pools. Regenerative finance (ReFi) builds on this foundation by integrating social and environmental impact into tokenized assets, promoting sustainable investments and circular economic models. Explore how tokenization bridges DeFi and ReFi to transform financial ecosystems and drive positive change.

Yield Farming

Decentralized finance (DeFi) leverages blockchain technology to enable yield farming, where users earn returns by staking or lending cryptocurrencies in a permissionless ecosystem. Regenerative finance (ReFi) integrates yield farming principles with sustainable practices, focusing on environmental impact and social equity through token incentives that support regenerative projects. Explore the differences in yield farming approaches to understand how DeFi and ReFi are shaping the future of finance.

Source and External Links

Decentralized finance - Decentralized finance (DeFi) uses smart contracts on permissionless blockchains to provide financial services like lending, borrowing, trading, and insurance without intermediaries, though it carries risks such as coding errors and hacks.

The Technology of Decentralized Finance (DeFi) - DeFi leverages distributed ledger technology to enable financial services such as lending and trading through smart contracts, removing traditional centralized intermediaries and creating a new composable financial ecosystem.

What is DeFi? - DeFi is a global, peer-to-peer financial system on public blockchains like Ethereum that allows users to access banking-like services such as earning interest, borrowing, and trading assets without paperwork or third parties, offering openness, transparency, and flexibility.

dowidth.com

dowidth.com