Liquidity staking enhances capital efficiency by allowing staked assets to remain liquid and tradable, while leveraged staking amplifies potential returns through borrowed funds but carries increased risk exposure. Both strategies aim to maximize yield in decentralized finance ecosystems by optimizing asset utilization and risk management. Explore the distinct advantages and risks of liquidity staking versus leveraged staking to better inform your investment decisions.

Why it is important

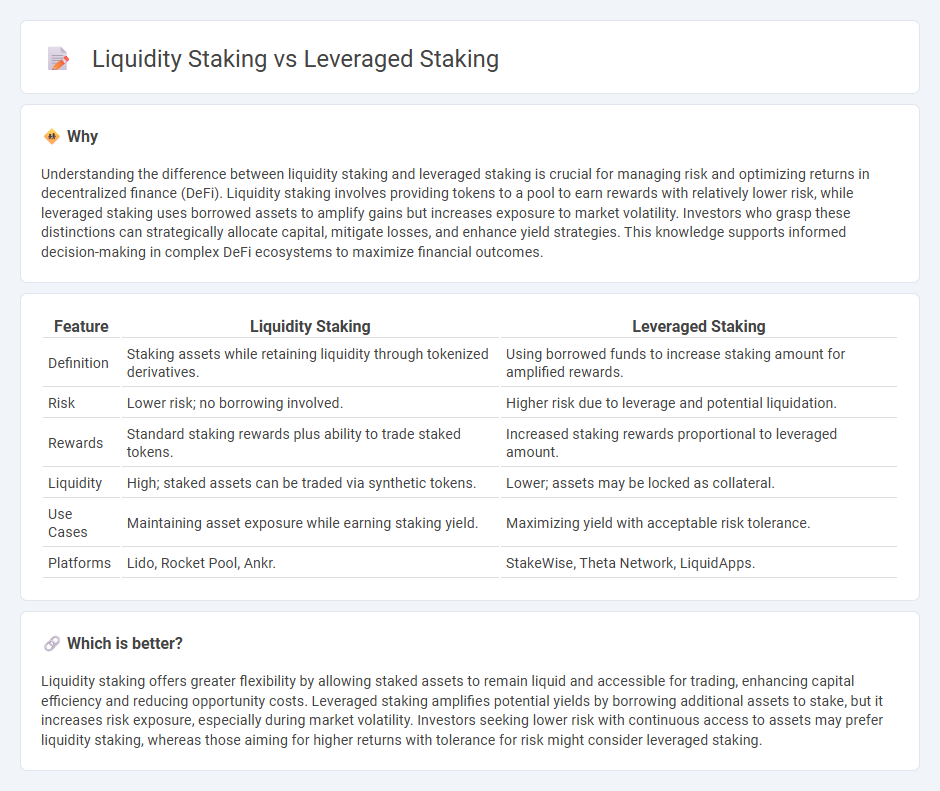

Understanding the difference between liquidity staking and leveraged staking is crucial for managing risk and optimizing returns in decentralized finance (DeFi). Liquidity staking involves providing tokens to a pool to earn rewards with relatively lower risk, while leveraged staking uses borrowed assets to amplify gains but increases exposure to market volatility. Investors who grasp these distinctions can strategically allocate capital, mitigate losses, and enhance yield strategies. This knowledge supports informed decision-making in complex DeFi ecosystems to maximize financial outcomes.

Comparison Table

| Feature | Liquidity Staking | Leveraged Staking |

|---|---|---|

| Definition | Staking assets while retaining liquidity through tokenized derivatives. | Using borrowed funds to increase staking amount for amplified rewards. |

| Risk | Lower risk; no borrowing involved. | Higher risk due to leverage and potential liquidation. |

| Rewards | Standard staking rewards plus ability to trade staked tokens. | Increased staking rewards proportional to leveraged amount. |

| Liquidity | High; staked assets can be traded via synthetic tokens. | Lower; assets may be locked as collateral. |

| Use Cases | Maintaining asset exposure while earning staking yield. | Maximizing yield with acceptable risk tolerance. |

| Platforms | Lido, Rocket Pool, Ankr. | StakeWise, Theta Network, LiquidApps. |

Which is better?

Liquidity staking offers greater flexibility by allowing staked assets to remain liquid and accessible for trading, enhancing capital efficiency and reducing opportunity costs. Leveraged staking amplifies potential yields by borrowing additional assets to stake, but it increases risk exposure, especially during market volatility. Investors seeking lower risk with continuous access to assets may prefer liquidity staking, whereas those aiming for higher returns with tolerance for risk might consider leveraged staking.

Connection

Liquidity staking enhances capital efficiency by allowing staked assets to remain liquid and tradable as tokenized derivatives. Leveraged staking amplifies returns by borrowing additional assets against staked holdings to increase exposure. Both methods integrate to optimize yield generation while maintaining asset utility within decentralized finance ecosystems.

Key Terms

Collateral

Leveraged staking uses collateral to borrow assets, amplifying staking rewards while increasing risk exposure due to potential liquidation. Liquidity staking involves providing collateral in liquidity pools, earning staking rewards combined with trading fees, which enhances asset utilization but carries impermanent loss risk. Explore the nuances of collateral management in both staking methods to maximize your crypto strategy.

Yield

Leveraged staking amplifies yield by borrowing assets to increase the amount staked, resulting in higher potential rewards but also increased risk and fees. Liquidity staking provides yield by contributing assets to liquidity pools, earning fees and rewards proportional to pool share while maintaining asset liquidity. Explore detailed comparisons to optimize your staking strategy for maximum returns.

Impermanent Loss

Leveraged staking involves borrowing assets to amplify staking rewards, increasing exposure and potential returns, but also amplifying risks such as impermanent loss during market volatility. Liquidity staking typically involves providing assets to liquidity pools in decentralized finance (DeFi) platforms, where impermanent loss occurs due to price divergence between paired tokens, affecting overall profitability. Explore the detailed mechanisms behind impermanent loss in leveraged and liquidity staking strategies to optimize your crypto investments.

Source and External Links

Leveraged Liquid Staking | EVAA PROTOCOL - Leveraged staking involves borrowing cryptocurrency to increase staking capacity, using liquid staking tokens (LSTs) as collateral to amplify staking returns, although it introduces risks like price volatility and liquidation.

Leverage Staking with Liquid Staking Derivatives (LSDs) - Leveraged staking uses recursive loops of staking and borrowing to multiply the invested amount significantly, thereby amplifying returns but also increasing market risks such as cascading liquidations.

Understanding DeFi: What is Leveraged Staking? - Leveraged staking is a strategy of borrowing additional crypto to stake more, increasing potential earnings via looping mechanisms on platforms like Summer.fi, while carrying heightened risks from token price volatility.

dowidth.com

dowidth.com