Dim sum bonds are yuan-denominated bonds issued outside China, primarily in the Hong Kong market, allowing foreign investors access to Chinese currency assets. Foreign bonds are debt securities issued by a foreign entity in the domestic market of another country, usually denominated in that country's currency, like Japan's samurai bonds or the U.S. Yankee bonds. Explore the distinctions and investment opportunities between dim sum bonds and foreign bonds to optimize your global portfolio strategy.

Why it is important

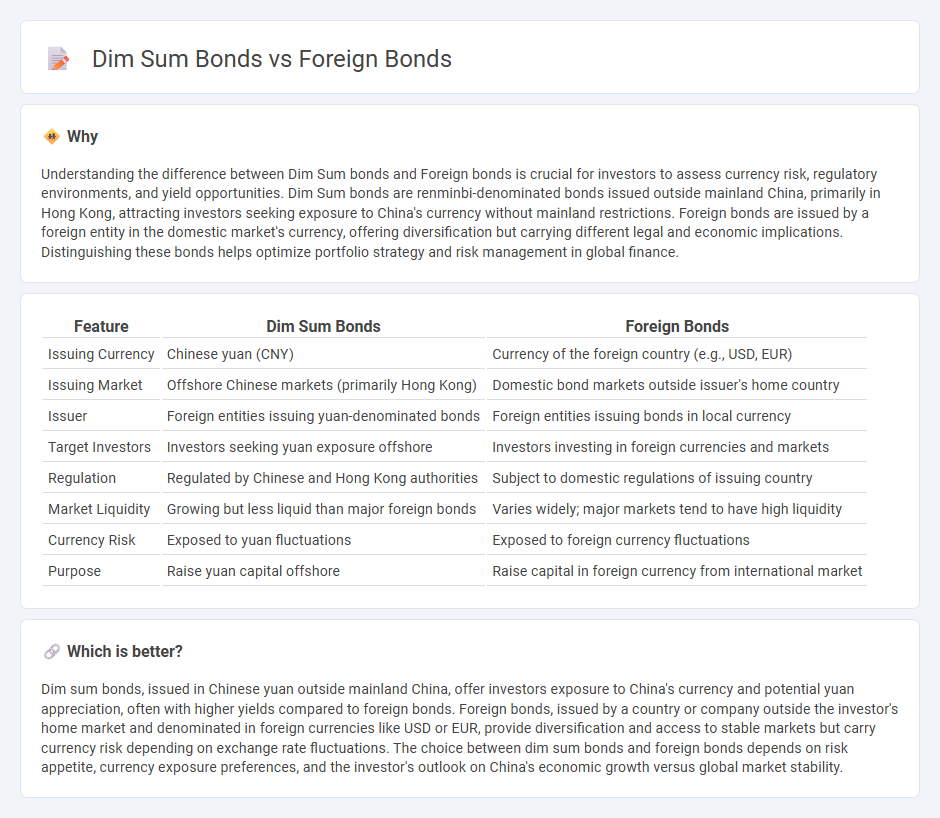

Understanding the difference between Dim Sum bonds and Foreign bonds is crucial for investors to assess currency risk, regulatory environments, and yield opportunities. Dim Sum bonds are renminbi-denominated bonds issued outside mainland China, primarily in Hong Kong, attracting investors seeking exposure to China's currency without mainland restrictions. Foreign bonds are issued by a foreign entity in the domestic market's currency, offering diversification but carrying different legal and economic implications. Distinguishing these bonds helps optimize portfolio strategy and risk management in global finance.

Comparison Table

| Feature | Dim Sum Bonds | Foreign Bonds |

|---|---|---|

| Issuing Currency | Chinese yuan (CNY) | Currency of the foreign country (e.g., USD, EUR) |

| Issuing Market | Offshore Chinese markets (primarily Hong Kong) | Domestic bond markets outside issuer's home country |

| Issuer | Foreign entities issuing yuan-denominated bonds | Foreign entities issuing bonds in local currency |

| Target Investors | Investors seeking yuan exposure offshore | Investors investing in foreign currencies and markets |

| Regulation | Regulated by Chinese and Hong Kong authorities | Subject to domestic regulations of issuing country |

| Market Liquidity | Growing but less liquid than major foreign bonds | Varies widely; major markets tend to have high liquidity |

| Currency Risk | Exposed to yuan fluctuations | Exposed to foreign currency fluctuations |

| Purpose | Raise yuan capital offshore | Raise capital in foreign currency from international market |

Which is better?

Dim sum bonds, issued in Chinese yuan outside mainland China, offer investors exposure to China's currency and potential yuan appreciation, often with higher yields compared to foreign bonds. Foreign bonds, issued by a country or company outside the investor's home market and denominated in foreign currencies like USD or EUR, provide diversification and access to stable markets but carry currency risk depending on exchange rate fluctuations. The choice between dim sum bonds and foreign bonds depends on risk appetite, currency exposure preferences, and the investor's outlook on China's economic growth versus global market stability.

Connection

Dim sum bonds and foreign bonds are connected through their role in international finance, as both are debt instruments issued by entities outside the local bond market to raise capital in foreign currencies. Dim sum bonds are specifically Chinese yuan-denominated bonds issued outside mainland China, primarily in Hong Kong, while foreign bonds refer more broadly to bonds issued by foreign entities in a domestic market's currency. Both types serve to diversify investor portfolios and provide issuers with access to international funding, facilitating cross-border capital flows.

Key Terms

Currency denomination

Foreign bonds are debt securities issued by a foreign entity and denominated in the currency of the country where they are issued, typically offering investors diversification and exposure to foreign markets. Dim sum bonds are offshore Chinese yuan-denominated bonds issued outside mainland China, mainly in Hong Kong, enabling investors to access Chinese currency exposure without direct mainland investment. Explore the distinct benefits and risks of each bond type to determine the best fit for your investment portfolio.

Issuance location

Foreign bonds are issued by foreign entities in the domestic market of another country, typically denominated in the issuer's home currency or the investor's local currency, such as Yankee bonds issued by foreign companies in the U.S. market. Dim sum bonds are Chinese yuan-denominated bonds issued outside mainland China, mainly in Hong Kong, targeting international investors and facilitating offshore RMB investment. Explore the key differences and strategic advantages of each bond type to understand their impact on global funding and currency exposure.

Regulatory environment

Foreign bonds are issued by a foreign entity in the domestic market of another country, subjecting them to the host country's stringent regulatory frameworks like the U.S. SEC regulations or Japan's FSA guidelines. Dim sum bonds are renminbi-denominated bonds issued in Hong Kong, regulated by the Hong Kong Monetary Authority, offering lighter restrictions compared to onshore mainland China bonds. Explore the regulatory nuances further to grasp their impact on risk and investment strategies.

Source and External Links

Foreign Bonds for Indian Investors: A Beginner's Guide - Foreign bonds are loans raised by a company or government from another country in the local currency of the where they are issued, allowing foreign issuers to raise capital and investors to diversify globally, but with risks like currency fluctuations and political instability.

International Bonds - Definition and Overview of Securities - Foreign bonds are issued in a domestic country by a foreign company using that country's currency and regulations, helping issuers reach more investors while offering classifications such as domestic, euro, and foreign bonds.

Foreign Currency Bonds - Taxable Bonds - Foreign currency bonds include various types like Yankee and Eurodollar bonds, and investors should be aware of risks including political instability, local market conditions, and legal enforceability in case of default.

dowidth.com

dowidth.com