Yield farming leverages decentralized finance (DeFi) protocols to maximize returns by lending or staking cryptocurrency assets, often yielding high interest rates but carrying significant risk. Insurance in the DeFi space provides protection against smart contract failures, hacks, or market volatility, mitigating potential losses for investors. Discover how to balance yield opportunities with security measures to optimize your financial strategy.

Why it is important

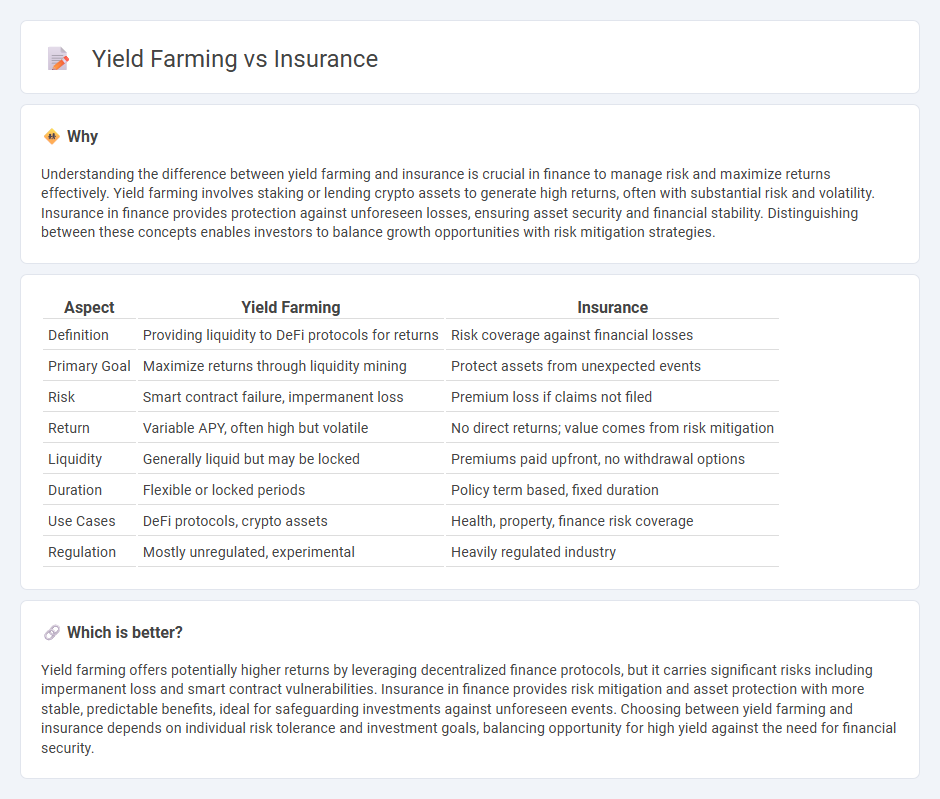

Understanding the difference between yield farming and insurance is crucial in finance to manage risk and maximize returns effectively. Yield farming involves staking or lending crypto assets to generate high returns, often with substantial risk and volatility. Insurance in finance provides protection against unforeseen losses, ensuring asset security and financial stability. Distinguishing between these concepts enables investors to balance growth opportunities with risk mitigation strategies.

Comparison Table

| Aspect | Yield Farming | Insurance |

|---|---|---|

| Definition | Providing liquidity to DeFi protocols for returns | Risk coverage against financial losses |

| Primary Goal | Maximize returns through liquidity mining | Protect assets from unexpected events |

| Risk | Smart contract failure, impermanent loss | Premium loss if claims not filed |

| Return | Variable APY, often high but volatile | No direct returns; value comes from risk mitigation |

| Liquidity | Generally liquid but may be locked | Premiums paid upfront, no withdrawal options |

| Duration | Flexible or locked periods | Policy term based, fixed duration |

| Use Cases | DeFi protocols, crypto assets | Health, property, finance risk coverage |

| Regulation | Mostly unregulated, experimental | Heavily regulated industry |

Which is better?

Yield farming offers potentially higher returns by leveraging decentralized finance protocols, but it carries significant risks including impermanent loss and smart contract vulnerabilities. Insurance in finance provides risk mitigation and asset protection with more stable, predictable benefits, ideal for safeguarding investments against unforeseen events. Choosing between yield farming and insurance depends on individual risk tolerance and investment goals, balancing opportunity for high yield against the need for financial security.

Connection

Yield farming involves users locking cryptocurrencies in DeFi protocols to earn returns, exposing them to risks like smart contract failures and market volatility. Insurance in yield farming provides risk mitigation by offering coverage against potential losses due to these vulnerabilities, enhancing user confidence in decentralized finance. This synergy between yield farming and insurance promotes a more secure and sustainable DeFi ecosystem.

Key Terms

Risk Management

Insurance provides risk management by offering financial protection against specific losses, ensuring stability for asset holders through claim compensation. Yield farming involves risk management through diversification and careful protocol selection to mitigate smart contract vulnerabilities and market volatility. Explore deeper insights into balancing insurance mechanisms with yield farming strategies to optimize risk and return.

Source and External Links

Auto Owners Resource Center - Department of Financial Services - Auto insurance is a contract protecting you against financial loss in accidents, with various coverage options and financial stability ratings for insurers.

Progressive: An Insurance Company You Can Rely On - Progressive offers customizable auto, motorcycle, RV, and life insurance with 24/7 support and potential savings over $800 annually for auto insurance.

Liberty Mutual: A trusted insurance company for over 100 years - Liberty Mutual provides personalized insurance options for auto, home, renters, and pet insurance, with average savings of $950 when bundling car and home insurance.

dowidth.com

dowidth.com