Laddered bond ETFs offer a structured approach to fixed income investing by holding bonds with staggered maturities, enhancing liquidity and interest rate risk management. Municipal bond funds pool resources to invest in tax-exempt bonds issued by local governments, providing tax-efficient income for investors in higher tax brackets. Explore the benefits and risks of each investment vehicle to optimize your portfolio strategy.

Why it is important

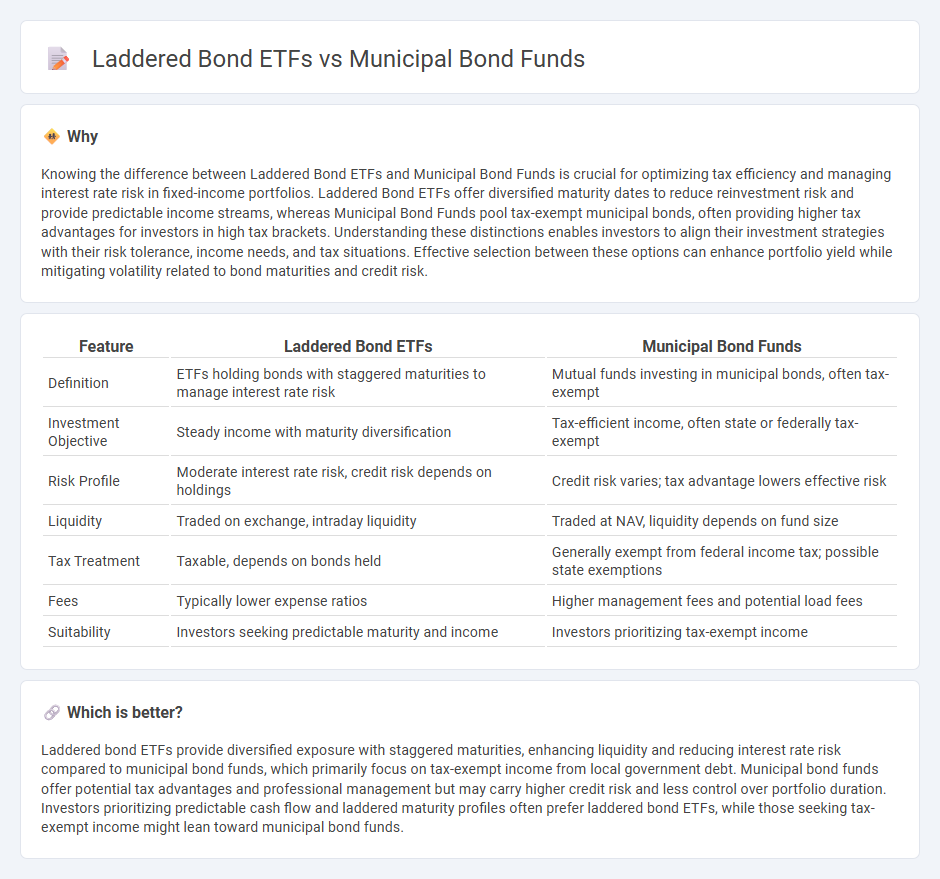

Knowing the difference between Laddered Bond ETFs and Municipal Bond Funds is crucial for optimizing tax efficiency and managing interest rate risk in fixed-income portfolios. Laddered Bond ETFs offer diversified maturity dates to reduce reinvestment risk and provide predictable income streams, whereas Municipal Bond Funds pool tax-exempt municipal bonds, often providing higher tax advantages for investors in high tax brackets. Understanding these distinctions enables investors to align their investment strategies with their risk tolerance, income needs, and tax situations. Effective selection between these options can enhance portfolio yield while mitigating volatility related to bond maturities and credit risk.

Comparison Table

| Feature | Laddered Bond ETFs | Municipal Bond Funds |

|---|---|---|

| Definition | ETFs holding bonds with staggered maturities to manage interest rate risk | Mutual funds investing in municipal bonds, often tax-exempt |

| Investment Objective | Steady income with maturity diversification | Tax-efficient income, often state or federally tax-exempt |

| Risk Profile | Moderate interest rate risk, credit risk depends on holdings | Credit risk varies; tax advantage lowers effective risk |

| Liquidity | Traded on exchange, intraday liquidity | Traded at NAV, liquidity depends on fund size |

| Tax Treatment | Taxable, depends on bonds held | Generally exempt from federal income tax; possible state exemptions |

| Fees | Typically lower expense ratios | Higher management fees and potential load fees |

| Suitability | Investors seeking predictable maturity and income | Investors prioritizing tax-exempt income |

Which is better?

Laddered bond ETFs provide diversified exposure with staggered maturities, enhancing liquidity and reducing interest rate risk compared to municipal bond funds, which primarily focus on tax-exempt income from local government debt. Municipal bond funds offer potential tax advantages and professional management but may carry higher credit risk and less control over portfolio duration. Investors prioritizing predictable cash flow and laddered maturity profiles often prefer laddered bond ETFs, while those seeking tax-exempt income might lean toward municipal bond funds.

Connection

Laddered bond ETFs and municipal bond funds both provide diversified fixed-income exposure by investing in bonds with staggered maturities to manage interest rate risk and ensure steady income streams. Laddered bond ETFs systematically spread bond maturities over time, closely aligning with the municipal bond funds' strategy of holding various tax-exempt bonds issued by local governments. This connection enhances portfolio stability and tax efficiency for investors seeking predictable, tax-advantaged income in the finance sector.

Key Terms

Credit Risk

Municipal bond funds primarily invest in a diversified portfolio of tax-exempt municipal securities with varying credit risks determined by the issuing entities, whereas laddered bond ETFs structure fixed-maturity bonds sequentially to mitigate interest rate risk but maintain exposure to credit risk based on individual bond ratings. Municipal bond funds may face higher credit risk concentration due to state or local government fiscal health, while laddered bond ETFs spread risk across multiple issuers, potentially lowering default probability. Explore detailed comparisons and credit risk metrics to optimize your bond investment strategy.

Yield Curve

Municipal bond funds typically offer diversified holdings that provide tax-advantaged income with varying maturities across the yield curve, optimizing risk and return. Laddered bond ETFs strategically spread investments across a series of maturities to manage interest rate risk while maintaining steady cash flows aligned with the yield curve. Explore how these structures impact your portfolio's income and risk profile to make informed investment decisions.

Liquidity

Municipal bond funds provide daily liquidity with the ability to redeem shares at net asset value, making them suitable for investors seeking flexible access to tax-exempt income. Laddered bond ETFs hold a series of bonds with staggered maturities, offering transparency and predictable cash flows but trade on exchanges with market prices fluctuating from net asset value. Explore the nuances of liquidity features in municipal bond funds versus laddered bond ETFs to optimize your fixed-income portfolio strategy.

Source and External Links

Thrivent Municipal Bond Fund - Class S & A - This fund invests in a nationally diversified portfolio of predominantly investment-grade municipal bonds issued by state or local governments to finance public projects, generally offering tax-exempt income and varying credit risk.

Nuveen High Yield Municipal Bond Fund - This fund targets non-investment-grade and unrated municipal bonds with longer maturities, aiming to provide a high level of tax-exempt income by seeking value in municipal bond market inefficiencies and using leverage strategically.

Municipal Bonds - Fidelity Investments - Municipal bonds are debt obligations issued by public entities to fund public projects, categorized mainly as general obligation bonds or revenue bonds, with varied tax treatments and credit profiles based on their structure and issuer.

dowidth.com

dowidth.com