Altcoin staking involves locking up cryptocurrency tokens to support blockchain network operations, earning rewards in the form of additional tokens. NFT staking allows holders to lock their non-fungible tokens to gain passive income or access exclusive benefits within decentralized finance ecosystems. Explore the differences and potential returns of altcoin staking versus NFT staking to optimize your digital asset strategy.

Why it is important

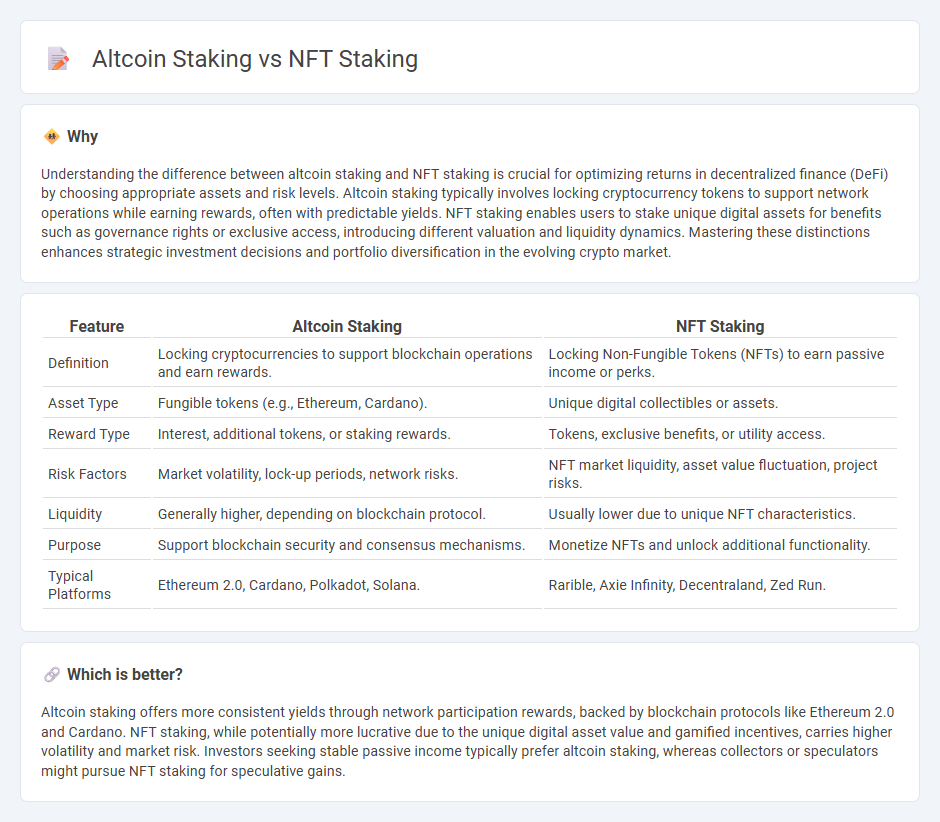

Understanding the difference between altcoin staking and NFT staking is crucial for optimizing returns in decentralized finance (DeFi) by choosing appropriate assets and risk levels. Altcoin staking typically involves locking cryptocurrency tokens to support network operations while earning rewards, often with predictable yields. NFT staking enables users to stake unique digital assets for benefits such as governance rights or exclusive access, introducing different valuation and liquidity dynamics. Mastering these distinctions enhances strategic investment decisions and portfolio diversification in the evolving crypto market.

Comparison Table

| Feature | Altcoin Staking | NFT Staking |

|---|---|---|

| Definition | Locking cryptocurrencies to support blockchain operations and earn rewards. | Locking Non-Fungible Tokens (NFTs) to earn passive income or perks. |

| Asset Type | Fungible tokens (e.g., Ethereum, Cardano). | Unique digital collectibles or assets. |

| Reward Type | Interest, additional tokens, or staking rewards. | Tokens, exclusive benefits, or utility access. |

| Risk Factors | Market volatility, lock-up periods, network risks. | NFT market liquidity, asset value fluctuation, project risks. |

| Liquidity | Generally higher, depending on blockchain protocol. | Usually lower due to unique NFT characteristics. |

| Purpose | Support blockchain security and consensus mechanisms. | Monetize NFTs and unlock additional functionality. |

| Typical Platforms | Ethereum 2.0, Cardano, Polkadot, Solana. | Rarible, Axie Infinity, Decentraland, Zed Run. |

Which is better?

Altcoin staking offers more consistent yields through network participation rewards, backed by blockchain protocols like Ethereum 2.0 and Cardano. NFT staking, while potentially more lucrative due to the unique digital asset value and gamified incentives, carries higher volatility and market risk. Investors seeking stable passive income typically prefer altcoin staking, whereas collectors or speculators might pursue NFT staking for speculative gains.

Connection

Altcoin staking and NFT staking both leverage blockchain technology to generate passive income by locking digital assets in decentralized networks. Altcoin staking involves validating transactions and securing proof-of-stake blockchains, earning rewards in the form of native tokens. NFT staking enables holders to lock unique digital collectibles to gain rewards or access exclusive services, intertwining asset ownership with earning potential in decentralized finance.

Key Terms

Yield

NFT staking offers variable yield based on the rarity and demand of the staked NFTs, whereas altcoin staking typically provides predictable interest rates tied to network inflation or transaction fees. Altcoin staking often supports blockchain security and governance, resulting in passive income through staking rewards, while NFT staking can unlock exclusive benefits like governance voting, marketplace perks, or enhanced user experiences. Explore the nuances of NFT and altcoin staking to optimize your yield strategies and boost portfolio returns.

Liquidity

NFT staking typically offers lower liquidity compared to altcoin staking due to the unique and illiquid nature of digital collectibles, which can take longer to sell or trade. Altcoin staking generally provides higher liquidity since staked tokens often remain part of the mainstream crypto markets with faster withdrawal and trading options. Explore the detailed differences between NFT staking and altcoin staking liquidity to optimize your digital asset strategy.

Smart Contracts

NFT staking leverages smart contracts to lock digital assets, enabling users to earn rewards based on NFT ownership and rarity, while altcoin staking primarily involves validating transactions on blockchain networks through delegated proof-of-stake or similar mechanisms. Smart contracts ensure transparency and automate reward distribution in both processes, but NFT staking uniquely ties incentives to digital collectibles' utility and market value. Explore the intricacies of smart contracts in NFT vs altcoin staking to optimize your blockchain investment strategy.

Source and External Links

How NFT Staking Works and Its Benefits - MetaLamp - NFT staking involves locking NFTs in smart contracts to earn rewards or privileges without selling them, helping stimulate long-term ownership and engagement by transferring NFTs to a staking smart contract and receiving rewards as specified by the contract.

What is NFT Staking and How Does It Work? - OSL - NFT staking lets users lock their NFTs in a smart contract for a specific period to earn cryptocurrency or token rewards, adding utility to NFTs beyond ownership and encouraging active participation in DeFi ecosystems.

What is NFT staking and how does it work? - Coinbase - NFT staking is a process where owners lock their digital assets on a platform via smart contracts to earn compensation without losing ownership, similar to yield farming in DeFi, requiring a compatible wallet and connection to a staking platform.

dowidth.com

dowidth.com