Inflation swaps and forward rate agreements are key financial derivatives used for managing interest rate and inflation risks, with inflation swaps allowing parties to exchange fixed payments for payments linked to inflation indices, while forward rate agreements set the interest rate to be paid or received on a future date. Both instruments help institutions hedge against market volatility but differ in structure and underlying exposures. Explore deeper to understand their distinct applications and benefits in modern finance.

Why it is important

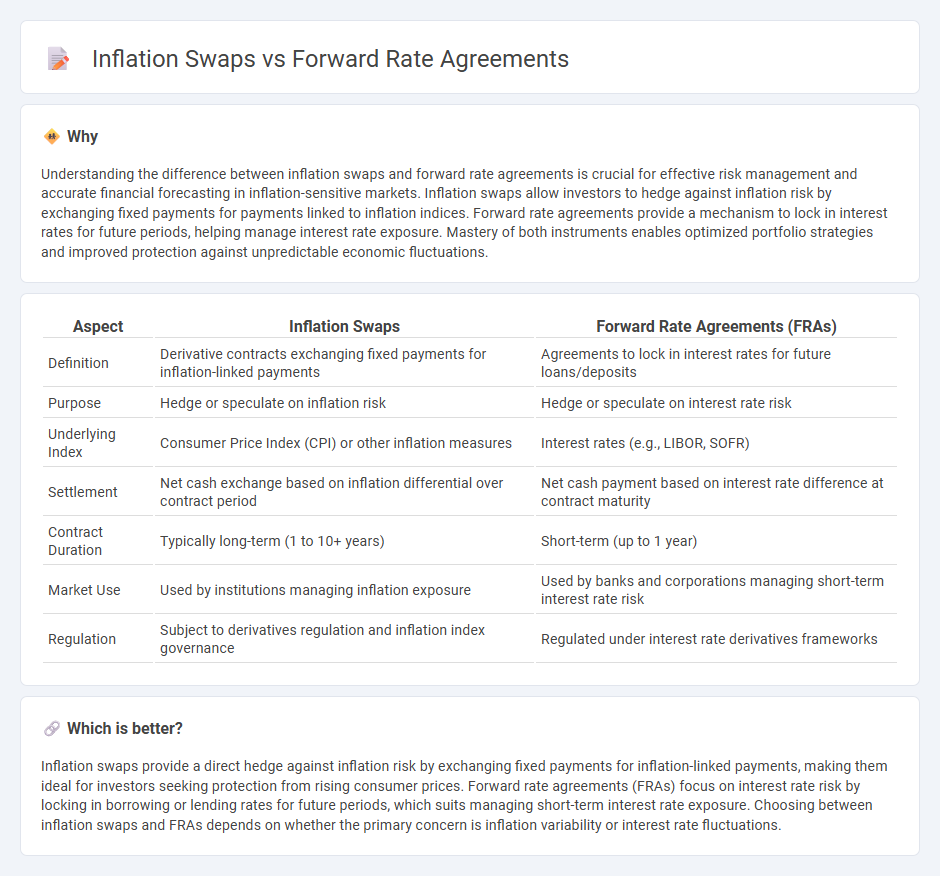

Understanding the difference between inflation swaps and forward rate agreements is crucial for effective risk management and accurate financial forecasting in inflation-sensitive markets. Inflation swaps allow investors to hedge against inflation risk by exchanging fixed payments for payments linked to inflation indices. Forward rate agreements provide a mechanism to lock in interest rates for future periods, helping manage interest rate exposure. Mastery of both instruments enables optimized portfolio strategies and improved protection against unpredictable economic fluctuations.

Comparison Table

| Aspect | Inflation Swaps | Forward Rate Agreements (FRAs) |

|---|---|---|

| Definition | Derivative contracts exchanging fixed payments for inflation-linked payments | Agreements to lock in interest rates for future loans/deposits |

| Purpose | Hedge or speculate on inflation risk | Hedge or speculate on interest rate risk |

| Underlying Index | Consumer Price Index (CPI) or other inflation measures | Interest rates (e.g., LIBOR, SOFR) |

| Settlement | Net cash exchange based on inflation differential over contract period | Net cash payment based on interest rate difference at contract maturity |

| Contract Duration | Typically long-term (1 to 10+ years) | Short-term (up to 1 year) |

| Market Use | Used by institutions managing inflation exposure | Used by banks and corporations managing short-term interest rate risk |

| Regulation | Subject to derivatives regulation and inflation index governance | Regulated under interest rate derivatives frameworks |

Which is better?

Inflation swaps provide a direct hedge against inflation risk by exchanging fixed payments for inflation-linked payments, making them ideal for investors seeking protection from rising consumer prices. Forward rate agreements (FRAs) focus on interest rate risk by locking in borrowing or lending rates for future periods, which suits managing short-term interest rate exposure. Choosing between inflation swaps and FRAs depends on whether the primary concern is inflation variability or interest rate fluctuations.

Connection

Inflation swaps and forward rate agreements (FRAs) are connected through their use in managing interest rate and inflation risk within financial markets. Inflation swaps allow counterparties to exchange fixed payments for payments linked to actual inflation, while FRAs enable locking in future interest rates for a specified period. Both derivatives serve as tools for hedging exposure to interest rate fluctuations, with inflation swaps focusing on inflation indexing and FRAs on short-term interest rate expectations.

Key Terms

Interest Rate

Forward rate agreements (FRAs) are contracts that lock in an interest rate for a future period, helping manage exposure to fluctuations in short-term interest rates. Inflation swaps exchange fixed interest payments for floating payments linked to an inflation index, allowing investors to hedge against inflation risk rather than pure interest rate risk. Explore the detailed differences and applications of FRAs and inflation swaps to optimize your interest rate risk management strategies.

Notional Amount

Forward Rate Agreements (FRAs) typically involve a fixed notional amount agreed upon between counterparties to hedge interest rate exposure over a short period, usually from one to six months. Inflation swaps, on the other hand, often feature larger and more variable notional amounts tied to underlying inflation indices, reflecting longer-term inflation risk management strategies. Explore the differences in notional structures to better understand their application and risk profiles.

Inflation Index

Forward rate agreements (FRAs) are interest rate derivatives used to lock in borrowing costs, referencing predetermined interest rates without direct linkage to inflation indices. Inflation swaps, on the other hand, specifically involve exchanging fixed payments for payments linked to a recognized inflation index, such as the Consumer Price Index (CPI), providing protection against inflation risk. Explore the detailed mechanics and applications of inflation indices in these instruments to enhance your risk management strategies.

Source and External Links

Forward rate agreement - Wikipedia - A Forward Rate Agreement (FRA) is an interest rate derivative contract between two parties that fixes an interest rate for a specified future period, settled by cash difference based on a reference interest rate like LIBOR, without exchanging principal.

Forward Rate Agreements - ANZ - An FRA is an agreement to exchange payments based on interest rate differences for a notional amount, useful for hedging short-term interest rate exposure by locking in a future interest rate for a given period.

Forward Rate Agreements -- Econ 236 2016.03.28 documentation - FRAs allow parties to fix borrowing or lending interest rates for a future period on a principal amount, with payment based on the difference between agreed and actual benchmark rates like LIBOR, settled at the start of the period.

dowidth.com

dowidth.com