Catastrophe bonds offer an innovative risk transfer mechanism by allowing insurers to raise capital from investors, providing protection against large-scale disasters without relying solely on traditional premiums. Traditional insurance pools premiums to cover losses, often facing limitations in capacity and longer claim settlement times. Explore the detailed differences between catastrophe bonds and traditional insurance to optimize your risk management strategy.

Why it is important

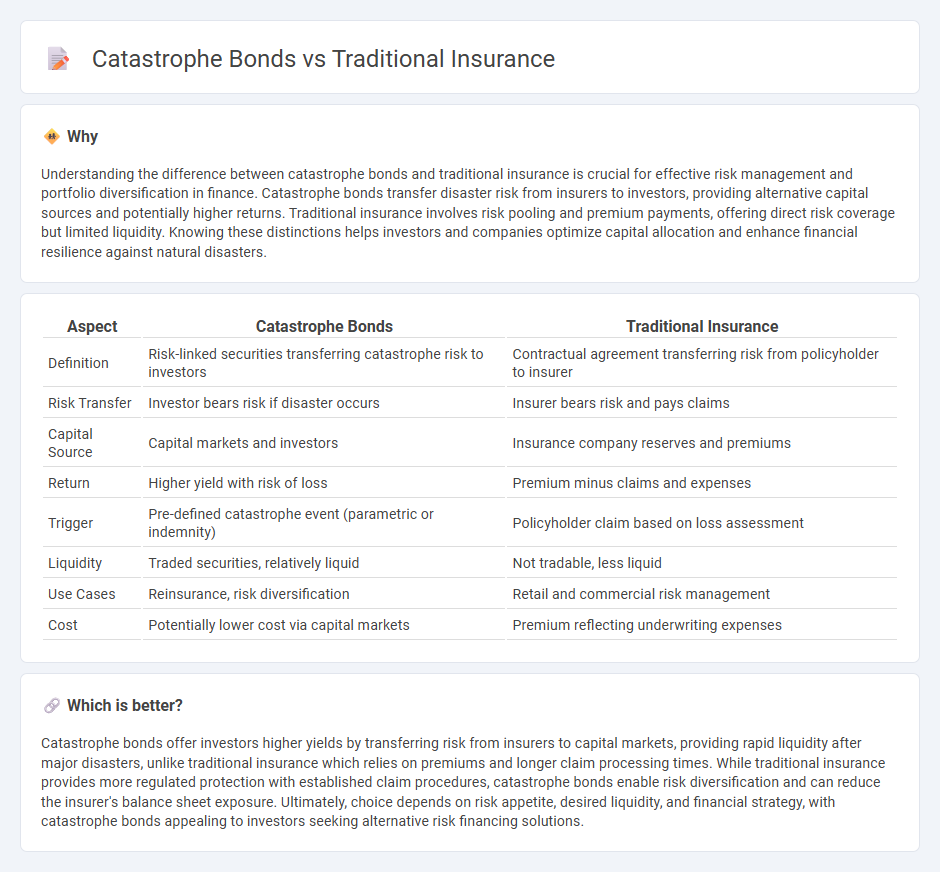

Understanding the difference between catastrophe bonds and traditional insurance is crucial for effective risk management and portfolio diversification in finance. Catastrophe bonds transfer disaster risk from insurers to investors, providing alternative capital sources and potentially higher returns. Traditional insurance involves risk pooling and premium payments, offering direct risk coverage but limited liquidity. Knowing these distinctions helps investors and companies optimize capital allocation and enhance financial resilience against natural disasters.

Comparison Table

| Aspect | Catastrophe Bonds | Traditional Insurance |

|---|---|---|

| Definition | Risk-linked securities transferring catastrophe risk to investors | Contractual agreement transferring risk from policyholder to insurer |

| Risk Transfer | Investor bears risk if disaster occurs | Insurer bears risk and pays claims |

| Capital Source | Capital markets and investors | Insurance company reserves and premiums |

| Return | Higher yield with risk of loss | Premium minus claims and expenses |

| Trigger | Pre-defined catastrophe event (parametric or indemnity) | Policyholder claim based on loss assessment |

| Liquidity | Traded securities, relatively liquid | Not tradable, less liquid |

| Use Cases | Reinsurance, risk diversification | Retail and commercial risk management |

| Cost | Potentially lower cost via capital markets | Premium reflecting underwriting expenses |

Which is better?

Catastrophe bonds offer investors higher yields by transferring risk from insurers to capital markets, providing rapid liquidity after major disasters, unlike traditional insurance which relies on premiums and longer claim processing times. While traditional insurance provides more regulated protection with established claim procedures, catastrophe bonds enable risk diversification and can reduce the insurer's balance sheet exposure. Ultimately, choice depends on risk appetite, desired liquidity, and financial strategy, with catastrophe bonds appealing to investors seeking alternative risk financing solutions.

Connection

Catastrophe bonds, also known as cat bonds, serve as a financial instrument that transfers risk from insurers to investors, complementing traditional insurance by providing additional capital for disaster-related claims. Traditional insurance companies utilize cat bonds to manage exposure to large-scale events such as hurricanes or earthquakes, reducing their reliance on reinsurance and enhancing financial stability. The integration of cat bonds into risk management strategies supports liquidity and mitigates the impact of catastrophic losses on insurers' balance sheets.

Key Terms

Risk Transfer

Traditional insurance involves the transfer of risk from policyholders to insurers, who pool premiums to cover potential losses. Catastrophe bonds transfer specific disaster-related risks from insurers to capital market investors by issuing securities that pay out upon defined catastrophic events. Explore how these risk transfer mechanisms impact insurance efficiency and capital management.

Premiums vs. Coupon Payments

Traditional insurance premiums are fixed payments made by policyholders to transfer risk to insurers, reflecting the coverage amount and risk profile. Catastrophe bonds offer investors coupon payments as returns for assuming specific disaster-related risks, with yields often higher than conventional bonds to compensate for potential loss of principal. Explore how these financial instruments differ in risk transfer and investor appeal to optimize your risk management strategy.

Indemnity vs. Parametric Trigger

Traditional insurance relies on indemnity triggers, compensating policyholders based on actual loss assessments to cover damages from events like natural disasters. Catastrophe bonds use parametric triggers, where payouts are triggered by predefined event parameters such as earthquake magnitude or hurricane wind speeds, enabling faster claims without loss adjustments. Explore the key differences and advantages of each method to understand their impact on risk management strategies.

Source and External Links

What Is Traditional Insurance Plan | ABSLI - Traditional insurance plans, particularly in life insurance, include long-established types like term insurance, endowment plans, and retirement plans, offering life coverage, fixed incomes, tax benefits, and sometimes bonuses, with categories for pure life protection and combined life insurance and investing.

Direct Healthcare Providers vs. Traditional Health Insurance - Traditional health insurance plans cover medical care costs, often provided by employers or purchased privately, and include types such as HMOs, PPOs, and POS plans, featuring broad coverage, guaranteed benefits, provider networks, and comprehensive protection against unexpected health issues.

Traditional Indemnity Insurance Plans - Traditional indemnity insurance plans reimburse patients based on usual, customary, and reasonable fees, often as fee-for-service plans with no restrictions on choice of provider, where patients pay and then are reimbursed per the policy's terms, typically handling co-insurance and deductibles.

dowidth.com

dowidth.com