Laddered bond ETFs offer a structured maturity schedule that helps manage interest rate risk while providing predictable income streams. Inflation-protected bond funds invest primarily in Treasury Inflation-Protected Securities (TIPS), aiming to preserve purchasing power by adjusting principal based on inflation rates. Explore detailed comparisons to determine which strategy aligns best with your investment goals.

Why it is important

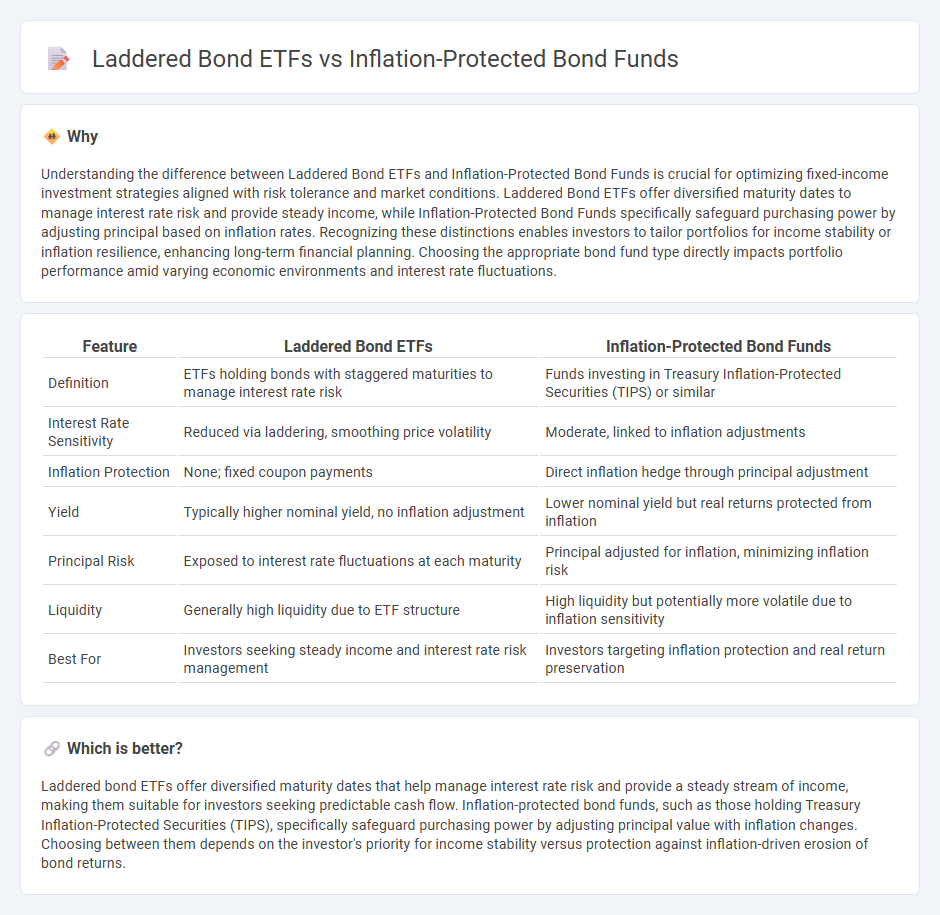

Understanding the difference between Laddered Bond ETFs and Inflation-Protected Bond Funds is crucial for optimizing fixed-income investment strategies aligned with risk tolerance and market conditions. Laddered Bond ETFs offer diversified maturity dates to manage interest rate risk and provide steady income, while Inflation-Protected Bond Funds specifically safeguard purchasing power by adjusting principal based on inflation rates. Recognizing these distinctions enables investors to tailor portfolios for income stability or inflation resilience, enhancing long-term financial planning. Choosing the appropriate bond fund type directly impacts portfolio performance amid varying economic environments and interest rate fluctuations.

Comparison Table

| Feature | Laddered Bond ETFs | Inflation-Protected Bond Funds |

|---|---|---|

| Definition | ETFs holding bonds with staggered maturities to manage interest rate risk | Funds investing in Treasury Inflation-Protected Securities (TIPS) or similar |

| Interest Rate Sensitivity | Reduced via laddering, smoothing price volatility | Moderate, linked to inflation adjustments |

| Inflation Protection | None; fixed coupon payments | Direct inflation hedge through principal adjustment |

| Yield | Typically higher nominal yield, no inflation adjustment | Lower nominal yield but real returns protected from inflation |

| Principal Risk | Exposed to interest rate fluctuations at each maturity | Principal adjusted for inflation, minimizing inflation risk |

| Liquidity | Generally high liquidity due to ETF structure | High liquidity but potentially more volatile due to inflation sensitivity |

| Best For | Investors seeking steady income and interest rate risk management | Investors targeting inflation protection and real return preservation |

Which is better?

Laddered bond ETFs offer diversified maturity dates that help manage interest rate risk and provide a steady stream of income, making them suitable for investors seeking predictable cash flow. Inflation-protected bond funds, such as those holding Treasury Inflation-Protected Securities (TIPS), specifically safeguard purchasing power by adjusting principal value with inflation changes. Choosing between them depends on the investor's priority for income stability versus protection against inflation-driven erosion of bond returns.

Connection

Laddered bond ETFs and inflation-protected bond funds both serve as strategies to manage interest rate risk and inflation exposure in fixed income portfolios. Laddered bond ETFs diversify maturity dates to reduce price volatility, while inflation-protected bond funds primarily invest in Treasury Inflation-Protected Securities (TIPS) to preserve purchasing power. Combining these approaches helps investors achieve a balanced income stream with protection against inflation erosion.

Key Terms

Inflation Risk

Inflation-protected bond funds primarily invest in Treasury Inflation-Protected Securities (TIPS) that adjust principal value with inflation, offering direct protection against rising consumer prices. Laddered bond ETFs diversify maturities across a fixed schedule, reducing reinvestment risk but providing limited inflation hedging since nominal bonds do not adjust for inflation. Explore detailed strategies to optimize fixed income portfolios in an inflationary environment.

Yield

Inflation-protected bond funds provide yields adjusted for inflation, safeguarding purchasing power and offering real return stability in volatile markets. Laddered bond ETFs, structured with staggered maturities, generate consistent income streams and reduce interest rate risk, appealing to yield-focused investors. Explore detailed comparisons to optimize your fixed-income portfolio strategy today.

Duration

Inflation-protected bond funds primarily invest in Treasury Inflation-Protected Securities (TIPS) to shield investors from rising inflation, typically maintaining shorter durations to reduce interest rate risk. Laddered bond ETFs strategically stagger maturities across bonds, optimizing duration to balance yield and interest rate sensitivity while enhancing liquidity. Explore detailed analyses to understand which strategy aligns with your investment horizon and risk tolerance.

Source and External Links

What is an inflation protected bond? - Inflation-protected bonds, such as those issued by national governments, adjust their principal and interest payments based on inflation, helping investors preserve purchasing power when inflation rises.

Inflation Protected Bond Fund (PRIPX) - T. Rowe Price - This mutual fund aims to offer inflation protection and income by investing primarily in inflation-protected debt securities.

Inflation-Protected Bonds ETFs - ETF Database - Inflation-protected bond ETFs provide diversified exposure to both U.S. and international inflation-linked debt, typically tracking indexes of these securities.

dowidth.com

dowidth.com