Synthetic assets replicate the performance of underlying financial instruments using derivatives, offering investors exposure without direct ownership. Structured products are pre-packaged investment strategies combining multiple assets or derivatives to achieve specific risk-return objectives tailored to investors' needs. Explore the key differences and benefits of synthetic assets and structured products to enhance your financial strategy.

Why it is important

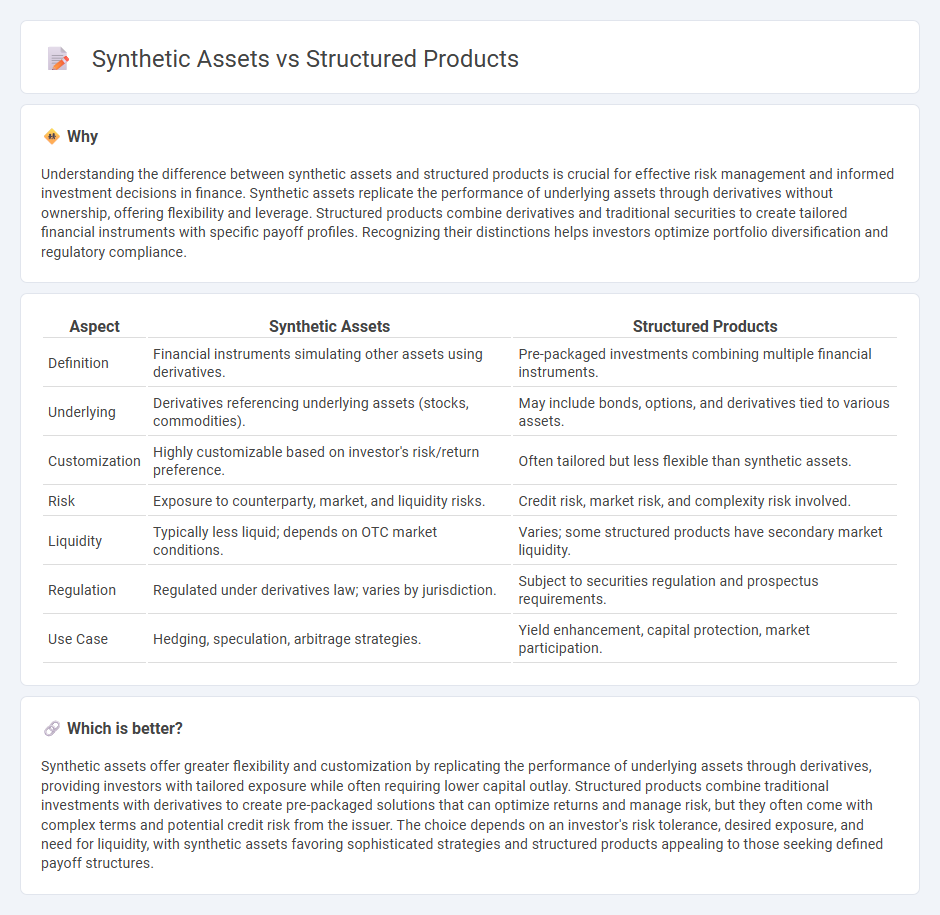

Understanding the difference between synthetic assets and structured products is crucial for effective risk management and informed investment decisions in finance. Synthetic assets replicate the performance of underlying assets through derivatives without ownership, offering flexibility and leverage. Structured products combine derivatives and traditional securities to create tailored financial instruments with specific payoff profiles. Recognizing their distinctions helps investors optimize portfolio diversification and regulatory compliance.

Comparison Table

| Aspect | Synthetic Assets | Structured Products |

|---|---|---|

| Definition | Financial instruments simulating other assets using derivatives. | Pre-packaged investments combining multiple financial instruments. |

| Underlying | Derivatives referencing underlying assets (stocks, commodities). | May include bonds, options, and derivatives tied to various assets. |

| Customization | Highly customizable based on investor's risk/return preference. | Often tailored but less flexible than synthetic assets. |

| Risk | Exposure to counterparty, market, and liquidity risks. | Credit risk, market risk, and complexity risk involved. |

| Liquidity | Typically less liquid; depends on OTC market conditions. | Varies; some structured products have secondary market liquidity. |

| Regulation | Regulated under derivatives law; varies by jurisdiction. | Subject to securities regulation and prospectus requirements. |

| Use Case | Hedging, speculation, arbitrage strategies. | Yield enhancement, capital protection, market participation. |

Which is better?

Synthetic assets offer greater flexibility and customization by replicating the performance of underlying assets through derivatives, providing investors with tailored exposure while often requiring lower capital outlay. Structured products combine traditional investments with derivatives to create pre-packaged solutions that can optimize returns and manage risk, but they often come with complex terms and potential credit risk from the issuer. The choice depends on an investor's risk tolerance, desired exposure, and need for liquidity, with synthetic assets favoring sophisticated strategies and structured products appealing to those seeking defined payoff structures.

Connection

Synthetic assets replicate the performance of underlying financial instruments using derivatives such as options, futures, or swaps. Structured products often incorporate synthetic assets to provide customized risk-return profiles tailored for specific investor needs. This connection allows for enhanced portfolio diversification and targeted exposure without direct ownership of the underlying assets.

Key Terms

Derivatives

Structured products are pre-packaged financial instruments combining derivatives like options and swaps to deliver tailored risk-return profiles. Synthetic assets replicate the performance of underlying securities through derivative contracts without owning the actual asset, enabling flexible exposure to market movements. Explore the advantages of each approach and their impact on portfolio diversification and risk management by learning more.

Underlying asset

Structured products are investment vehicles designed to provide customized exposure to underlying assets like equities, bonds, or indices through predefined payoffs. Synthetic assets replicate the economic exposure of underlying assets using derivatives such as options, swaps, or futures, without direct ownership. Explore the distinct advantages and risks associated with each approach to optimize your investment strategy.

Risk profile

Structured products offer tailored risk-return profiles by combining traditional financial instruments with derivatives, typically providing principal protection or capital guarantee depending on market conditions. Synthetic assets replicate the performance of underlying assets through derivatives like swaps or options but often entail higher counterparty and liquidity risks due to their complex nature. Explore detailed comparisons to understand how risk profiles vary and find the optimal investment strategy for your portfolio.

Source and External Links

Understanding Structured Products - Structured products are tailored investment packages combining bonds and underlying assets with pre-defined features, offering diversified portfolio solutions adapted to different market conditions and investor profiles.

Structured product - Structured products, or market-linked investments, are pre-packaged finance strategies based on securities or indices with various types like equity-linked or credit-linked notes, designed by specialists and contingent on underlying asset performance.

Understanding Structured Notes With Principal Protection - Structured notes combine bonds and derivatives to meet specific investment goals, sometimes offering principal protection but still carrying unique risks and complexity distinct from mutual funds or ETFs.

dowidth.com

dowidth.com